Evan Watts opened a dental practice on January 1 2017 During

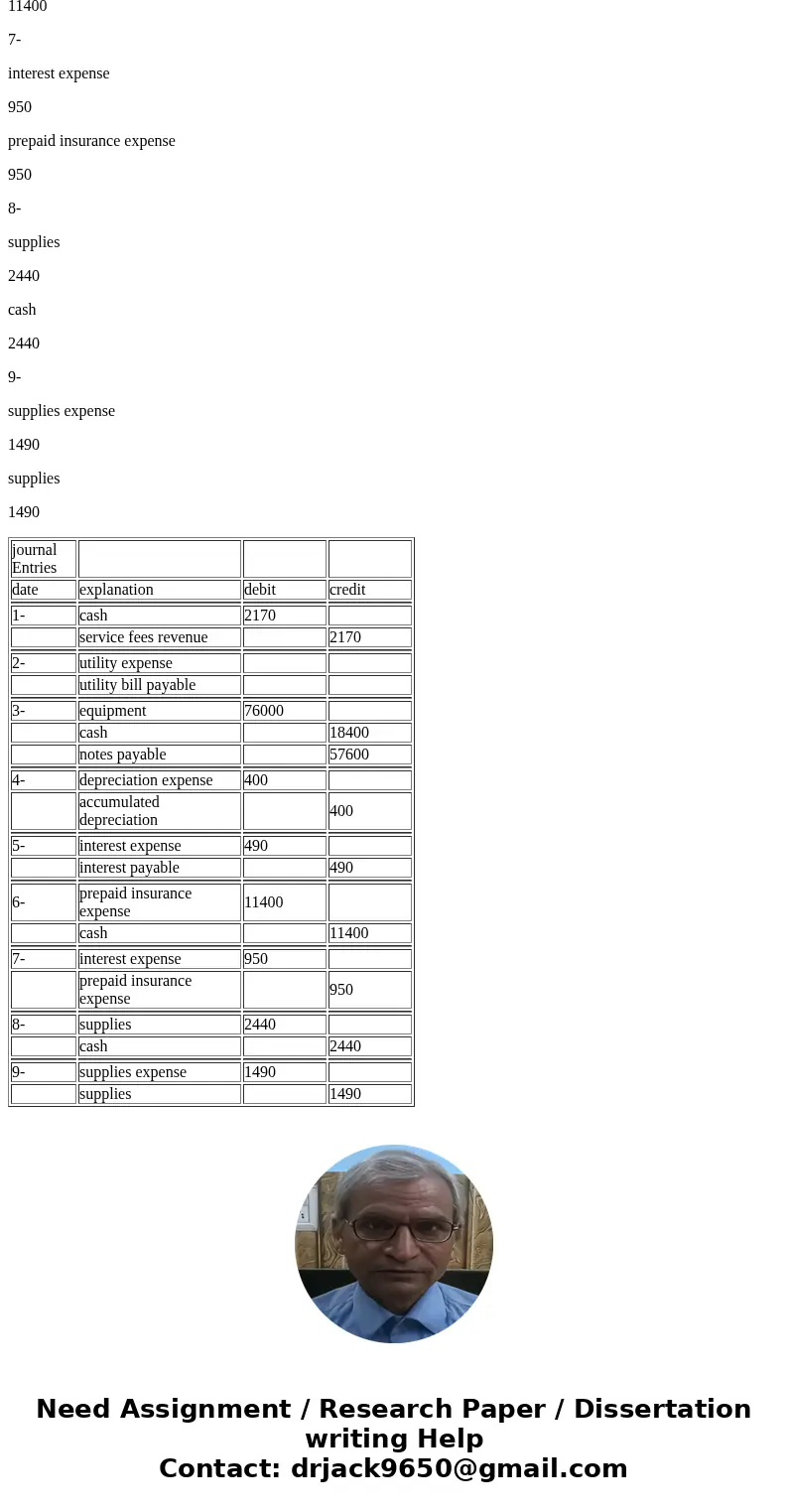

Evan Watts opened a dental practice on January 1, 2017. During the first month of operations, the following transactions occurred.

| 1. | Watts performed services for patients totalling $2,170. These services have not yet been recorded. | |

| 2. | Utility expenses incurred but not paid prior to January 31 totalled $390. | |

| 3. | Purchased dental equipment on January 1 for $76,000, paying $18,400 in cash and signing a $57,600, three-year note payable. The equipment depreciates $400 per month. Interest is $490 per month. | |

| 4. | Purchased a one-year malpractice insurance policy on January 1 for $11,400. | |

| 5. | Purchased $2,440 of dental supplies. On January 31, determined that $950 of supplies were on hand. |

Solution

journal Entries

date

explanation

debit

credit

1-

cash

2170

service fees revenue

2170

2-

utility expense

utility bill payable

3-

equipment

76000

cash

18400

notes payable

57600

4-

depreciation expense

400

accumulated depreciation

400

5-

interest expense

490

interest payable

490

6-

prepaid insurance expense

11400

cash

11400

7-

interest expense

950

prepaid insurance expense

950

8-

supplies

2440

cash

2440

9-

supplies expense

1490

supplies

1490

| journal Entries | |||

| date | explanation | debit | credit |

| 1- | cash | 2170 | |

| service fees revenue | 2170 | ||

| 2- | utility expense | ||

| utility bill payable | |||

| 3- | equipment | 76000 | |

| cash | 18400 | ||

| notes payable | 57600 | ||

| 4- | depreciation expense | 400 | |

| accumulated depreciation | 400 | ||

| 5- | interest expense | 490 | |

| interest payable | 490 | ||

| 6- | prepaid insurance expense | 11400 | |

| cash | 11400 | ||

| 7- | interest expense | 950 | |

| prepaid insurance expense | 950 | ||

| 8- | supplies | 2440 | |

| cash | 2440 | ||

| 9- | supplies expense | 1490 | |

| supplies | 1490 |

Homework Sourse

Homework Sourse