Problem 3 A company needs a new grinder Compute the present

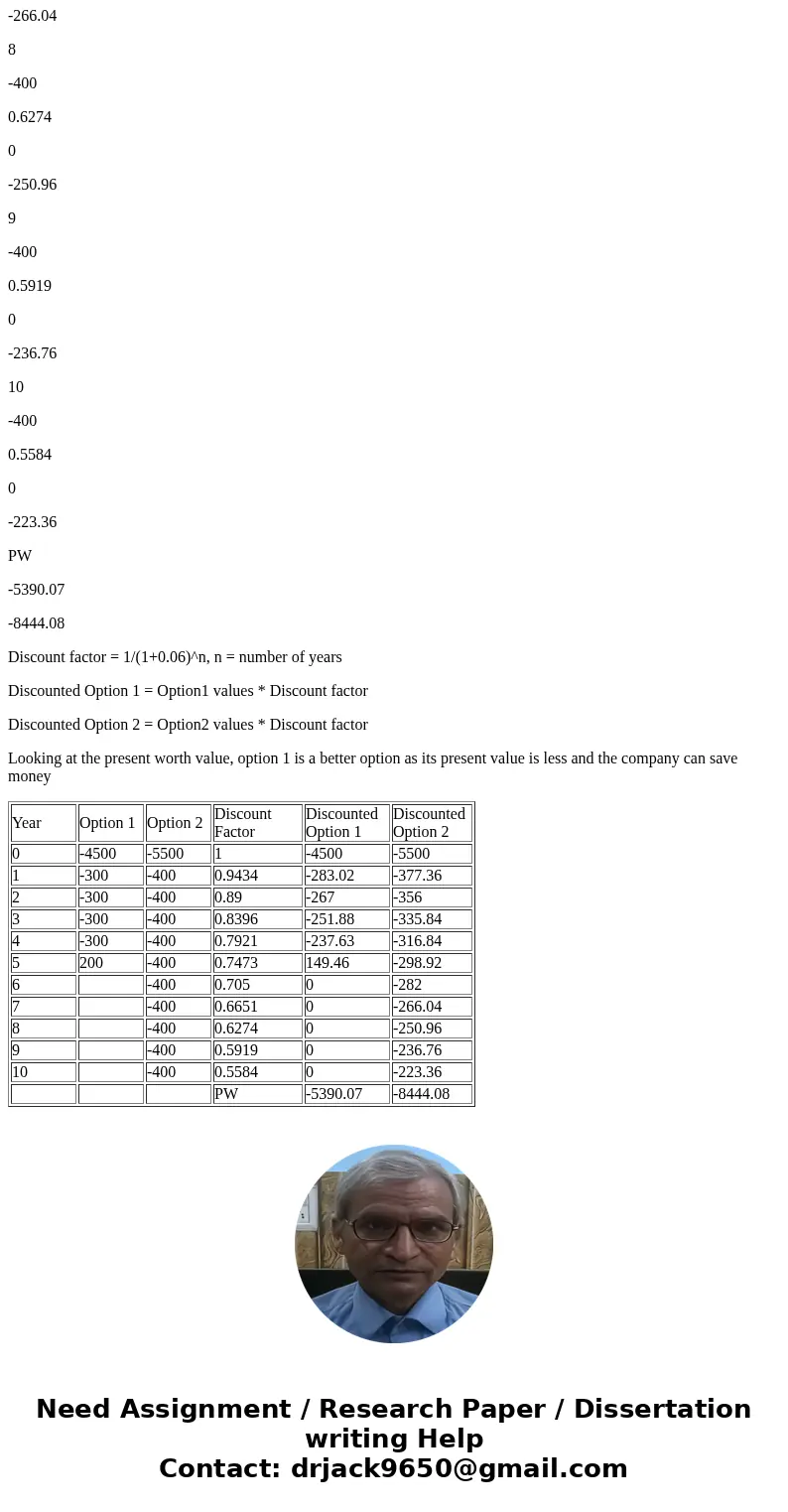

Problem 3: A company needs a new grinder. Compute the present worth for the mutually exclusive alternatives and identify which option is better. Assume an interest rate of 6% and that the grinder will be replaced with an identical model at the end of its life.

Option 1: Initial cost of $4500, annual costs of $300, salvage value of $500, life of 5 years

Option B: Initial cost of $5500, annual costs of $400, no salvage value, life of 10 years

Solution

Year

Option 1

Option 2

Discount Factor

Discounted Option 1

Discounted Option 2

0

-4500

-5500

1

-4500

-5500

1

-300

-400

0.9434

-283.02

-377.36

2

-300

-400

0.89

-267

-356

3

-300

-400

0.8396

-251.88

-335.84

4

-300

-400

0.7921

-237.63

-316.84

5

200

-400

0.7473

149.46

-298.92

6

-400

0.705

0

-282

7

-400

0.6651

0

-266.04

8

-400

0.6274

0

-250.96

9

-400

0.5919

0

-236.76

10

-400

0.5584

0

-223.36

PW

-5390.07

-8444.08

Discount factor = 1/(1+0.06)^n, n = number of years

Discounted Option 1 = Option1 values * Discount factor

Discounted Option 2 = Option2 values * Discount factor

Looking at the present worth value, option 1 is a better option as its present value is less and the company can save money

| Year | Option 1 | Option 2 | Discount Factor | Discounted Option 1 | Discounted Option 2 |

| 0 | -4500 | -5500 | 1 | -4500 | -5500 |

| 1 | -300 | -400 | 0.9434 | -283.02 | -377.36 |

| 2 | -300 | -400 | 0.89 | -267 | -356 |

| 3 | -300 | -400 | 0.8396 | -251.88 | -335.84 |

| 4 | -300 | -400 | 0.7921 | -237.63 | -316.84 |

| 5 | 200 | -400 | 0.7473 | 149.46 | -298.92 |

| 6 | -400 | 0.705 | 0 | -282 | |

| 7 | -400 | 0.6651 | 0 | -266.04 | |

| 8 | -400 | 0.6274 | 0 | -250.96 | |

| 9 | -400 | 0.5919 | 0 | -236.76 | |

| 10 | -400 | 0.5584 | 0 | -223.36 | |

| PW | -5390.07 | -8444.08 |

Homework Sourse

Homework Sourse