Listed below are yearend account balances in millions taken

Listed below are year-end account balances (in $ millions) taken from the records of Symphony Stores.

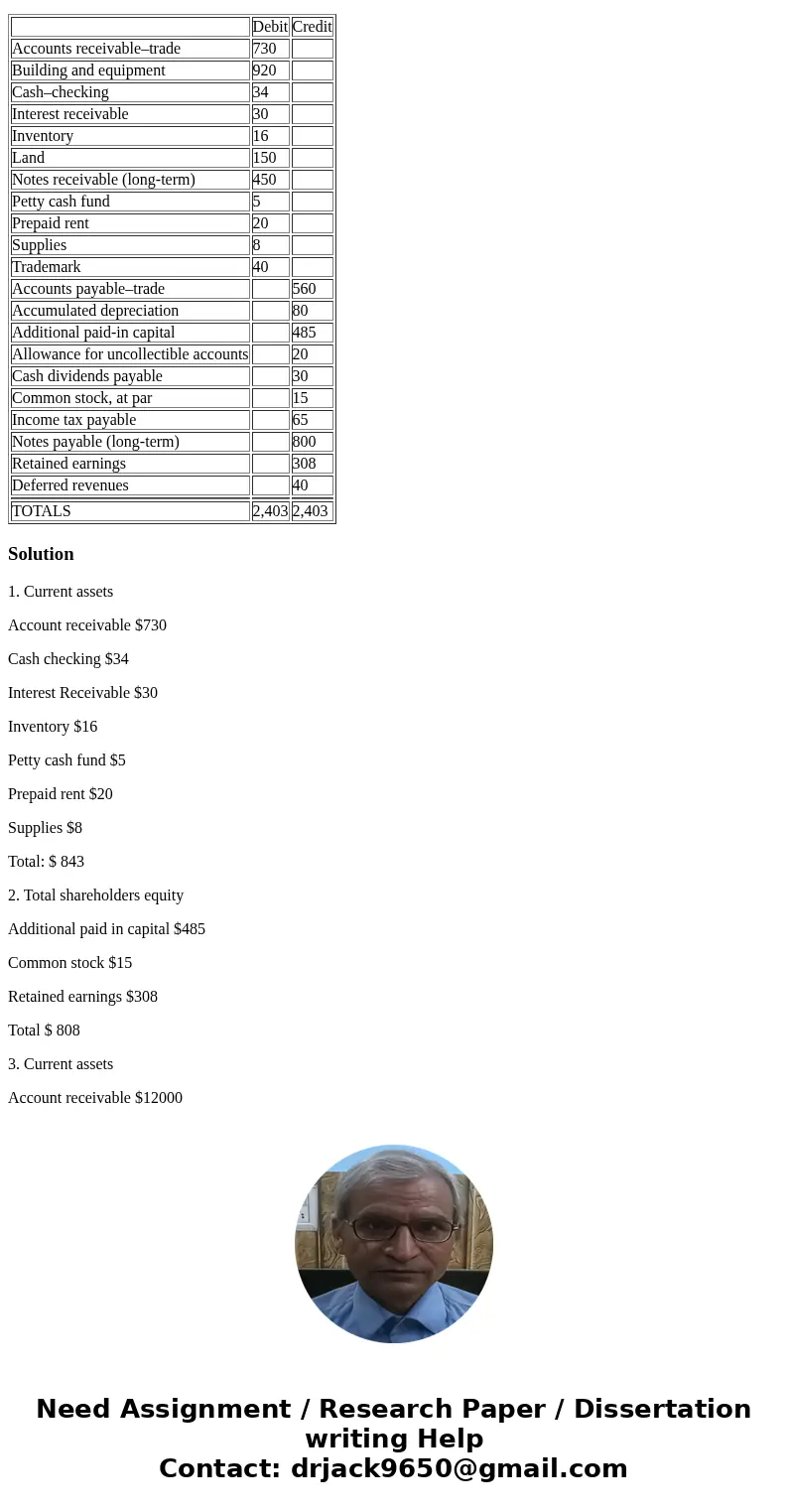

Debit

Credit

Accounts receivable–trade

730

Building and equipment

920

Cash–checking

34

Interest receivable

30

Inventory

16

Land

150

Notes receivable (long-term)

450

Petty cash fund

5

Prepaid rent

20

Supplies

8

Trademark

40

Accounts payable–trade

560

Accumulated depreciation

80

Additional paid-in capital

485

Allowance for uncollectible accounts

20

Cash dividends payable

30

Common stock, at par

15

Income tax payable

65

Notes payable (long-term)

800

Retained earnings

308

Deferred revenues

40

TOTALS

2,403

2,403

What would Symphony report as total current assets?

Question options:

$823

$838

$843

$1,696

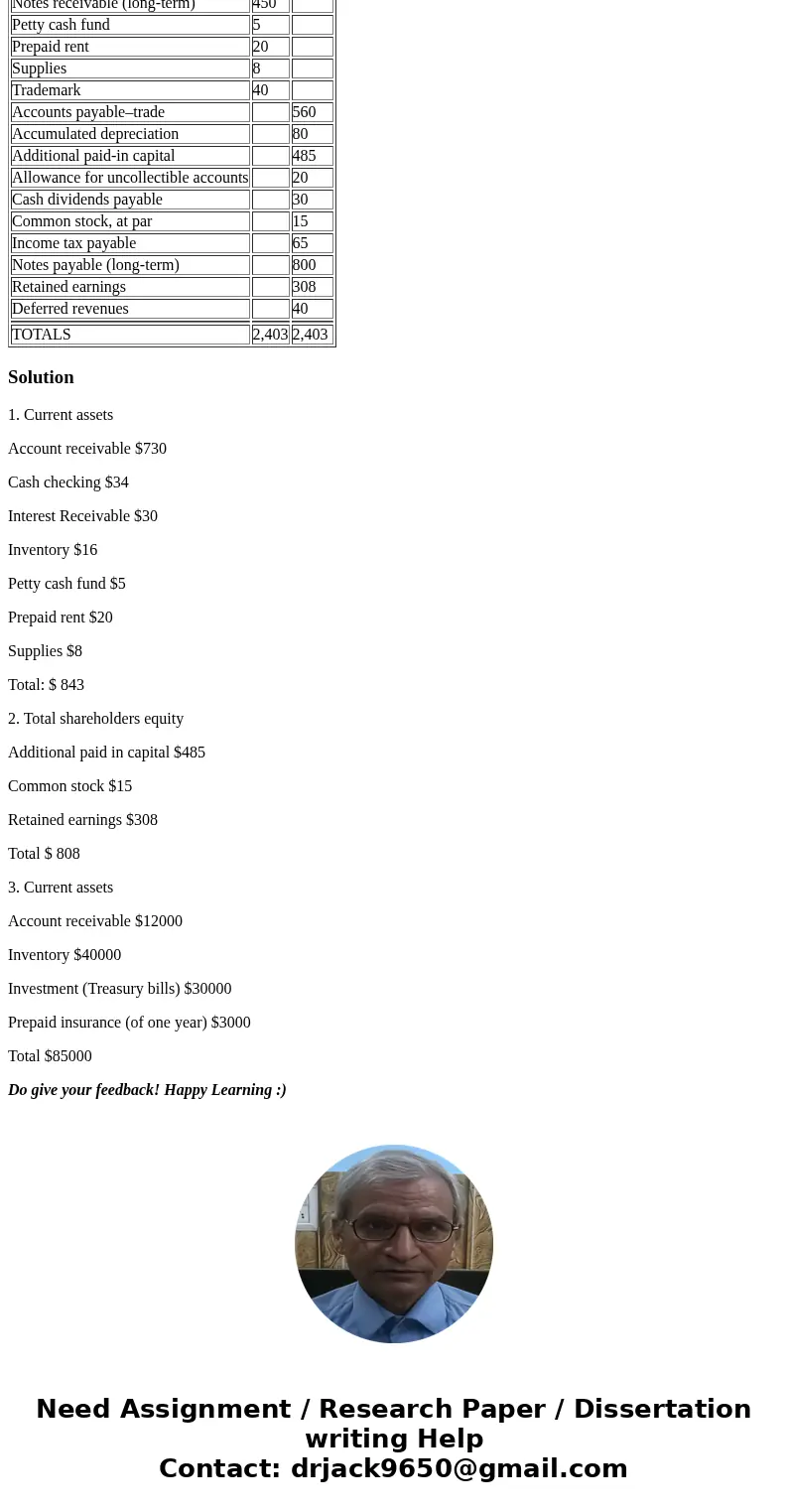

Listed below are year-end account balances (in $ millions) taken from the records of Symphony Stores.

Debit

Credit

Accounts receivable–trade

730

Building and equipment

920

Cash–checking

34

Interest receivable

30

Inventory

16

Land

150

Notes receivable (long-term)

450

Petty cash fund

5

Prepaid rent

20

Supplies

8

Trademark

40

Accounts payable–trade

560

Accumulated depreciation

80

Additional paid-in capital

485

Allowance for uncollectible accounts

20

Cash dividends payable

30

Common stock, at par

15

Income tax payable

65

Notes payable (long-term)

800

Retained earnings

308

Deferred revenues

40

TOTALS

2,403

2,403

What would Symphony report as total shareholders\' equity?

Question options:

$323

$808

$838

$928

Janson Corporation Co.\'s trial balance included the following account balances at December 31, 2016:

Accounts receivable

$12,000

Inventories

40,000

Patent

12,000

Investments

30,000

Prepaid insurance

6,000

Note receivable, due 2019

50,000

Investments consist of treasury bills that were purchased in November and mature in January. Prepaid insurance is for the next two years. What amount should be included in the current asset section of Janson\'s December 31, 2016, balance sheet?

$88,000.

$85,000.

$55,000.

$135,000.

Please Show your work!

| Debit | Credit | |

| Accounts receivable–trade | 730 | |

| Building and equipment | 920 | |

| Cash–checking | 34 | |

| Interest receivable | 30 | |

| Inventory | 16 | |

| Land | 150 | |

| Notes receivable (long-term) | 450 | |

| Petty cash fund | 5 | |

| Prepaid rent | 20 | |

| Supplies | 8 | |

| Trademark | 40 | |

| Accounts payable–trade | 560 | |

| Accumulated depreciation | 80 | |

| Additional paid-in capital | 485 | |

| Allowance for uncollectible accounts | 20 | |

| Cash dividends payable | 30 | |

| Common stock, at par | 15 | |

| Income tax payable | 65 | |

| Notes payable (long-term) | 800 | |

| Retained earnings | 308 | |

| Deferred revenues | 40 | |

| TOTALS | 2,403 | 2,403 |

Solution

1. Current assets

Account receivable $730

Cash checking $34

Interest Receivable $30

Inventory $16

Petty cash fund $5

Prepaid rent $20

Supplies $8

Total: $ 843

2. Total shareholders equity

Additional paid in capital $485

Common stock $15

Retained earnings $308

Total $ 808

3. Current assets

Account receivable $12000

Inventory $40000

Investment (Treasury bills) $30000

Prepaid insurance (of one year) $3000

Total $85000

Do give your feedback! Happy Learning :)

Homework Sourse

Homework Sourse