Journalize the transactions Include entries to close net inc

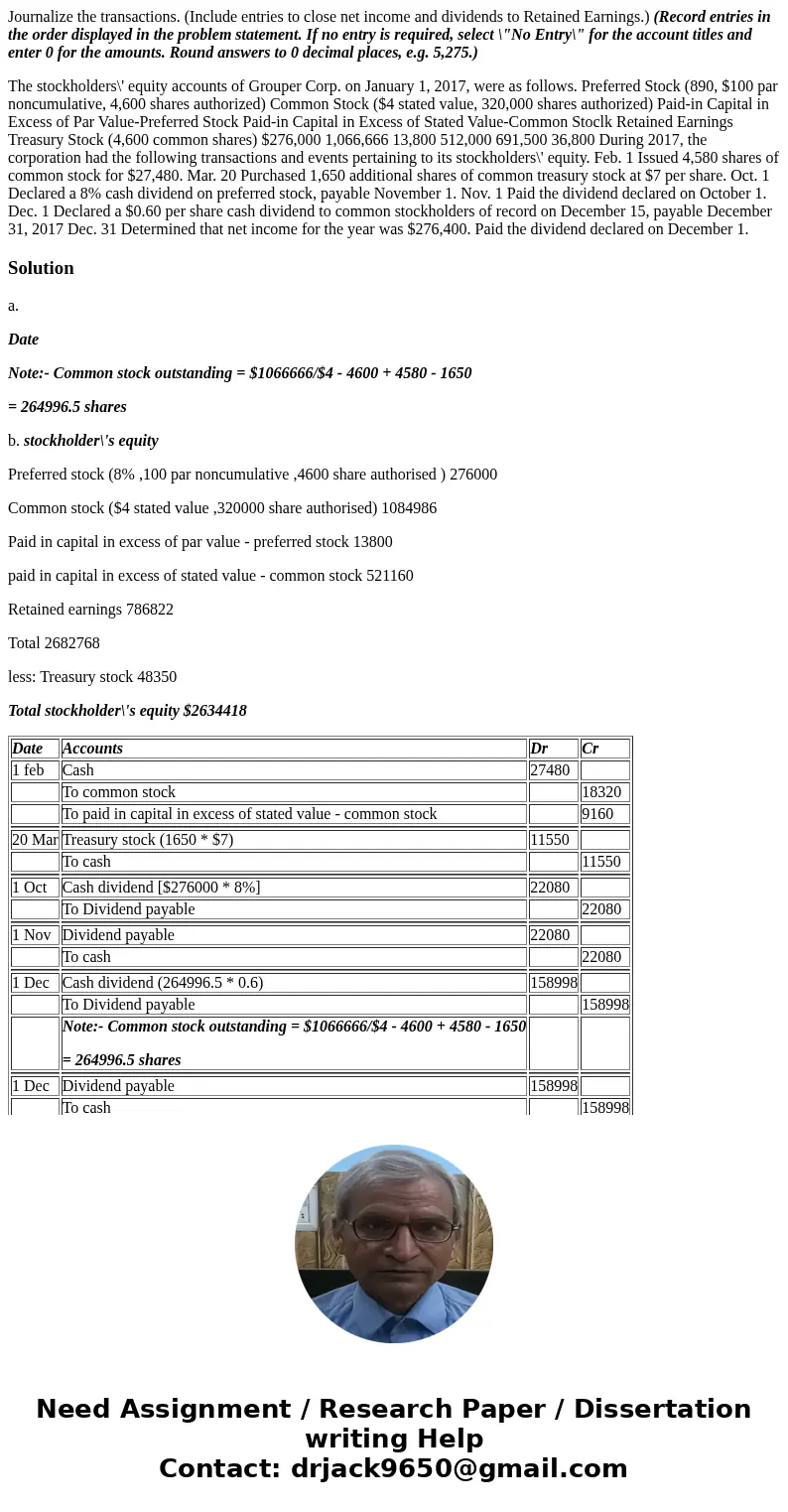

Journalize the transactions. (Include entries to close net income and dividends to Retained Earnings.) (Record entries in the order displayed in the problem statement. If no entry is required, select \"No Entry\" for the account titles and enter 0 for the amounts. Round answers to 0 decimal places, e.g. 5,275.)

Solution

a.

Date

Note:- Common stock outstanding = $1066666/$4 - 4600 + 4580 - 1650

= 264996.5 shares

b. stockholder\'s equity

Preferred stock (8% ,100 par noncumulative ,4600 share authorised ) 276000

Common stock ($4 stated value ,320000 share authorised) 1084986

Paid in capital in excess of par value - preferred stock 13800

paid in capital in excess of stated value - common stock 521160

Retained earnings 786822

Total 2682768

less: Treasury stock 48350

Total stockholder\'s equity $2634418

| Date | Accounts | Dr | Cr |

| 1 feb | Cash | 27480 | |

| To common stock | 18320 | ||

| To paid in capital in excess of stated value - common stock | 9160 | ||

| 20 Mar | Treasury stock (1650 * $7) | 11550 | |

| To cash | 11550 | ||

| 1 Oct | Cash dividend [$276000 * 8%] | 22080 | |

| To Dividend payable | 22080 | ||

| 1 Nov | Dividend payable | 22080 | |

| To cash | 22080 | ||

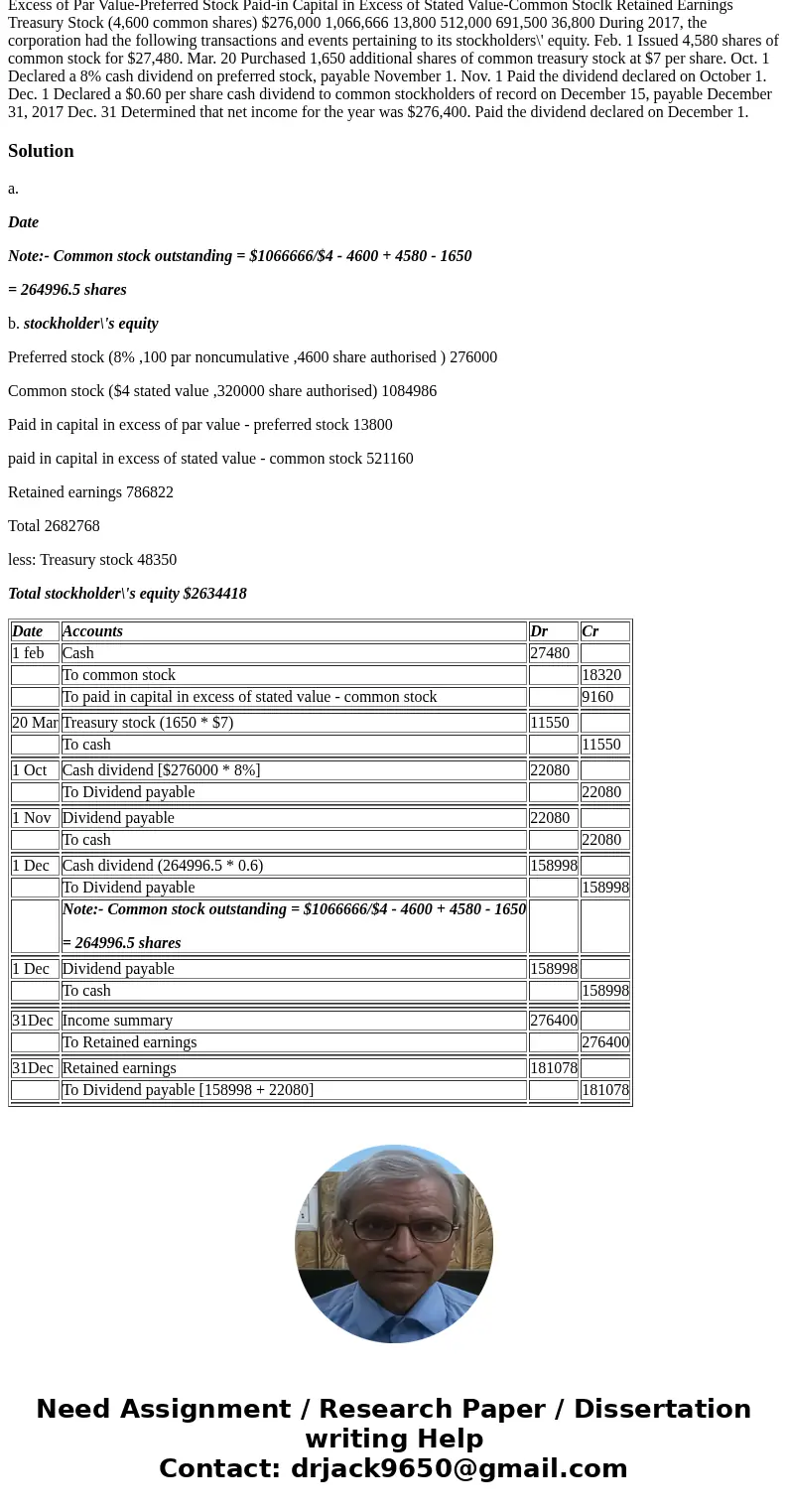

| 1 Dec | Cash dividend (264996.5 * 0.6) | 158998 | |

| To Dividend payable | 158998 | ||

| Note:- Common stock outstanding = $1066666/$4 - 4600 + 4580 - 1650 = 264996.5 shares | |||

| 1 Dec | Dividend payable | 158998 | |

| To cash | 158998 | ||

| 31Dec | Income summary | 276400 | |

| To Retained earnings | 276400 | ||

| 31Dec | Retained earnings | 181078 | |

| To Dividend payable [158998 + 22080] | 181078 | ||

Homework Sourse

Homework Sourse