Q Florida Power and Light has committed to building a solar

Q) Florida Power and Light has committed to building a solar power plant. JoAnne, an IE working for FPL, has been tasked with evaluating the three current designs. FPL uses an interest rate of 10% and a 20-year horizon.

Design 1: Flat Solar Panels A field of \"flat\" solar panels angled to best catch the sun will yield 2.6 MW of power and will cost $87 million initially with first-year operating costs at $2 million, growing $250,000 annually. It will produce electricity worth $6.9 million the first year and will increase by 8% each year thereafter.

Design 2: Mechanized Solar Panels A field of mechanized solar panels rotates from side to side so that they are always positioned parallel to the sun\'s rays, maximizing the production of elec-tricity. This design will yield 3.1 MW of power and will cost $101 million initially with first-year operat-ing costs at $2.3 million, growing $300,000 annually. It will produce electricity worth $8.8 million the first year and will increase 8% each year thereafter.

Design 3: Solar Collector Field This design uses a field of mirrors to focus the sun\'s rays onto a boiler mounted in a tower. The boiler then produces steam and generates electricity the same way a coal-fired plant operates. This system will yield 3.3 MW of power and will cost $91 million initially with first-year operating costs at $3 million, growing $350,000 annually. It will produce electric-ity worth $9.7 million the first year and will increase 8% each year thereafter.

Which design is better?

Solution

To find the best design , we will calculate the Net Present Value!!.

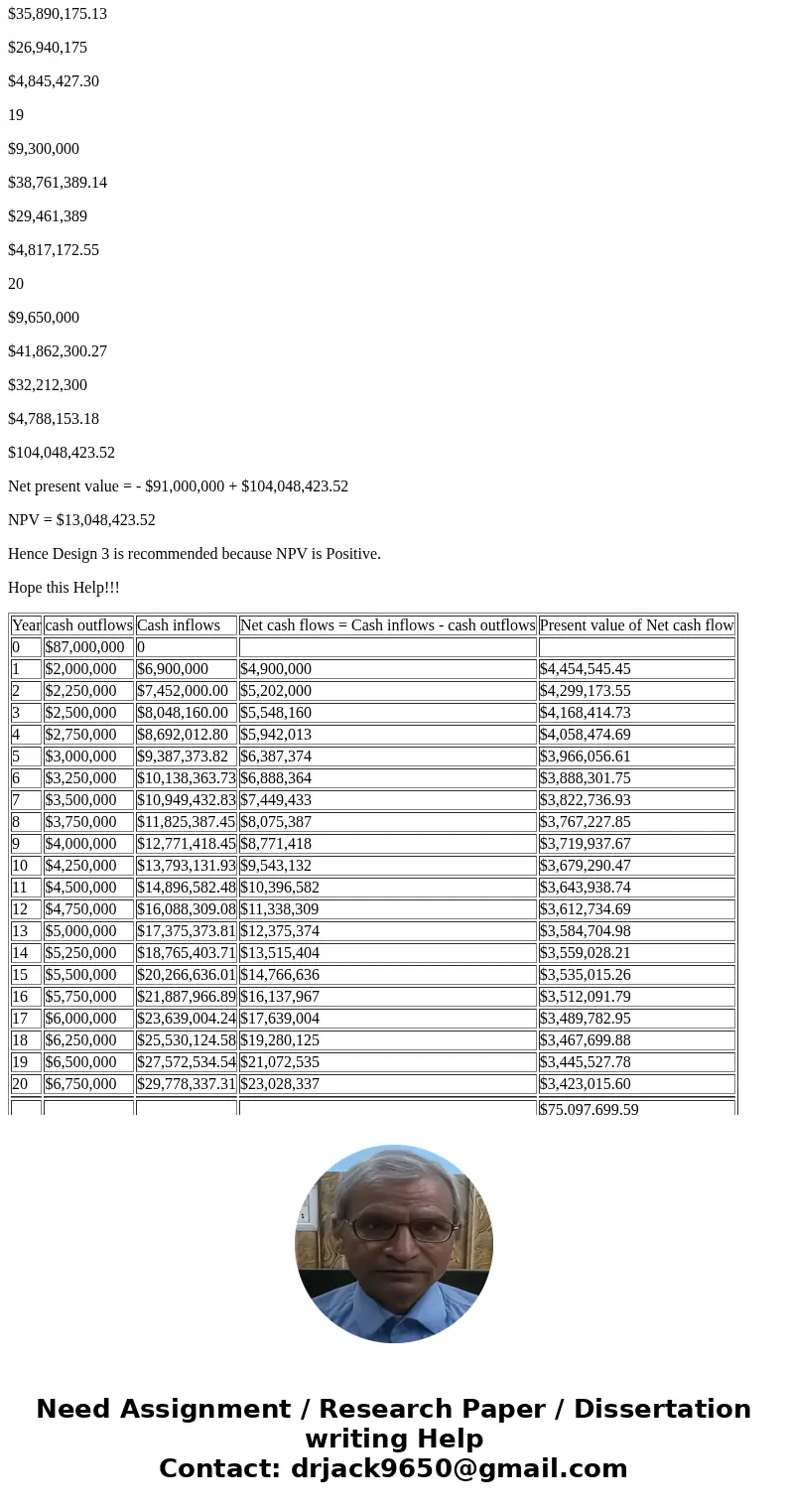

Design 1: Flat Solar Panels

Year

cash outflows

Cash inflows

Net cash flows = Cash inflows - cash outflows

Present value of Net cash flow

0

$87,000,000

0

1

$2,000,000

$6,900,000

$4,900,000

$4,454,545.45

2

$2,250,000

$7,452,000.00

$5,202,000

$4,299,173.55

3

$2,500,000

$8,048,160.00

$5,548,160

$4,168,414.73

4

$2,750,000

$8,692,012.80

$5,942,013

$4,058,474.69

5

$3,000,000

$9,387,373.82

$6,387,374

$3,966,056.61

6

$3,250,000

$10,138,363.73

$6,888,364

$3,888,301.75

7

$3,500,000

$10,949,432.83

$7,449,433

$3,822,736.93

8

$3,750,000

$11,825,387.45

$8,075,387

$3,767,227.85

9

$4,000,000

$12,771,418.45

$8,771,418

$3,719,937.67

10

$4,250,000

$13,793,131.93

$9,543,132

$3,679,290.47

11

$4,500,000

$14,896,582.48

$10,396,582

$3,643,938.74

12

$4,750,000

$16,088,309.08

$11,338,309

$3,612,734.69

13

$5,000,000

$17,375,373.81

$12,375,374

$3,584,704.98

14

$5,250,000

$18,765,403.71

$13,515,404

$3,559,028.21

15

$5,500,000

$20,266,636.01

$14,766,636

$3,535,015.26

16

$5,750,000

$21,887,966.89

$16,137,967

$3,512,091.79

17

$6,000,000

$23,639,004.24

$17,639,004

$3,489,782.95

18

$6,250,000

$25,530,124.58

$19,280,125

$3,467,699.88

19

$6,500,000

$27,572,534.54

$21,072,535

$3,445,527.78

20

$6,750,000

$29,778,337.31

$23,028,337

$3,423,015.60

$75,097,699.59

Net present value = - $ 87,000,000 + $75,097,699.59

Net present value = - $11,902,300.41

Design 2: Mechanized Solar Panels

Year

cash outflows

Cash inflows

Net cash flows = Cash inflows - cash outflows

Present value of Net cash flow

0

$101,000,000

1

$2,300,000

$8,800,000

$6,500,000

$5,909,090.91

2

$2,600,000

$9,504,000.00

$6,904,000

$5,705,785.12

3

$2,900,000

$10,264,320.00

$7,364,320

$5,532,922.61

4

$3,200,000

$11,085,465.60

$7,885,466

$5,385,879.11

5

$3,500,000

$11,972,302.85

$8,472,303

$5,260,633.49

6

$3,800,000

$12,930,087.08

$9,130,087

$5,153,696.13

7

$4,100,000

$13,964,494.04

$9,864,494

$5,062,045.20

8

$4,400,000

$15,081,653.57

$10,681,654

$4,983,070.22

9

$4,700,000

$16,288,185.85

$11,588,186

$4,914,522.02

10

$5,000,000

$17,591,240.72

$12,591,241

$4,854,468.36

11

$5,300,000

$18,998,539.98

$13,698,540

$4,801,254.69

12

$5,600,000

$20,518,423.17

$14,918,423

$4,753,469.37

13

$5,900,000

$22,159,897.03

$16,259,897

$4,709,912.99

14

$6,200,000

$23,932,688.79

$17,732,689

$4,669,571.18

15

$6,500,000

$25,847,303.89

$19,347,304

$4,631,590.73

16

$6,800,000

$27,915,088.20

$21,115,088

$4,595,258.40

17

$7,100,000

$30,148,295.26

$23,048,295

$4,559,982.34

18

$7,400,000

$32,560,158.88

$25,160,159

$4,525,275.73

19

$7,700,000

$35,164,971.59

$27,464,972

$4,490,742.32

20

$8,000,000

$37,978,169.32

$29,978,169

$4,456,063.85

$98,955,234.80

Net present value = - $101,000,000 + $98,955,234.80

NPV = - $2,044,765.20

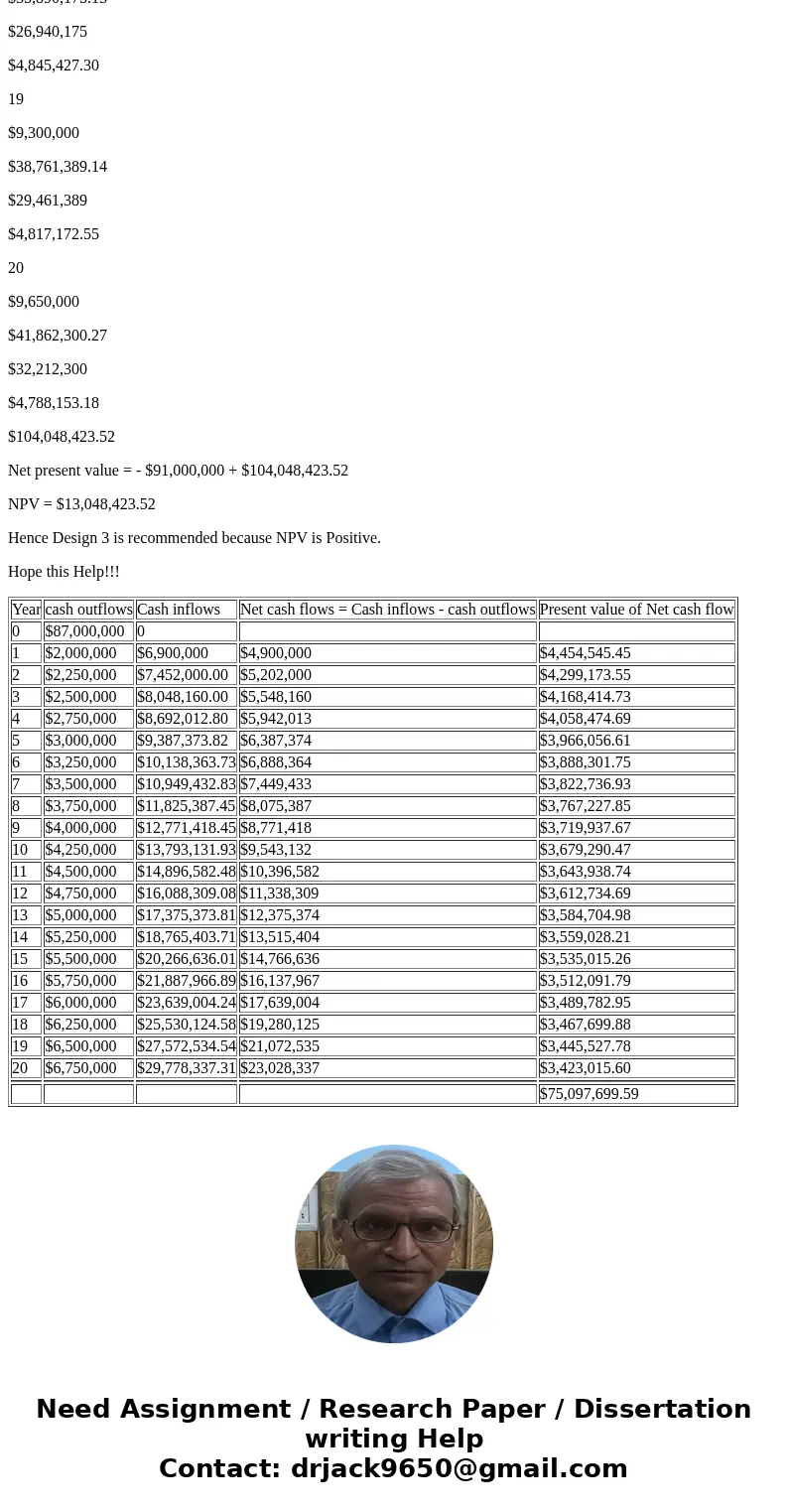

Design 3: Solar Collector Field

Year

cash outflows

Cash inflows

Net cash flows = Cash inflows - cash outflows

Present value of Net cash flow

0

$91,000,000

1

$3,000,000

$9,700,000

$6,700,000

$6,090,909.09

2

$3,350,000

$10,476,000.00

$7,126,000

$5,889,256.20

3

$3,700,000

$11,314,080.00

$7,614,080

$5,720,571.00

4

$4,050,000

$12,219,206.40

$8,169,206

$5,579,677.89

5

$4,400,000

$13,196,742.91

$8,796,743

$5,462,085.25

6

$4,750,000

$14,252,482.34

$9,502,482

$5,363,903.55

7

$5,100,000

$15,392,680.93

$10,292,681

$5,281,772.78

8

$5,450,000

$16,624,095.41

$11,174,095

$5,212,797.97

9

$5,800,000

$17,954,023.04

$12,154,023

$5,154,492.22

10

$6,150,000

$19,390,344.88

$13,240,345

$5,104,726.12

11

$6,500,000

$20,941,572.47

$14,441,572

$5,061,683.05

12

$6,850,000

$22,616,898.27

$15,766,898

$5,023,819.69

13

$7,200,000

$24,426,250.13

$17,226,250

$4,989,831.06

14

$7,550,000

$26,380,350.14

$18,830,350

$4,958,619.72

15

$7,900,000

$28,490,778.16

$20,590,778

$4,929,268.58

16

$8,250,000

$30,770,040.41

$22,520,040

$4,901,016.93

17

$8,600,000

$33,231,643.64

$24,631,644

$4,873,239.38

18

$8,950,000

$35,890,175.13

$26,940,175

$4,845,427.30

19

$9,300,000

$38,761,389.14

$29,461,389

$4,817,172.55

20

$9,650,000

$41,862,300.27

$32,212,300

$4,788,153.18

$104,048,423.52

Net present value = - $91,000,000 + $104,048,423.52

NPV = $13,048,423.52

Hence Design 3 is recommended because NPV is Positive.

Hope this Help!!!

| Year | cash outflows | Cash inflows | Net cash flows = Cash inflows - cash outflows | Present value of Net cash flow |

| 0 | $87,000,000 | 0 | ||

| 1 | $2,000,000 | $6,900,000 | $4,900,000 | $4,454,545.45 |

| 2 | $2,250,000 | $7,452,000.00 | $5,202,000 | $4,299,173.55 |

| 3 | $2,500,000 | $8,048,160.00 | $5,548,160 | $4,168,414.73 |

| 4 | $2,750,000 | $8,692,012.80 | $5,942,013 | $4,058,474.69 |

| 5 | $3,000,000 | $9,387,373.82 | $6,387,374 | $3,966,056.61 |

| 6 | $3,250,000 | $10,138,363.73 | $6,888,364 | $3,888,301.75 |

| 7 | $3,500,000 | $10,949,432.83 | $7,449,433 | $3,822,736.93 |

| 8 | $3,750,000 | $11,825,387.45 | $8,075,387 | $3,767,227.85 |

| 9 | $4,000,000 | $12,771,418.45 | $8,771,418 | $3,719,937.67 |

| 10 | $4,250,000 | $13,793,131.93 | $9,543,132 | $3,679,290.47 |

| 11 | $4,500,000 | $14,896,582.48 | $10,396,582 | $3,643,938.74 |

| 12 | $4,750,000 | $16,088,309.08 | $11,338,309 | $3,612,734.69 |

| 13 | $5,000,000 | $17,375,373.81 | $12,375,374 | $3,584,704.98 |

| 14 | $5,250,000 | $18,765,403.71 | $13,515,404 | $3,559,028.21 |

| 15 | $5,500,000 | $20,266,636.01 | $14,766,636 | $3,535,015.26 |

| 16 | $5,750,000 | $21,887,966.89 | $16,137,967 | $3,512,091.79 |

| 17 | $6,000,000 | $23,639,004.24 | $17,639,004 | $3,489,782.95 |

| 18 | $6,250,000 | $25,530,124.58 | $19,280,125 | $3,467,699.88 |

| 19 | $6,500,000 | $27,572,534.54 | $21,072,535 | $3,445,527.78 |

| 20 | $6,750,000 | $29,778,337.31 | $23,028,337 | $3,423,015.60 |

| $75,097,699.59 |

Homework Sourse

Homework Sourse