Ch 23 Homework Outdoor Outters has created a flexible budget

Solution

70000 units

80000 units

95000 units

Sales

$1400000

$1600000

=95000*20 (sales value per unit)

$1900000

Less: Cost of goods sold

$840000

$960000

= 1900000*0.6[cost of goods sold to sales]

$1140000

Gross profit on sales

$560000

$640000

=1900000-1140000

$760000

Less: Operating expenses ($90000 fixed)

$370000

$410000

=1900000*0.2(variable) +90000 (fixed)

$470000

Operating income

$190000

$230000

=760000-470000

$290000

Less: Income taxes@30% of operating income

$57000

$69000

=290000*0.3

$87000

Net Income

$133000

$161000

=290000-87000

$203000

Sales value per unit = 1400000/70000 = $20 or 1600000/80000 = $20

Cost of goods sold to sales = 840000/1400000=0.6 or 960000/1600000 = 0.6

Operating expense:

Fixed = 90000

Variable = 370000-90000 = 280000 or 410000-90000 = 320000

Variable operating expense to sales = 280000/1400000 = 0.2 or 320000/1600000 = 0.2

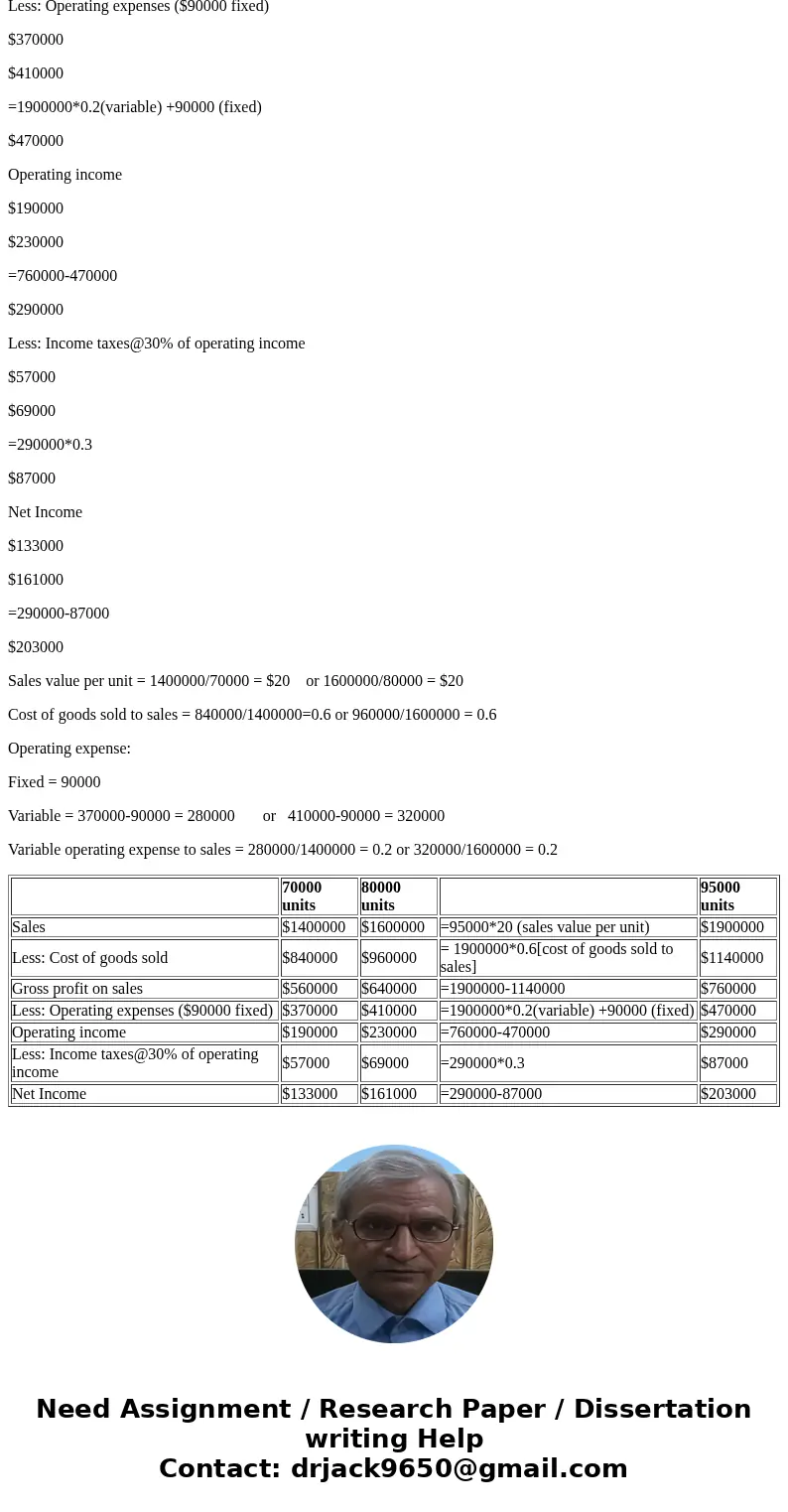

| 70000 units | 80000 units | 95000 units | ||

| Sales | $1400000 | $1600000 | =95000*20 (sales value per unit) | $1900000 |

| Less: Cost of goods sold | $840000 | $960000 | = 1900000*0.6[cost of goods sold to sales] | $1140000 |

| Gross profit on sales | $560000 | $640000 | =1900000-1140000 | $760000 |

| Less: Operating expenses ($90000 fixed) | $370000 | $410000 | =1900000*0.2(variable) +90000 (fixed) | $470000 |

| Operating income | $190000 | $230000 | =760000-470000 | $290000 |

| Less: Income taxes@30% of operating income | $57000 | $69000 | =290000*0.3 | $87000 |

| Net Income | $133000 | $161000 | =290000-87000 | $203000 |

Homework Sourse

Homework Sourse