Barbour Corporation located in Buffalo New York is a retaile

Solution

Answer

Working:

T-1

T-2

Total

Sales

$ 330,000.00

$ 330,000.00

Variable cost of goods sold

$ 99,000.00

$ 99,000.00

Contribution margin

$ 231,000.00

$ 231,000.00

Expenses:

Fixed corporate cost

$ 80,000.00

$ 95,000.00

$ 175,000.00

Variable selling & admin cost

$ 16,500.00

$ 16,500.00

Fixed selling & admin

$ 32,000.00

$ 41,000.00

$ 73,000.00

Total expenses

$ 128,500.00

$ 136,000.00

$ 264,500.00

Operating Income (Loss) if T2 is dropped

$ 102,500.00

$ (136,000.00)

$ (33,500.00)

Operating Income (Loss) if T2 is not dropped

$ 83,000.00

$ (36,000.00)

$ 47,000.00

Answer:

Change in Annual Operating Income by dropping T-2 & Selling only T-1 =

Net Loss on Discontinuing T -2

[33500 + 47000]

$ 80,500.00

Working

A

Sales

$ 300,000.00

B

Variable COGS

$ 90,000.00

C

Variable selling

$ 15,000.00

D=A-B-C

Contribution margin

$ 195,000.00

E=(D/A) x 100

CM ratio

65%

Answer

A

Loss on Dropping T - 2

$ 80,500.00

B

CM Ratio

65%

C=A/B

Sales required to cover above loss

$ 123,846.15

D

Current Sale

$ 300,000.00

E=(C/D) x 100

Required % Increase in Sales of T -1

41.28%

Working and Answer

T-1

T-2

Total

Sales

$ 330,000.00

$ 330,000.00

Variable cost of goods sold

$ 99,000.00

$ 99,000.00

Contribution margin

$ 231,000.00

$ 231,000.00

Expenses:

Fixed corporate cost

$ 80,000.00

$ 36,500.00

$ 116,500.00

Variable selling & admin cost

$ 16,500.00

$ 16,500.00

Fixed selling & admin

$ 32,000.00

$ 41,000.00

$ 73,000.00

Total expenses

$ 128,500.00

$ 77,500.00

$ 206,000.00

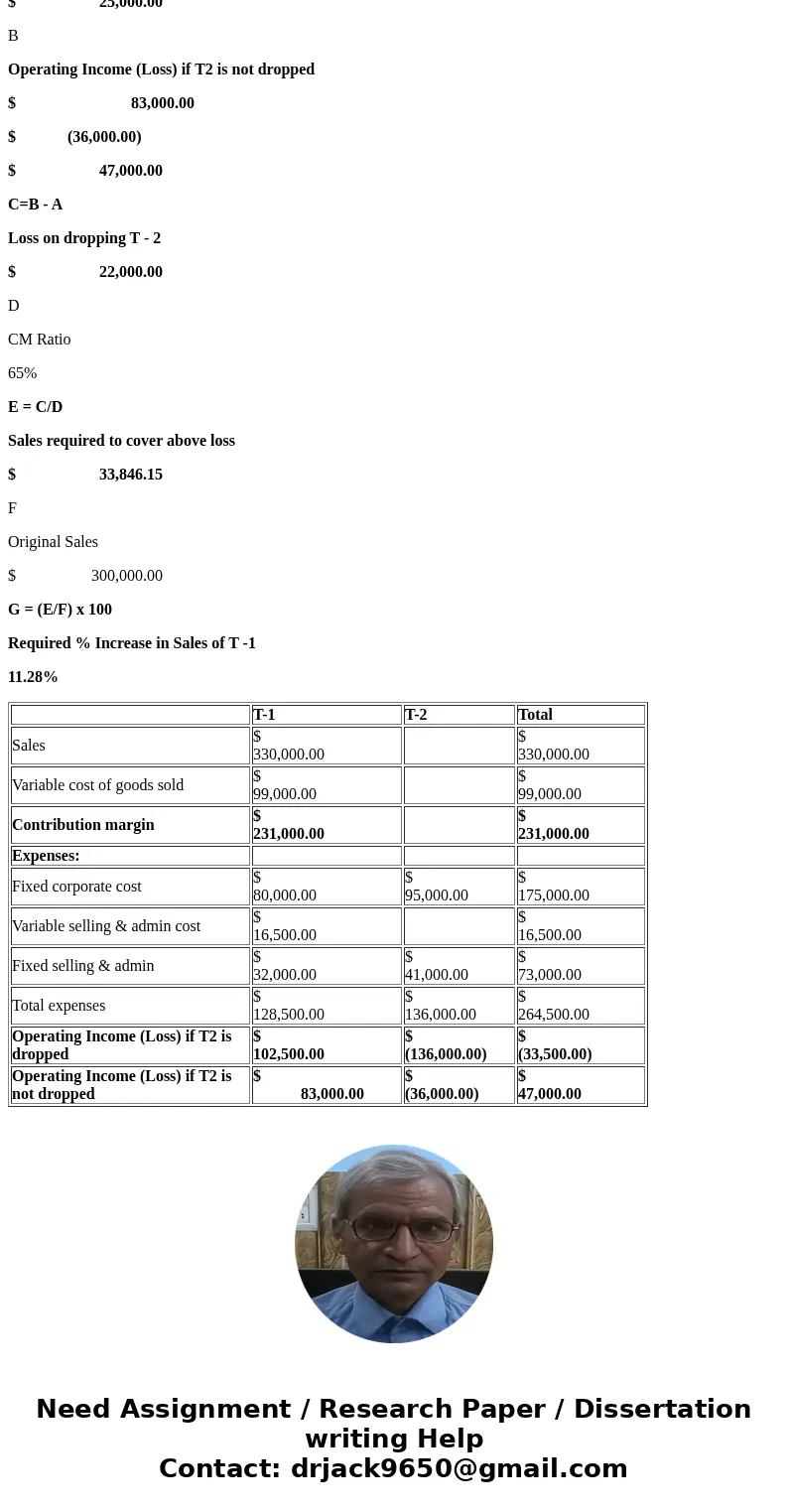

A

Operating Income (Loss) if T2 is dropped

$ 102,500.00

$ (77,500.00)

$ 25,000.00

B

Operating Income (Loss) if T2 is not dropped

$ 83,000.00

$ (36,000.00)

$ 47,000.00

C=B - A

Loss on dropping T - 2

$ 22,000.00

D

CM Ratio

65%

E = C/D

Sales required to cover above loss

$ 33,846.15

F

Original Sales

$ 300,000.00

G = (E/F) x 100

Required % Increase in Sales of T -1

11.28%

| T-1 | T-2 | Total | |

| Sales | $ 330,000.00 | $ 330,000.00 | |

| Variable cost of goods sold | $ 99,000.00 | $ 99,000.00 | |

| Contribution margin | $ 231,000.00 | $ 231,000.00 | |

| Expenses: | |||

| Fixed corporate cost | $ 80,000.00 | $ 95,000.00 | $ 175,000.00 |

| Variable selling & admin cost | $ 16,500.00 | $ 16,500.00 | |

| Fixed selling & admin | $ 32,000.00 | $ 41,000.00 | $ 73,000.00 |

| Total expenses | $ 128,500.00 | $ 136,000.00 | $ 264,500.00 |

| Operating Income (Loss) if T2 is dropped | $ 102,500.00 | $ (136,000.00) | $ (33,500.00) |

| Operating Income (Loss) if T2 is not dropped | $ 83,000.00 | $ (36,000.00) | $ 47,000.00 |

Homework Sourse

Homework Sourse