Required information Use the following information for the E

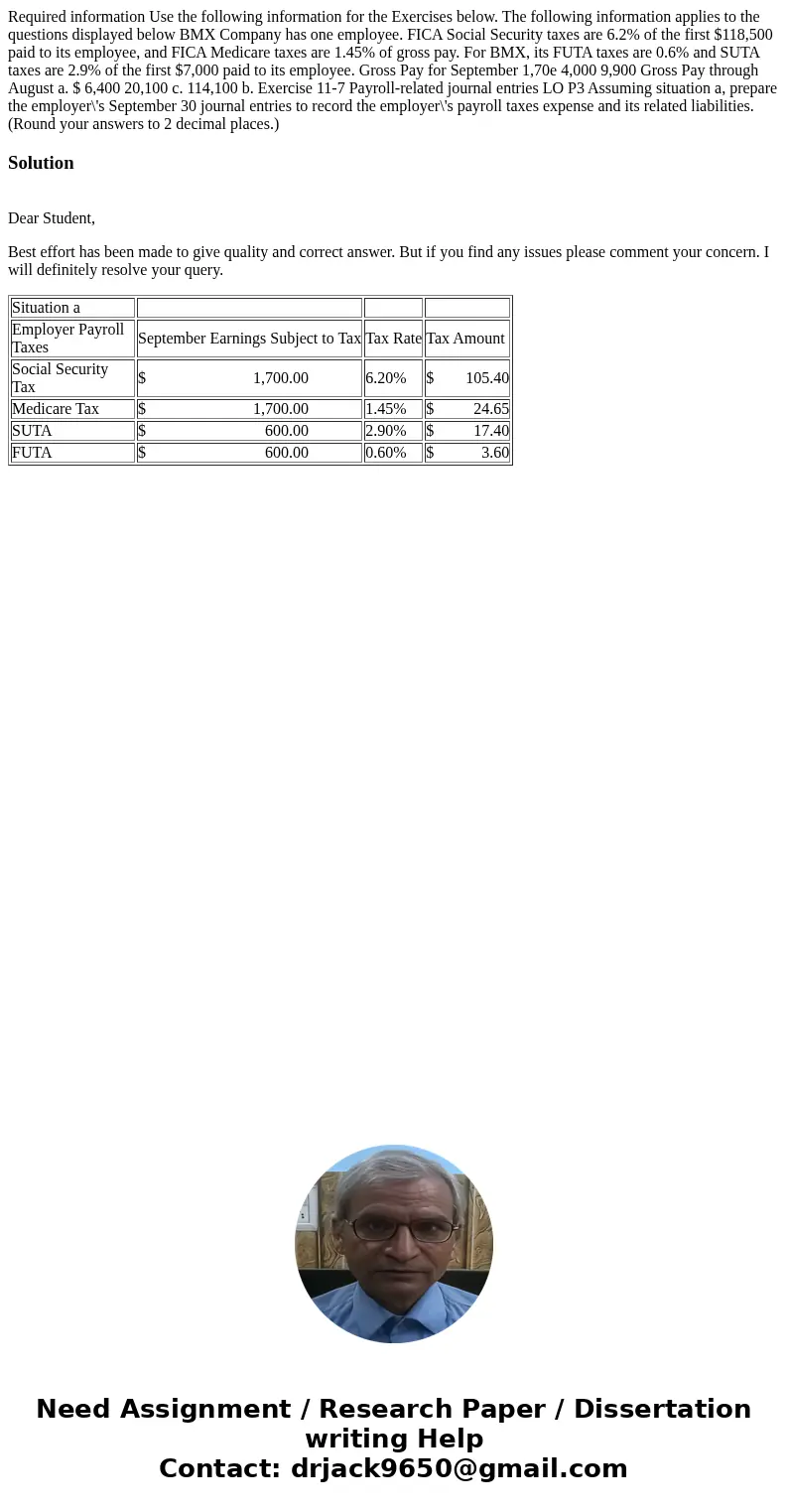

Required information Use the following information for the Exercises below. The following information applies to the questions displayed below BMX Company has one employee. FICA Social Security taxes are 6.2% of the first $118,500 paid to its employee, and FICA Medicare taxes are 1.45% of gross pay. For BMX, its FUTA taxes are 0.6% and SUTA taxes are 2.9% of the first $7,000 paid to its employee. Gross Pay for September 1,70e 4,000 9,900 Gross Pay through August a. $ 6,400 20,100 c. 114,100 b. Exercise 11-7 Payroll-related journal entries LO P3 Assuming situation a, prepare the employer\'s September 30 journal entries to record the employer\'s payroll taxes expense and its related liabilities. (Round your answers to 2 decimal places.)

Solution

Dear Student,

Best effort has been made to give quality and correct answer. But if you find any issues please comment your concern. I will definitely resolve your query.

| Situation a | |||

| Employer Payroll Taxes | September Earnings Subject to Tax | Tax Rate | Tax Amount |

| Social Security Tax | $ 1,700.00 | 6.20% | $ 105.40 |

| Medicare Tax | $ 1,700.00 | 1.45% | $ 24.65 |

| SUTA | $ 600.00 | 2.90% | $ 17.40 |

| FUTA | $ 600.00 | 0.60% | $ 3.60 |

Homework Sourse

Homework Sourse