Pilgrim Corporation makes a range of products The companys p

Pilgrim Corporation makes a range of products. The company\'s predetermined overhead rate is $24 per direct labor-hour, which was calculated using the following budgeted data:

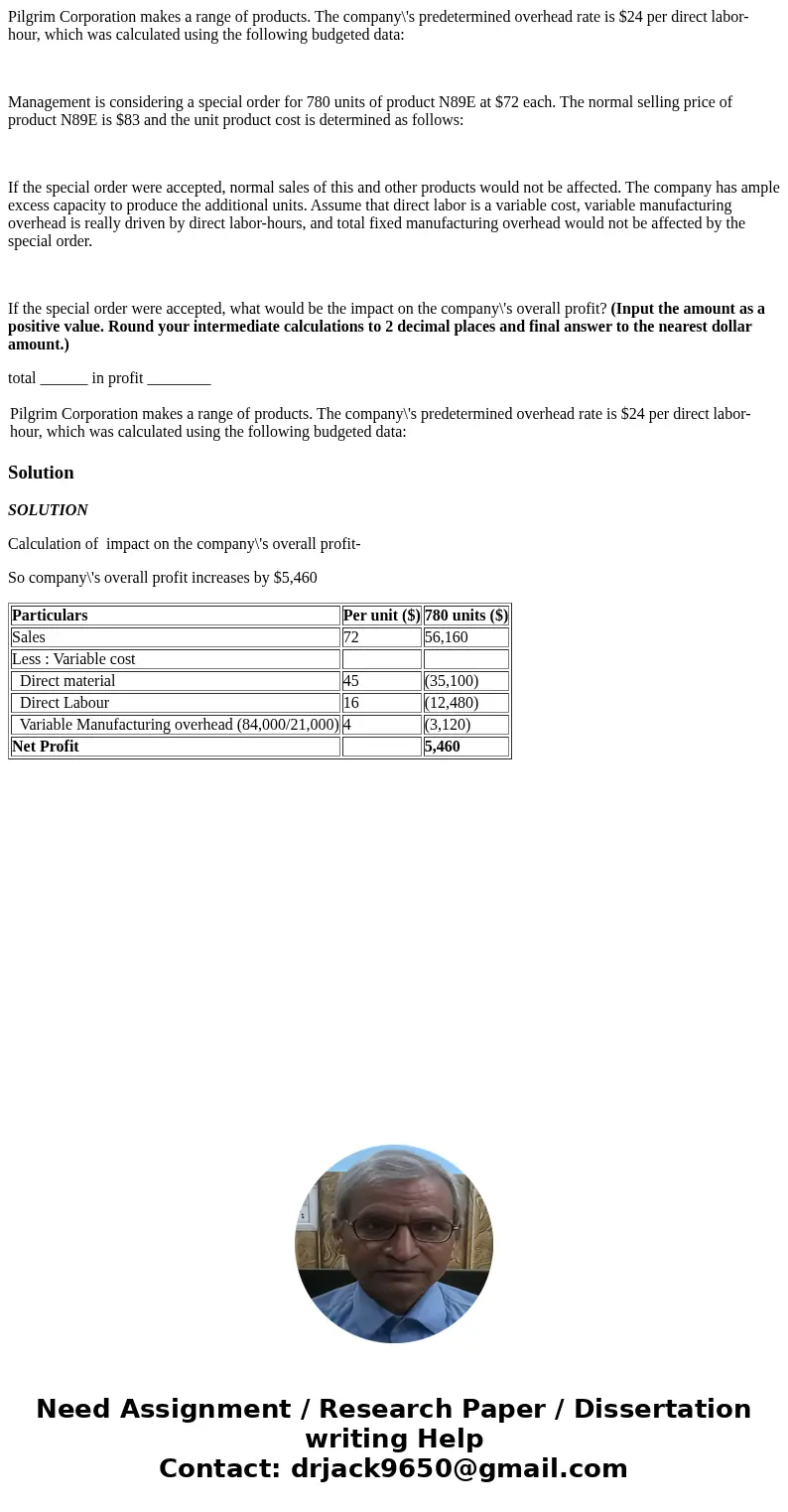

Management is considering a special order for 780 units of product N89E at $72 each. The normal selling price of product N89E is $83 and the unit product cost is determined as follows:

If the special order were accepted, normal sales of this and other products would not be affected. The company has ample excess capacity to produce the additional units. Assume that direct labor is a variable cost, variable manufacturing overhead is really driven by direct labor-hours, and total fixed manufacturing overhead would not be affected by the special order.

If the special order were accepted, what would be the impact on the company\'s overall profit? (Input the amount as a positive value. Round your intermediate calculations to 2 decimal places and final answer to the nearest dollar amount.)

total ______ in profit ________

| Pilgrim Corporation makes a range of products. The company\'s predetermined overhead rate is $24 per direct labor-hour, which was calculated using the following budgeted data: |

Solution

SOLUTION

Calculation of impact on the company\'s overall profit-

So company\'s overall profit increases by $5,460

| Particulars | Per unit ($) | 780 units ($) |

| Sales | 72 | 56,160 |

| Less : Variable cost | ||

| Direct material | 45 | (35,100) |

| Direct Labour | 16 | (12,480) |

| Variable Manufacturing overhead (84,000/21,000) | 4 | (3,120) |

| Net Profit | 5,460 |

Homework Sourse

Homework Sourse