cash budget by quarters is given below for a retail company

Solution

1

2

3

4

Year

Cash Bal. Beg

6

8

8

8

6

Add: Collections from Customers

82

78

100

96

356

Less: Disbursements

Purchase of Inventory

39

49

47

31

166

S and A

40

30

30

23

123

Eq Purchases

11

10

14

10

45

Dividends

2

2

2

2

8

Total

92

91

93

66

342

Excess(deficiency) of cash available over disbursements

(4)

(5)

15

38

20

Financing:

Borrowings

12

13

0

0

25

Repayments(incl interest)

0

0

(7)

(19)

(26)

Total Financing

12

13

(7)

(19)

(1)

Cash Balance Ending

8

8

8

19

19

* Interest Paymnets of 1000

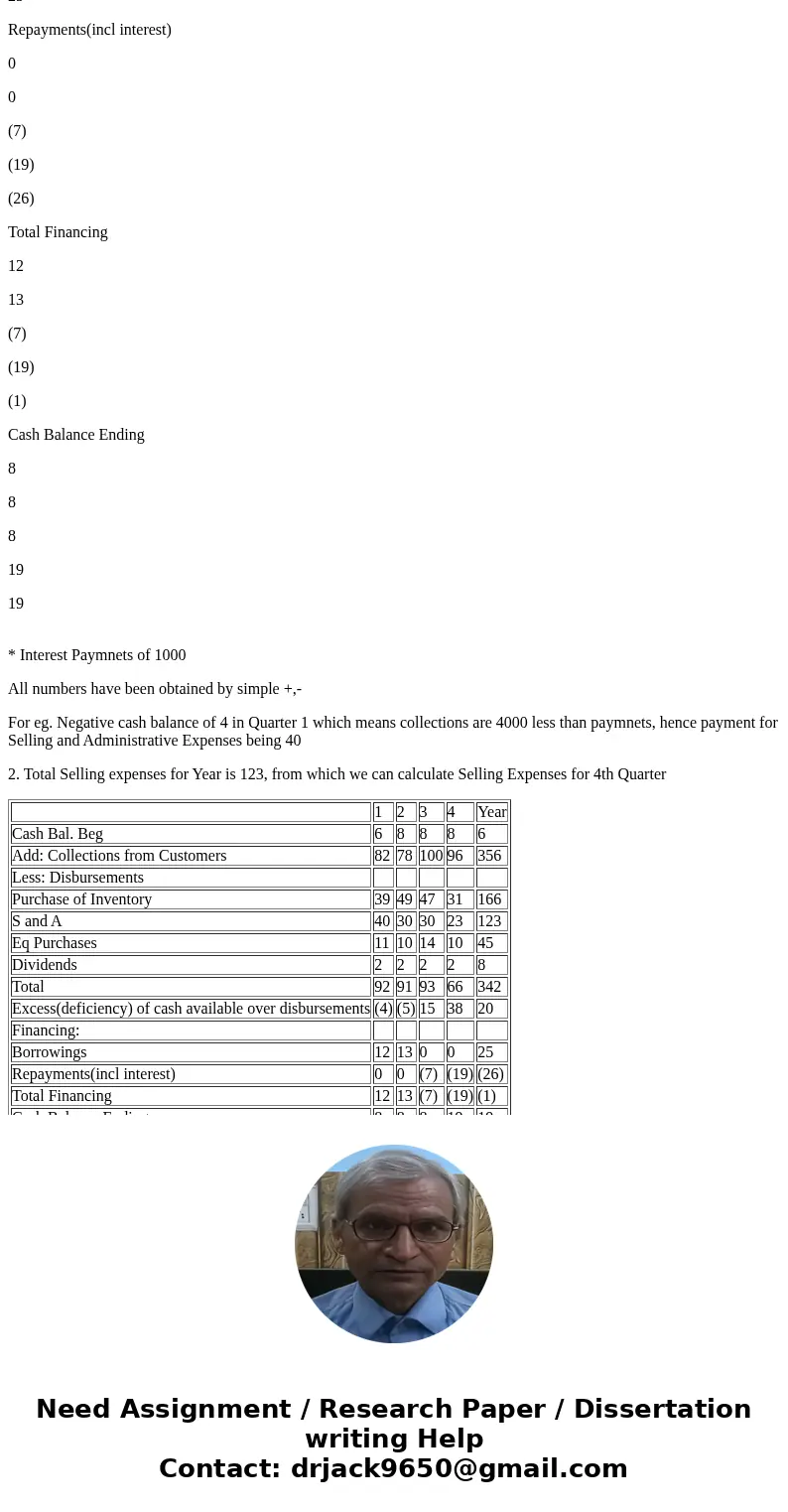

All numbers have been obtained by simple +,-

For eg. Negative cash balance of 4 in Quarter 1 which means collections are 4000 less than paymnets, hence payment for Selling and Administrative Expenses being 40

2. Total Selling expenses for Year is 123, from which we can calculate Selling Expenses for 4th Quarter

| 1 | 2 | 3 | 4 | Year | |

| Cash Bal. Beg | 6 | 8 | 8 | 8 | 6 |

| Add: Collections from Customers | 82 | 78 | 100 | 96 | 356 |

| Less: Disbursements | |||||

| Purchase of Inventory | 39 | 49 | 47 | 31 | 166 |

| S and A | 40 | 30 | 30 | 23 | 123 |

| Eq Purchases | 11 | 10 | 14 | 10 | 45 |

| Dividends | 2 | 2 | 2 | 2 | 8 |

| Total | 92 | 91 | 93 | 66 | 342 |

| Excess(deficiency) of cash available over disbursements | (4) | (5) | 15 | 38 | 20 |

| Financing: | |||||

| Borrowings | 12 | 13 | 0 | 0 | 25 |

| Repayments(incl interest) | 0 | 0 | (7) | (19) | (26) |

| Total Financing | 12 | 13 | (7) | (19) | (1) |

| Cash Balance Ending | 8 | 8 | 8 | 19 | 19 |

Homework Sourse

Homework Sourse