In its proposed 2017 income statement Hrabik Corporation rep

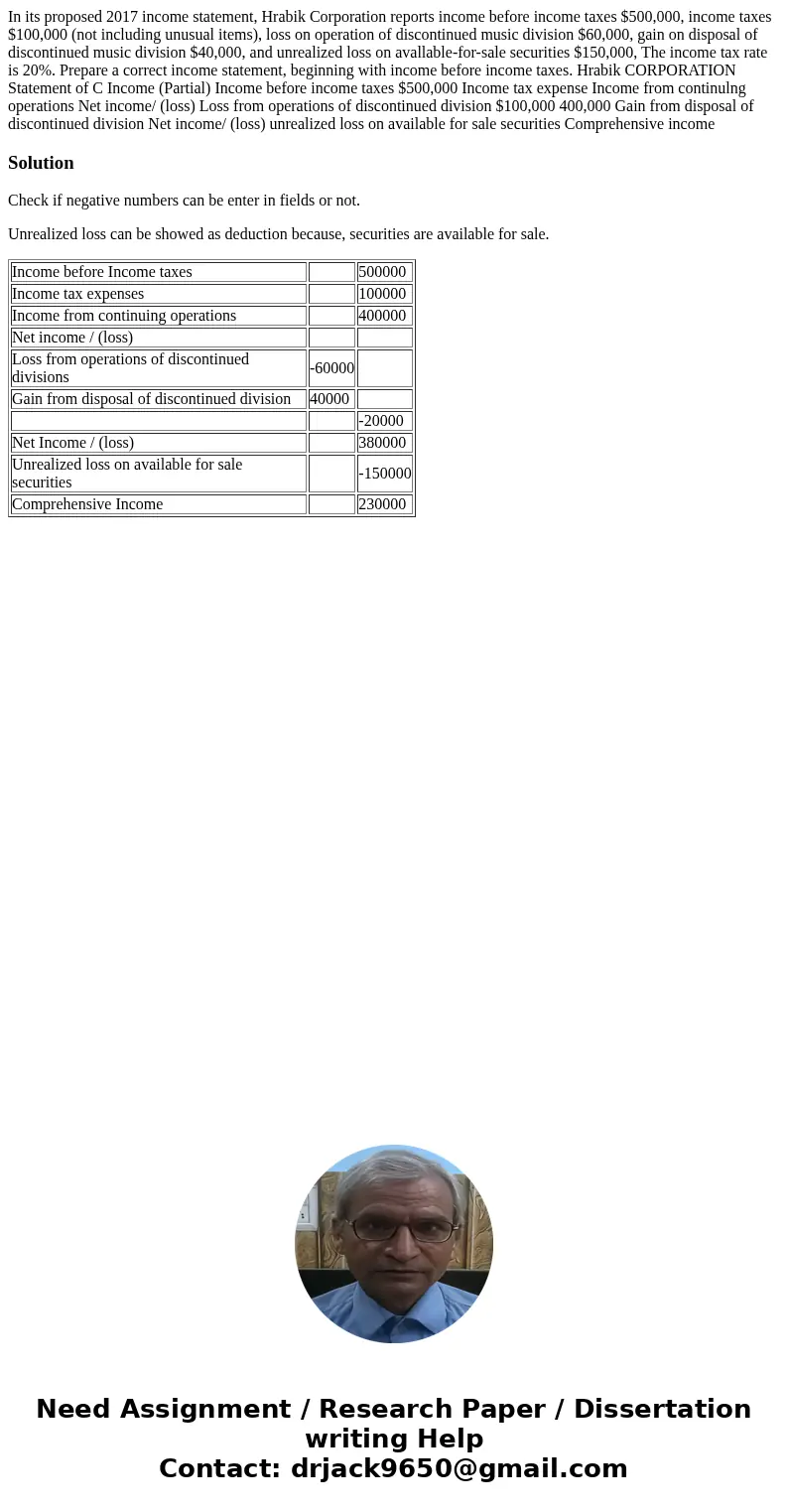

In its proposed 2017 income statement, Hrabik Corporation reports income before income taxes $500,000, income taxes $100,000 (not including unusual items), loss on operation of discontinued music division $60,000, gain on disposal of discontinued music division $40,000, and unrealized loss on avallable-for-sale securities $150,000, The income tax rate is 20%. Prepare a correct income statement, beginning with income before income taxes. Hrabik CORPORATION Statement of C Income (Partial) Income before income taxes $500,000 Income tax expense Income from continulng operations Net income/ (loss) Loss from operations of discontinued division $100,000 400,000 Gain from disposal of discontinued division Net income/ (loss) unrealized loss on available for sale securities Comprehensive income

Solution

Check if negative numbers can be enter in fields or not.

Unrealized loss can be showed as deduction because, securities are available for sale.

| Income before Income taxes | 500000 | |

| Income tax expenses | 100000 | |

| Income from continuing operations | 400000 | |

| Net income / (loss) | ||

| Loss from operations of discontinued divisions | -60000 | |

| Gain from disposal of discontinued division | 40000 | |

| -20000 | ||

| Net Income / (loss) | 380000 | |

| Unrealized loss on available for sale securities | -150000 | |

| Comprehensive Income | 230000 |

Homework Sourse

Homework Sourse