apter 2 HOn ents 201870Second Summer 2018 value 1432 points

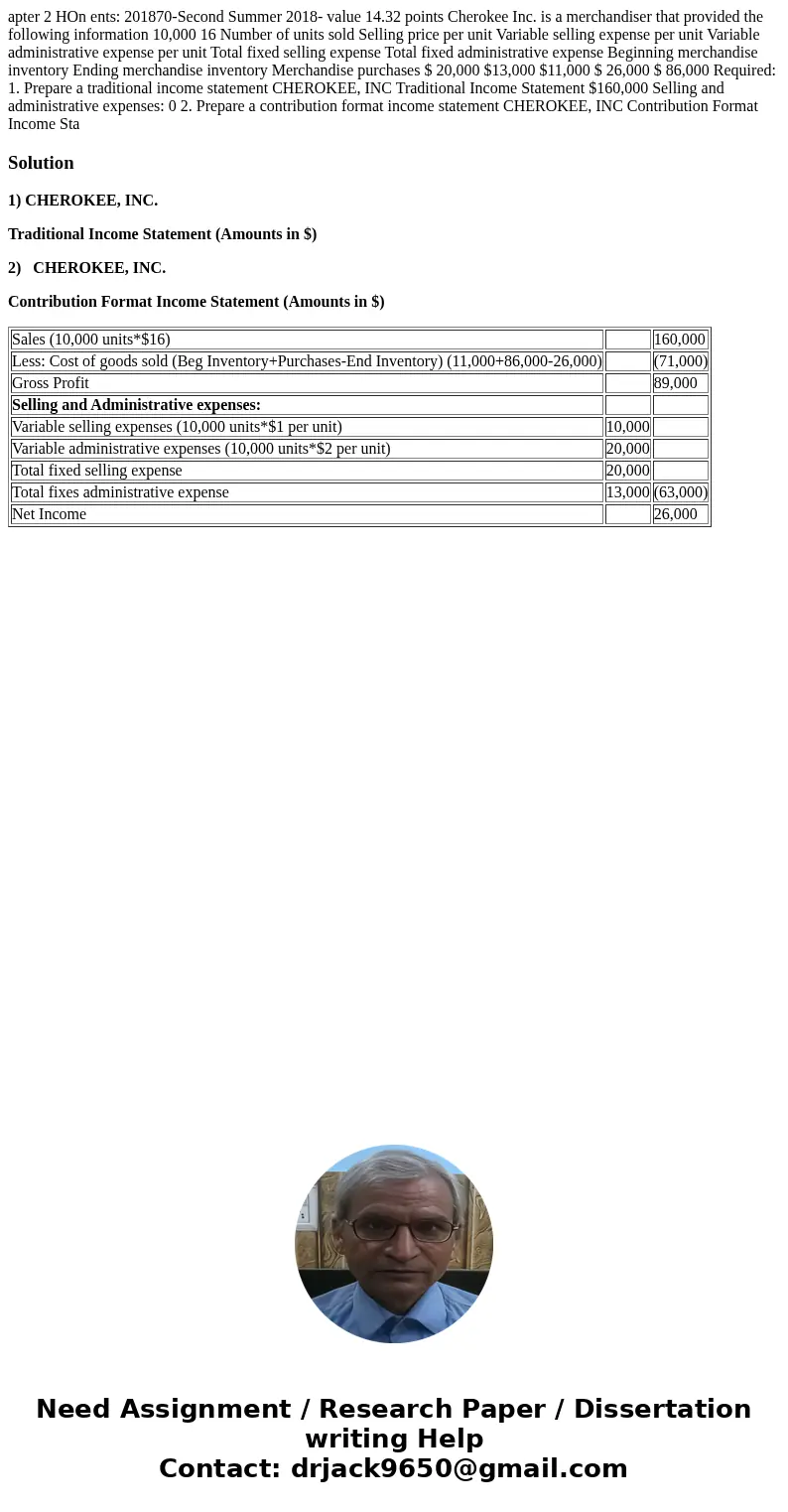

apter 2 HOn ents: 201870-Second Summer 2018- value 14.32 points Cherokee Inc. is a merchandiser that provided the following information 10,000 16 Number of units sold Selling price per unit Variable selling expense per unit Variable administrative expense per unit Total fixed selling expense Total fixed administrative expense Beginning merchandise inventory Ending merchandise inventory Merchandise purchases $ 20,000 $13,000 $11,000 $ 26,000 $ 86,000 Required: 1. Prepare a traditional income statement CHEROKEE, INC Traditional Income Statement $160,000 Selling and administrative expenses: 0 2. Prepare a contribution format income statement CHEROKEE, INC Contribution Format Income Sta

Solution

1) CHEROKEE, INC.

Traditional Income Statement (Amounts in $)

2) CHEROKEE, INC.

Contribution Format Income Statement (Amounts in $)

| Sales (10,000 units*$16) | 160,000 | |

| Less: Cost of goods sold (Beg Inventory+Purchases-End Inventory) (11,000+86,000-26,000) | (71,000) | |

| Gross Profit | 89,000 | |

| Selling and Administrative expenses: | ||

| Variable selling expenses (10,000 units*$1 per unit) | 10,000 | |

| Variable administrative expenses (10,000 units*$2 per unit) | 20,000 | |

| Total fixed selling expense | 20,000 | |

| Total fixes administrative expense | 13,000 | (63,000) |

| Net Income | 26,000 |

Homework Sourse

Homework Sourse