2 July 01 Record the dividend received from the foreign subs

2. July 01 Record the dividend received from the foreign subsidiary.

3. December 31 Record the equity in the net income of the foreign subsidiary.

4. December 31 Record the amortization of the differential.

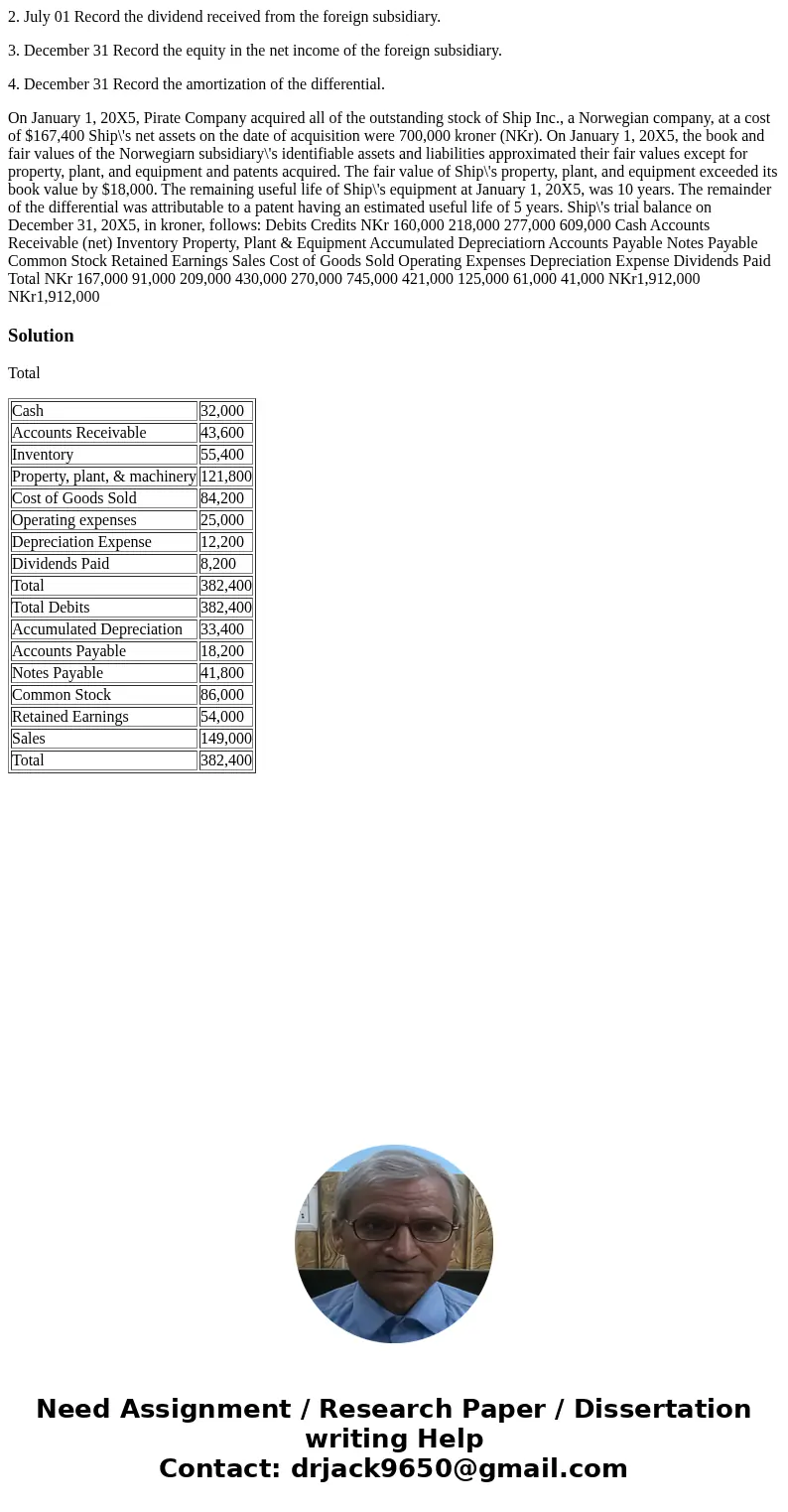

On January 1, 20X5, Pirate Company acquired all of the outstanding stock of Ship Inc., a Norwegian company, at a cost of $167,400 Ship\'s net assets on the date of acquisition were 700,000 kroner (NKr). On January 1, 20X5, the book and fair values of the Norwegiarn subsidiary\'s identifiable assets and liabilities approximated their fair values except for property, plant, and equipment and patents acquired. The fair value of Ship\'s property, plant, and equipment exceeded its book value by $18,000. The remaining useful life of Ship\'s equipment at January 1, 20X5, was 10 years. The remainder of the differential was attributable to a patent having an estimated useful life of 5 years. Ship\'s trial balance on December 31, 20X5, in kroner, follows: Debits Credits NKr 160,000 218,000 277,000 609,000 Cash Accounts Receivable (net) Inventory Property, Plant & Equipment Accumulated Depreciatiorn Accounts Payable Notes Payable Common Stock Retained Earnings Sales Cost of Goods Sold Operating Expenses Depreciation Expense Dividends Paid Total NKr 167,000 91,000 209,000 430,000 270,000 745,000 421,000 125,000 61,000 41,000 NKr1,912,000 NKr1,912,000Solution

Total

| Cash | 32,000 |

| Accounts Receivable | 43,600 |

| Inventory | 55,400 |

| Property, plant, & machinery | 121,800 |

| Cost of Goods Sold | 84,200 |

| Operating expenses | 25,000 |

| Depreciation Expense | 12,200 |

| Dividends Paid | 8,200 |

| Total | 382,400 |

| Total Debits | 382,400 |

| Accumulated Depreciation | 33,400 |

| Accounts Payable | 18,200 |

| Notes Payable | 41,800 |

| Common Stock | 86,000 |

| Retained Earnings | 54,000 |

| Sales | 149,000 |

| Total | 382,400 |

Homework Sourse

Homework Sourse