Aces Inc a manufacturer of tennis rackets began operations t

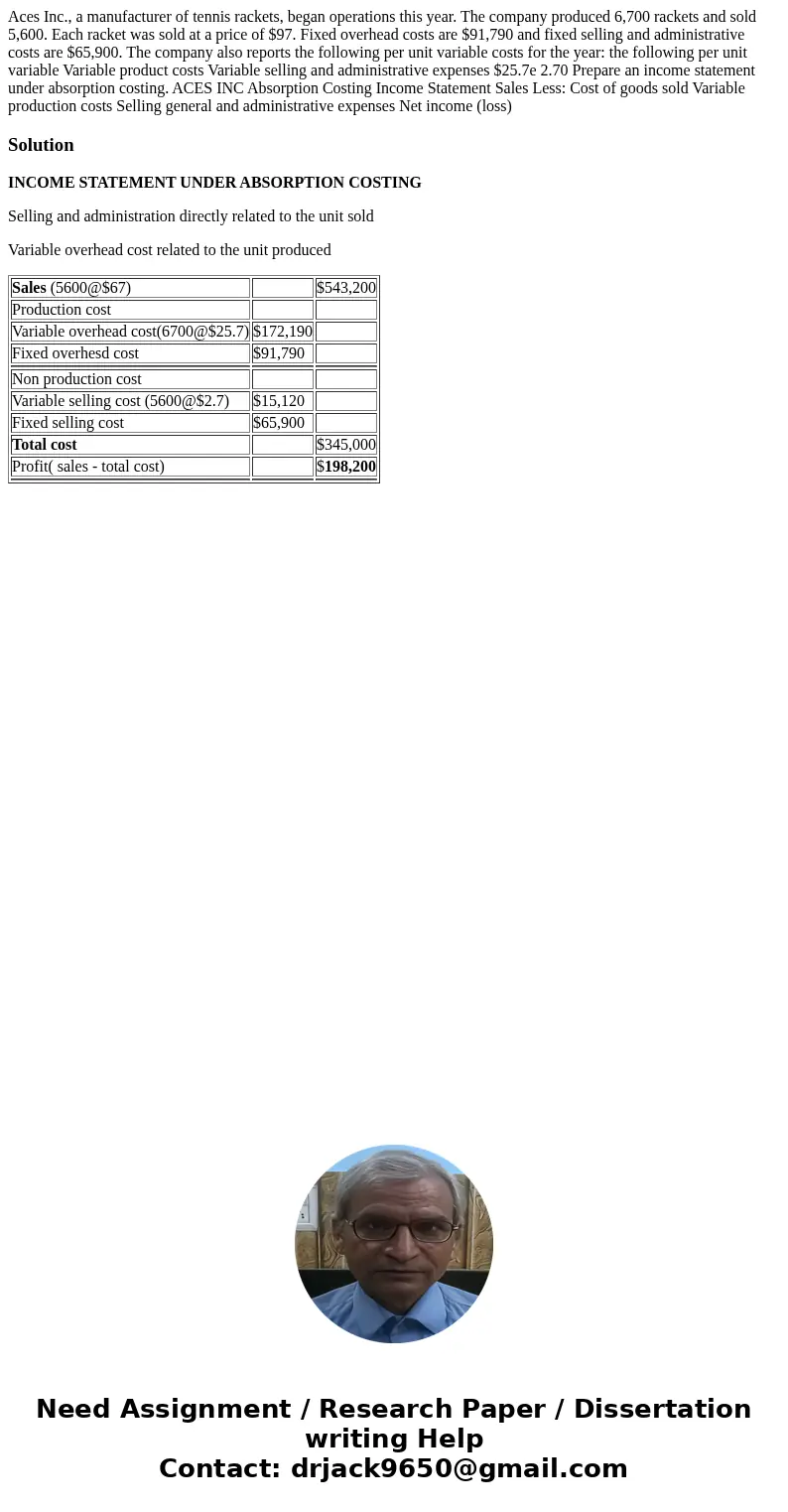

Aces Inc., a manufacturer of tennis rackets, began operations this year. The company produced 6,700 rackets and sold 5,600. Each racket was sold at a price of $97. Fixed overhead costs are $91,790 and fixed selling and administrative costs are $65,900. The company also reports the following per unit variable costs for the year: the following per unit variable Variable product costs Variable selling and administrative expenses $25.7e 2.70 Prepare an income statement under absorption costing. ACES INC Absorption Costing Income Statement Sales Less: Cost of goods sold Variable production costs Selling general and administrative expenses Net income (loss)

Solution

INCOME STATEMENT UNDER ABSORPTION COSTING

Selling and administration directly related to the unit sold

Variable overhead cost related to the unit produced

| Sales (5600@$67) | $543,200 | |

| Production cost | ||

| Variable overhead cost(6700@$25.7) | $172,190 | |

| Fixed overhesd cost | $91,790 | |

| Non production cost | ||

| Variable selling cost (5600@$2.7) | $15,120 | |

| Fixed selling cost | $65,900 | |

| Total cost | $345,000 | |

| Profit( sales - total cost) | $198,200 | |

Homework Sourse

Homework Sourse