The Polozzi Trust projects that it will incur the following

The Polozzi Trust projects that it will incur the following items in the next year, which will be its first year of existence.

Interest income $25,000

Rent income 100,000

Cost recovery deductions for the rental activity $35,000

Capital gain income 40,000

Fiduciary and tax preparation fees 7,000

Betty, the grantor of the trust, is working with you on the language in the trust instrument relative to the derivation of annual accounting income for the entity. She will name Shirley as the sole income beneficiary and Benny as the remainder beneficiary. If an amount is zero, enter \"0\".

a. If the allocation takes place, Shirley will receive how much for the year?

b. Betty suggests that the capital gains, rental revenues, and one-half of interest income should be allocable to corpus, while cost recovery expenses, one-half of interest income, and fiduciary administrative fees are allocable to income. If the allocation takes place, Shirley will receive how much for the year?

Solution

A. Calculation of amount received by Shirley :

Note: Please note that capital gain income is not a part of Distributable Income. So, that shall not be distributed to Shirley.

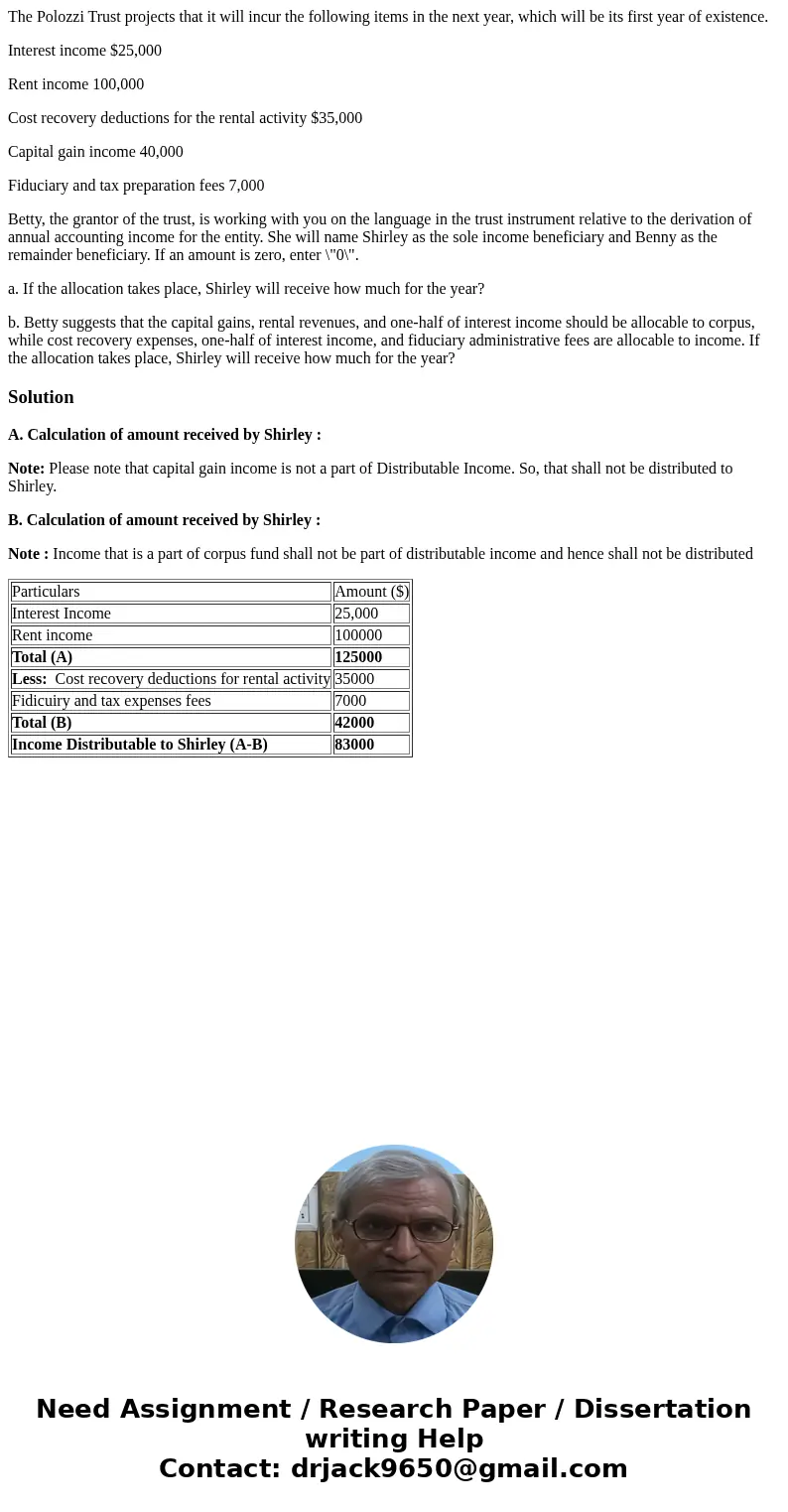

B. Calculation of amount received by Shirley :

Note : Income that is a part of corpus fund shall not be part of distributable income and hence shall not be distributed

| Particulars | Amount ($) |

| Interest Income | 25,000 |

| Rent income | 100000 |

| Total (A) | 125000 |

| Less: Cost recovery deductions for rental activity | 35000 |

| Fidicuiry and tax expenses fees | 7000 |

| Total (B) | 42000 |

| Income Distributable to Shirley (A-B) | 83000 |

Homework Sourse

Homework Sourse