Apparel Company Comparative Balance Sheet December 31 2002 2

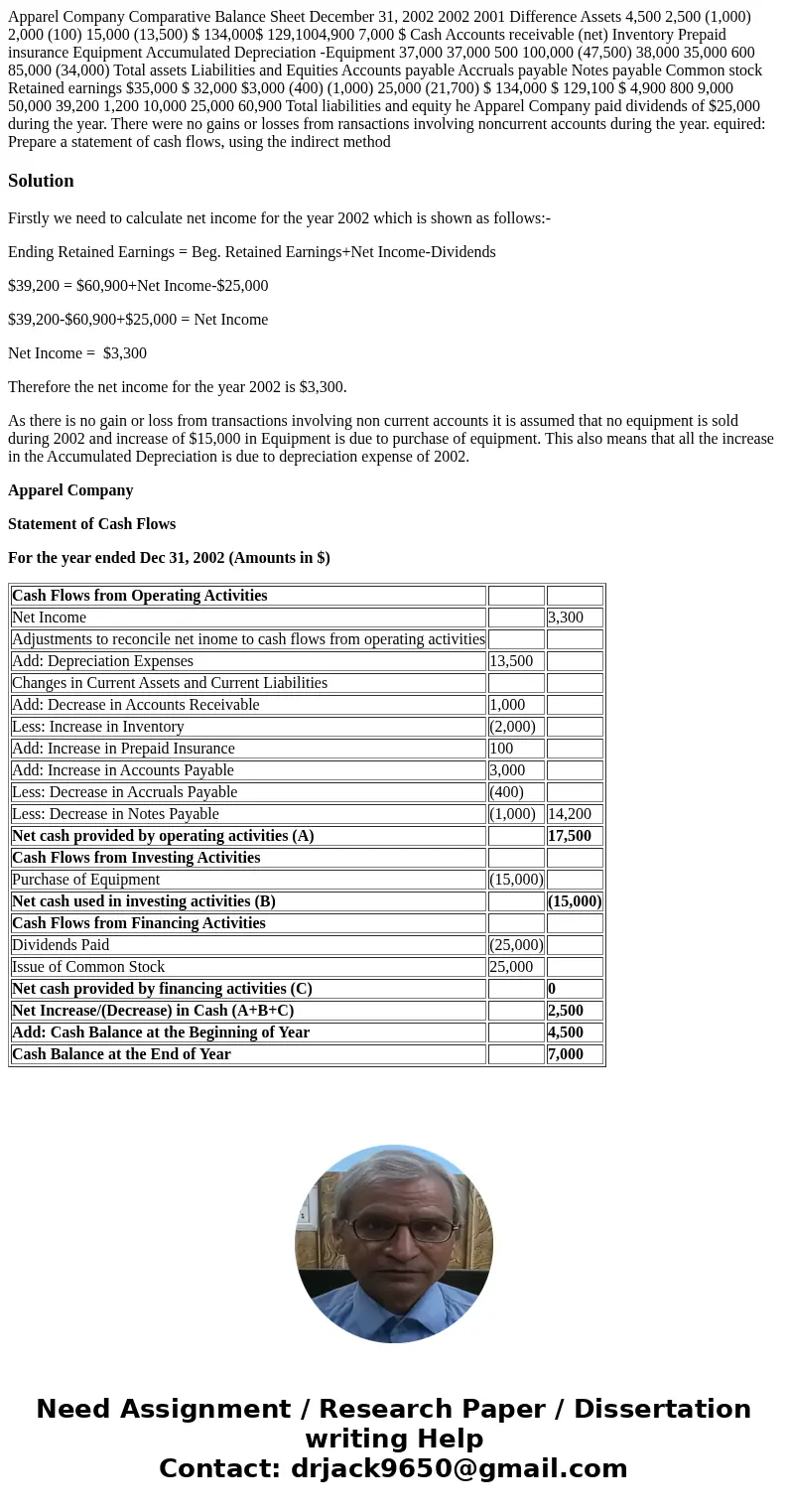

Apparel Company Comparative Balance Sheet December 31, 2002 2002 2001 Difference Assets 4,500 2,500 (1,000) 2,000 (100) 15,000 (13,500) $ 134,000$ 129,1004,900 7,000 $ Cash Accounts receivable (net) Inventory Prepaid insurance Equipment Accumulated Depreciation -Equipment 37,000 37,000 500 100,000 (47,500) 38,000 35,000 600 85,000 (34,000) Total assets Liabilities and Equities Accounts payable Accruals payable Notes payable Common stock Retained earnings $35,000 $ 32,000 $3,000 (400) (1,000) 25,000 (21,700) $ 134,000 $ 129,100 $ 4,900 800 9,000 50,000 39,200 1,200 10,000 25,000 60,900 Total liabilities and equity he Apparel Company paid dividends of $25,000 during the year. There were no gains or losses from ransactions involving noncurrent accounts during the year. equired: Prepare a statement of cash flows, using the indirect method

Solution

Firstly we need to calculate net income for the year 2002 which is shown as follows:-

Ending Retained Earnings = Beg. Retained Earnings+Net Income-Dividends

$39,200 = $60,900+Net Income-$25,000

$39,200-$60,900+$25,000 = Net Income

Net Income = $3,300

Therefore the net income for the year 2002 is $3,300.

As there is no gain or loss from transactions involving non current accounts it is assumed that no equipment is sold during 2002 and increase of $15,000 in Equipment is due to purchase of equipment. This also means that all the increase in the Accumulated Depreciation is due to depreciation expense of 2002.

Apparel Company

Statement of Cash Flows

For the year ended Dec 31, 2002 (Amounts in $)

| Cash Flows from Operating Activities | ||

| Net Income | 3,300 | |

| Adjustments to reconcile net inome to cash flows from operating activities | ||

| Add: Depreciation Expenses | 13,500 | |

| Changes in Current Assets and Current Liabilities | ||

| Add: Decrease in Accounts Receivable | 1,000 | |

| Less: Increase in Inventory | (2,000) | |

| Add: Increase in Prepaid Insurance | 100 | |

| Add: Increase in Accounts Payable | 3,000 | |

| Less: Decrease in Accruals Payable | (400) | |

| Less: Decrease in Notes Payable | (1,000) | 14,200 |

| Net cash provided by operating activities (A) | 17,500 | |

| Cash Flows from Investing Activities | ||

| Purchase of Equipment | (15,000) | |

| Net cash used in investing activities (B) | (15,000) | |

| Cash Flows from Financing Activities | ||

| Dividends Paid | (25,000) | |

| Issue of Common Stock | 25,000 | |

| Net cash provided by financing activities (C) | 0 | |

| Net Increase/(Decrease) in Cash (A+B+C) | 2,500 | |

| Add: Cash Balance at the Beginning of Year | 4,500 | |

| Cash Balance at the End of Year | 7,000 |

Homework Sourse

Homework Sourse