Suppose You are an investment analyst working in the corpora

Solution

ALCOA CORPORATION

DETAILS OF MEMBERS:

TABLE OF CONENTS

PROFIT & LOSS

BALANCE SHEET

INTRODUCTION

ALCOA CORPORATION IS AN AMERICAN INDUSTRIAL CORPORATION. IT IS THE WORLDS’ 6TH LARGEST PRODUCER OF ALUMINIUM.

ALCOA IS MAJOR PRODUCER OF PRIMARY ALUMINIUM, FABRICATED ALUMINIUM AND ALUMINA COMBINED, THROUGH ITS ACTIVE AND GROWING PARTICIPATION IN ALL MAJOR ASPECTS OF THE INDUSTRY :

IT CONDUCTS OPERATION IN 10 COUNTRIES.

THE POLITICAL ECONOMY RESEARCH INSTITUTE RANKS ALCOA 15TH AMONG CORPORATIONS EMITTING AIRBORNE POLLUTANTS IN THE US.

IN APRIL 2003, ALCOA INC. AGREED TO SPEND $330 MILLION TO INSTALL A NEW COAL-FIRED POWER PLANT WITH STATE OF THE ART POLLUTION CONTROLS TO ELIMINATE HARMFUL EMISSIONS FROM THE POWER PLANT.

ALCOA ALSO MAINTAINS SEVERAL R&D CENTRES IN THE US. THE LARGEST ONE, ALCOA TECHNICAL CENTER, IS LOCATED EAST OF ITS PITTSBURGH HEADQUARTERS AT ALCOA CENTER, PENNSYLVANIA.

ALCOA BECAME ONE OF THE SAFEST COMPANIES IN THE WORLD, DESPITE THE ALUMINUIM INDUSTRY’S INERENT RISKS.

FY

2017

2016

2015

TOTAL REVENUE

11652

9318

11199

COST OF REVENUE

9072

7898

9039

GROSS PROFIT

2580

1420

2160

OPERATING EXPENSES

R&D

32

33

69

SALES, GENERAL ADMIN

284

359

353

NON-RECURRING ITEMS

309

318

983

OTHER OP. ITEMS

750

718

780

OPEARTING INCOME

1205

(8)

(25)

ADD’L INCOME EXP. ITEMS

58

89

(42)

EBIT

1263

81

(67)

INTEREST EXPENSE

104

243

270

EBT

1159

(162)

(337)

INCOME TAX

600

184

402

MINORITY INTEREST

(342)

(54)

(124)

NET INCOME

217

(400)

(863)

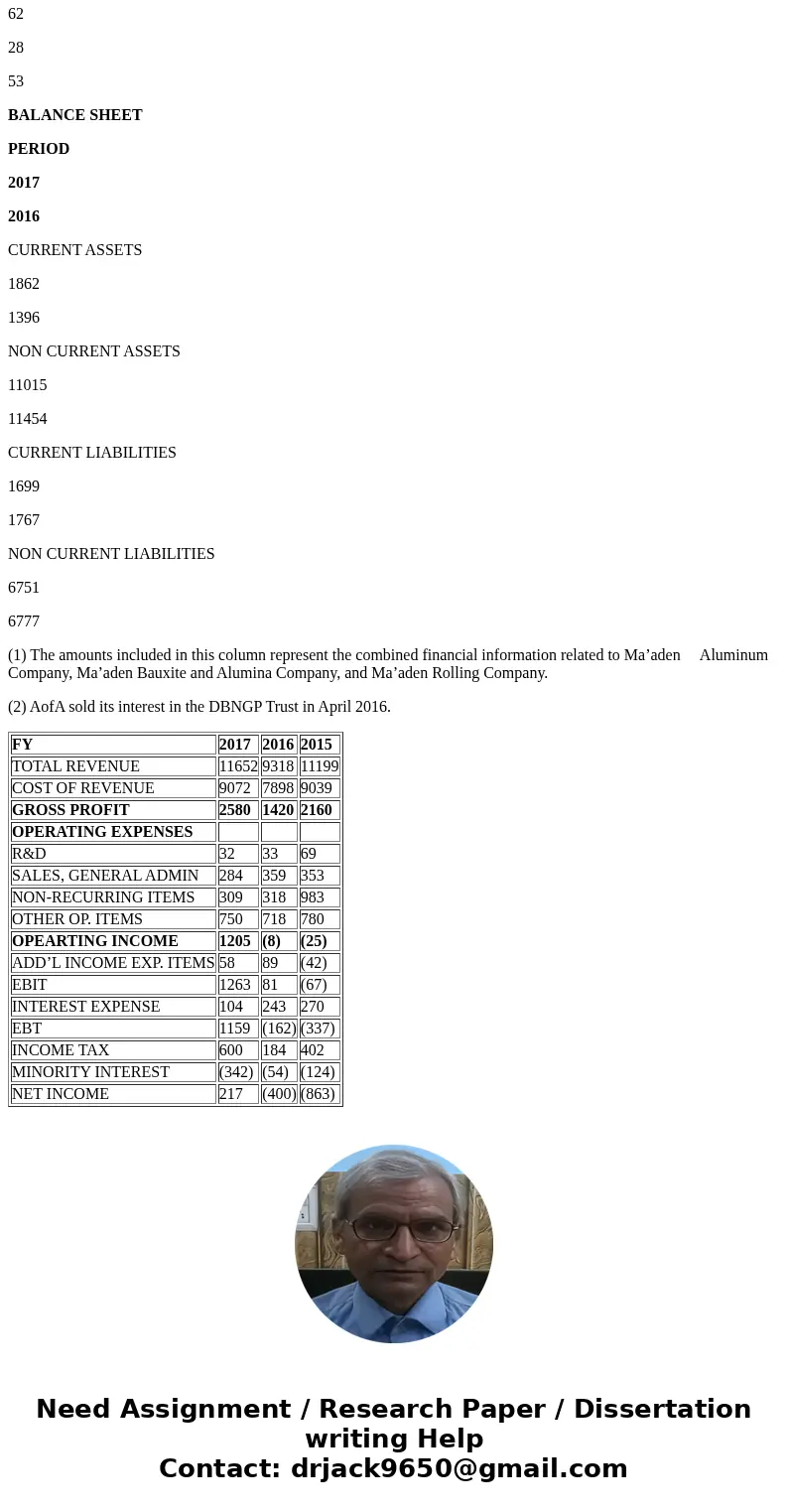

ANNUAL INCOME STATEMENT (VALUES IN ‘000,000) (FIGURES IN $)

PROFITABILITY ANALYSIS OF INCOME STATEMENT

RATIOS

2017

2016

2015

GROSS PROFIT MARGIN=GROSS PROFIT/REVENUE

0.22

0.15

0.19

OP. PROFIT MARGIN=OP. PROFIT/REVENUE

0.10

-0.0008

-0.002

NET PROFIT MARGIN= NET PROFIT/REVENUE

0.019

-0.043

-0.077

RECOMMENDATION –

THE COMPANY SEEMS TO BE GROWING. WHEN LOOKED UPON AT RATIOS, PAST YEARS HAVE BEEN A TOUGHER TIME FOR ALCOA CORP. THE EXPENSES WERE DIFFICULT TO BEAR AND SHAREHOLDERS HAD NO PROFIT IN HANDS.

MOVING TO NEXT YR, 2016THE IT HAS REDUCED LOSS BY MORE THAN 50% AND SURVIVED WELL. AND LAST YEAR, FINALLY THE CO. WAS ABLE TO RETAIN PROFITS FOR ITS SHAREHOLDERS AFTER PAYING THE EXPENSES AND ARREARS.

THE COMPANY IS EXPECTED TO ARISE IN NEAR FUTURE AND PROVIDE A GOOD RETURN.

REFERNCES:

APPENDICES:

PROFIT AND LOSS

PERIOD

2017

2016

2015

SALES

4469

3507

4119

COGS

3781

2844

3209

INCOME (LOSS) BEFORE TAXES

132

85

125

NET (LOSS)/INCOME

82

21

43

EQUITY IN NET (LOSS) INCOME

52

25

60

OTHER

10

3

(7)

CO.’S EQUITY IN NET (LOSS)INCOME

62

28

53

BALANCE SHEET

PERIOD

2017

2016

CURRENT ASSETS

1862

1396

NON CURRENT ASSETS

11015

11454

CURRENT LIABILITIES

1699

1767

NON CURRENT LIABILITIES

6751

6777

(1) The amounts included in this column represent the combined financial information related to Ma’aden Aluminum Company, Ma’aden Bauxite and Alumina Company, and Ma’aden Rolling Company.

(2) AofA sold its interest in the DBNGP Trust in April 2016.

| FY | 2017 | 2016 | 2015 |

| TOTAL REVENUE | 11652 | 9318 | 11199 |

| COST OF REVENUE | 9072 | 7898 | 9039 |

| GROSS PROFIT | 2580 | 1420 | 2160 |

| OPERATING EXPENSES | |||

| R&D | 32 | 33 | 69 |

| SALES, GENERAL ADMIN | 284 | 359 | 353 |

| NON-RECURRING ITEMS | 309 | 318 | 983 |

| OTHER OP. ITEMS | 750 | 718 | 780 |

| OPEARTING INCOME | 1205 | (8) | (25) |

| ADD’L INCOME EXP. ITEMS | 58 | 89 | (42) |

| EBIT | 1263 | 81 | (67) |

| INTEREST EXPENSE | 104 | 243 | 270 |

| EBT | 1159 | (162) | (337) |

| INCOME TAX | 600 | 184 | 402 |

| MINORITY INTEREST | (342) | (54) | (124) |

| NET INCOME | 217 | (400) | (863) |

Homework Sourse

Homework Sourse