Saddle Inc has two types of handbags standard and custom The

Saddle Inc. has two types of handbags: standard and custom. The controller has decided to use a plantwide overhead rate based on direct labor costs. The president has heard of activity-based costing and wants to see how the results would differ if this system were used. Two activity cost pools were developed: machining and machine setup. Presented below is information related to the company’s operations.

Standard

Custom

Direct labor costs $58,000 $97,000

Machine hours 1,190 1,220

Setup hours 109 400

Total estimated overhead costs are $304,000. Overhead cost allocated to the machining activity cost pool is $197,000, and $107,000 is allocated to the machine setup activity cost pool.

Compute the overhead rate using the traditional (plantwide) approach. (Round answer to 2 decimal places, e.g. 12.25.)

Predetermined overhead rate

% of direct labor cost

Compute the overhead rates using the activity-based costing approach. (Round answers to 2 decimal places, e.g. 12.25.)

Machining

$

per machine hour

Machine setup

$

per setup hour

Determine the difference in allocation between the two approaches. (Round answers to 0 decimal places, e.g. 1,225.)

Traditional costing

Standard

$

Custom

$

Activity-based costing

Standard

$

Custom

$

Solution

Answers

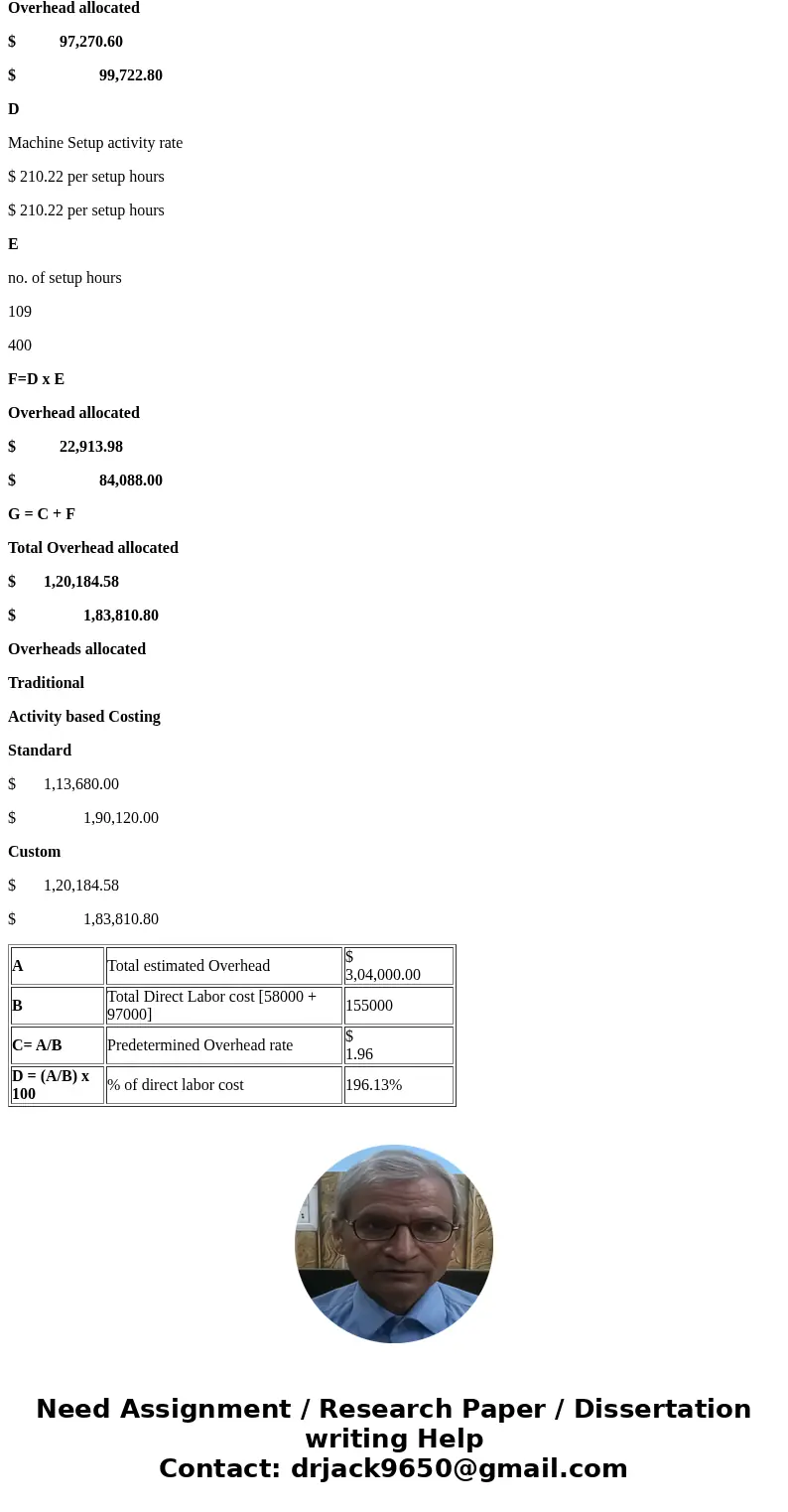

A

Total estimated Overhead

$ 3,04,000.00

B

Total Direct Labor cost [58000 + 97000]

155000

C= A/B

Predetermined Overhead rate

$ 1.96

D = (A/B) x 100

% of direct labor cost

196.13%

Cost Pool

Overhead cost

Cost driver

Total cost drivers

Activity rates [Answer]

Machine Activity

$ 1,97,000.00

machine hours

1190 + 1220 = 2410 machine hours

197000/2410 = $ 81.74 per machine hours

Machine Setup

$ 1,07,000.00

setup hours

109 + 400 = 509 setup hours

107000/509 = $ 210.22 per setup hours

---traditional method

Standard

Custom

A

Predetermined Overhead rate

$1.96 per $ labor cost

$1.96 per $ labor cost

B

Direct labor cost

$ 58,000.00

$ 97,000.00

C=A x B

Total overhead allocated

$ 1,13,680.00

$ 1,90,120.00

---Activity based costing method

Standard

Custom

A

Predetermined Overhead rate

$1.96 per $labor cost

$1.96 per $labor cost

B

Direct labor cost

$ 58,000.00

$ 97,000.00

C=A x B

Total overhead allocated

$ 1,13,680.00

$ 1,90,120.00

Standard

Custom

A

Machine Activity cost pool rate

$81.74 per machine hours

$81.74 per machine hours

B

Total machine hours

1190

1220

C=A x B

Overhead allocated

$ 97,270.60

$ 99,722.80

D

Machine Setup activity rate

$ 210.22 per setup hours

$ 210.22 per setup hours

E

no. of setup hours

109

400

F=D x E

Overhead allocated

$ 22,913.98

$ 84,088.00

G = C + F

Total Overhead allocated

$ 1,20,184.58

$ 1,83,810.80

Overheads allocated

Traditional

Activity based Costing

Standard

$ 1,13,680.00

$ 1,90,120.00

Custom

$ 1,20,184.58

$ 1,83,810.80

| A | Total estimated Overhead | $ 3,04,000.00 |

| B | Total Direct Labor cost [58000 + 97000] | 155000 |

| C= A/B | Predetermined Overhead rate | $ 1.96 |

| D = (A/B) x 100 | % of direct labor cost | 196.13% |

Homework Sourse

Homework Sourse