1 The delivery truck is estimated to have a life cycle of 20

1. The delivery truck is estimated to have a life cycle of 200,000 miles. It was driven for for 16,500 miles in 2015 & 24,600 miles in 2016

2. The office furniture has a life expectancy of 7 years.

3. The Computer has life expectancy of 4years

Round any per unit calculations to the nearest half penny. Round all annual depreciation expenses to the nearest dollar. Use this information to compute for fiscal year 2016 the following values:

1. Book value of the Delivery Truck

2. Depreciation Expense-Truck

3. Book value of the office Furniture

4. Depreciation Expense-Office furniture

5. Book value of the computer

6. Depreciation Expense- computer

Solution

1. Book value of the Delivery Truck - $49930

2. Depreciation Expense-Truck - $6027

3. Book value of the office Furniture - $ 10858

4. Depreciation Expense-Office furniture - $2071

5. Book value of the computer - $1250

6. Depreciation Expense- computer - $1250

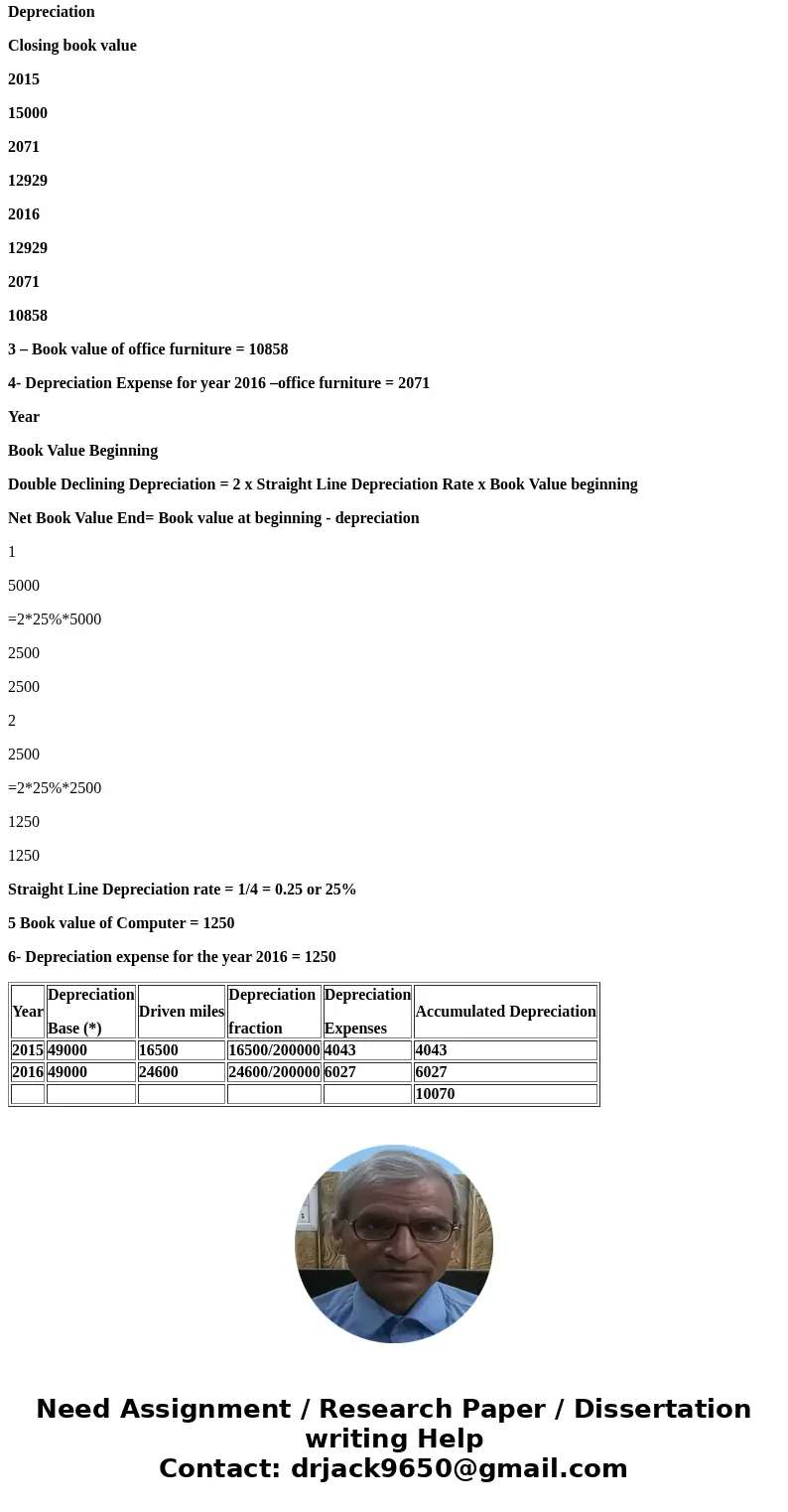

Workings given below:

Year

Depreciation

Base (*)

Driven miles

Depreciation

fraction

Depreciation

Expenses

Accumulated Depreciation

2015

49000

16500

16500/200000

4043

4043

2016

49000

24600

24600/200000

6027

6027

10070

*Depreciation Base = Cost – Salvage value = 60000-11000 = 49000

1- Book value of delivery truck = 60000-10070 = 49930

2- Depreciation Expense for year 2016 = 6027

Office Furniture :

Depreciation = [Cost of asset – salvage value]/life of asset

= [15000-500]/7 = 2071/year

Year

Opening Book value

Depreciation

Closing book value

2015

15000

2071

12929

2016

12929

2071

10858

3 – Book value of office furniture = 10858

4- Depreciation Expense for year 2016 –office furniture = 2071

Year

Book Value Beginning

Double Declining Depreciation = 2 x Straight Line Depreciation Rate x Book Value beginning

Net Book Value End= Book value at beginning - depreciation

1

5000

=2*25%*5000

2500

2500

2

2500

=2*25%*2500

1250

1250

Straight Line Depreciation rate = 1/4 = 0.25 or 25%

5 Book value of Computer = 1250

6- Depreciation expense for the year 2016 = 1250

| Year | Depreciation Base (*) | Driven miles | Depreciation fraction | Depreciation Expenses | Accumulated Depreciation |

| 2015 | 49000 | 16500 | 16500/200000 | 4043 | 4043 |

| 2016 | 49000 | 24600 | 24600/200000 | 6027 | 6027 |

| 10070 |

Homework Sourse

Homework Sourse