Brief Exercise 54 Prepare the journal entries to record the

Solution

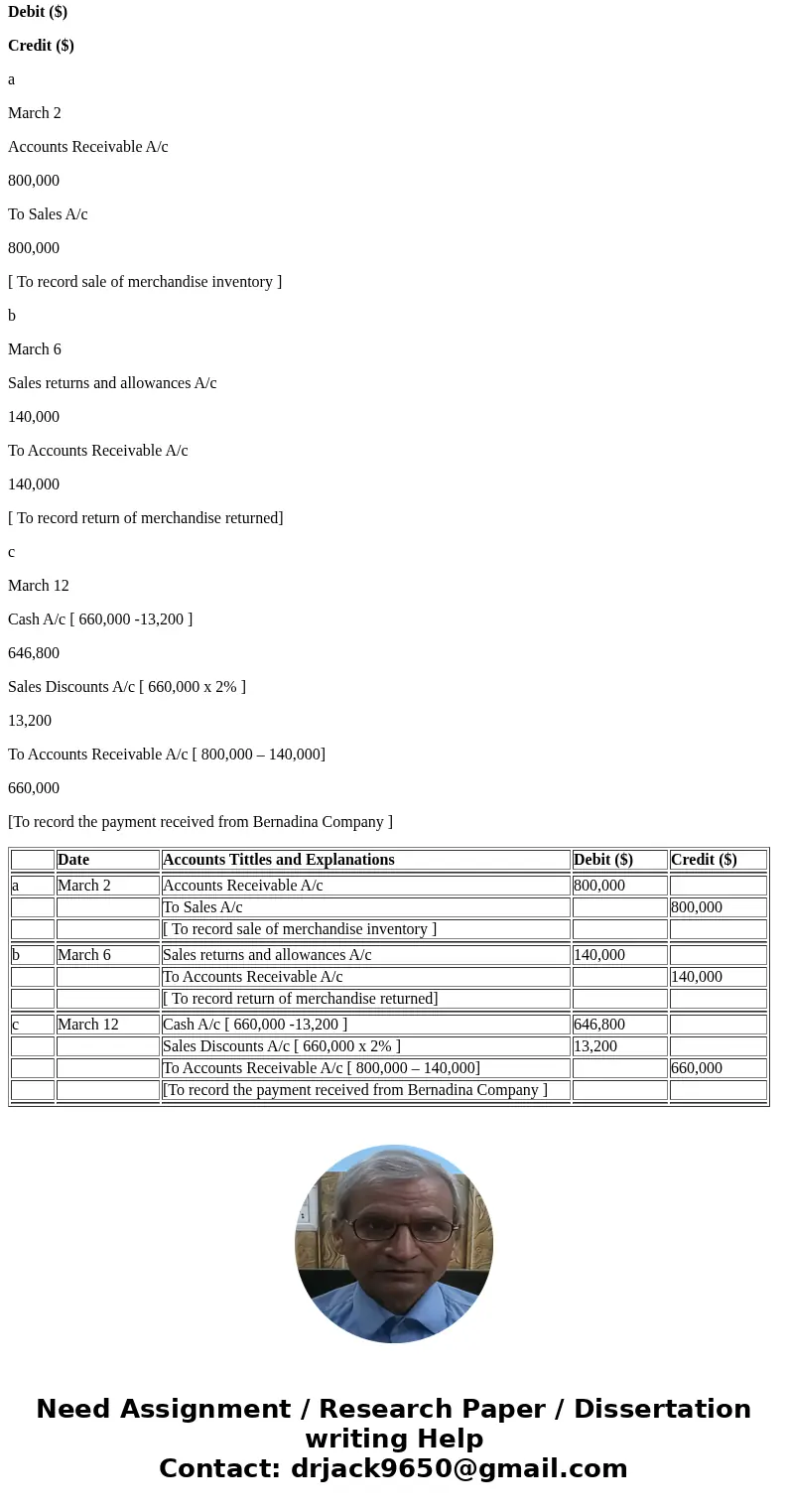

Journal Entries in the books of McLeena Company

Date

Accounts Tittles and Explanations

Debit ($)

Credit ($)

a

March 2

Accounts Receivable A/c

800,000

To Sales A/c

800,000

[ To record sale of merchandise inventory ]

b

March 6

Sales returns and allowances A/c

140,000

To Accounts Receivable A/c

140,000

[ To record return of merchandise returned]

c

March 12

Cash A/c [ 660,000 -13,200 ]

646,800

Sales Discounts A/c [ 660,000 x 2% ]

13,200

To Accounts Receivable A/c [ 800,000 – 140,000]

660,000

[To record the payment received from Bernadina Company ]

| Date | Accounts Tittles and Explanations | Debit ($) | Credit ($) | |

| a | March 2 | Accounts Receivable A/c | 800,000 | |

| To Sales A/c | 800,000 | |||

| [ To record sale of merchandise inventory ] | ||||

| b | March 6 | Sales returns and allowances A/c | 140,000 | |

| To Accounts Receivable A/c | 140,000 | |||

| [ To record return of merchandise returned] | ||||

| c | March 12 | Cash A/c [ 660,000 -13,200 ] | 646,800 | |

| Sales Discounts A/c [ 660,000 x 2% ] | 13,200 | |||

| To Accounts Receivable A/c [ 800,000 – 140,000] | 660,000 | |||

| [To record the payment received from Bernadina Company ] | ||||

Homework Sourse

Homework Sourse