Exercise 33 Preparing adjusting entries LO P1 a Depreciation

Solution

Adjusting Journal entries

Transaction

General Journal

Debit

Credit

a

Depreciation expenses

$ 11,000.00

Accumulated Depreciation

$ 11,000.00

(Being Depreciation charged for the year on Equipment)

b

Insurance expenses

$ 4,280.00

Prepaid Insurance

4280

(Insurance expenses booked for the year)

c

Office supplies consumed

$ 2,581.00

Office supplies

$ 2,581.00

(Consumption of office supplies debited as expense)

d

Service Revenue

$ 9,750.00

Unearned Revenue

$ 9,750.00

(Being revenue earned this year out of advance revenue)

e

Insurance expenses

$ 4,280.00

Prepaid Insurance

$ 4,280.00

(Insurance expenses booked for the year, $ 4280 Expired)

f

Wages

$ 5,000.00

Wages payable

$ 5,000.00

(Wages to be paid next year booked as a current liability)

Alternatively Transaction (a) May have following Journal entry assuming Depreciation is deducted from value of asset.

Depreciation Expense

$ 11000

Equipment

$ 11000

(Depreciation charged on Equipment)

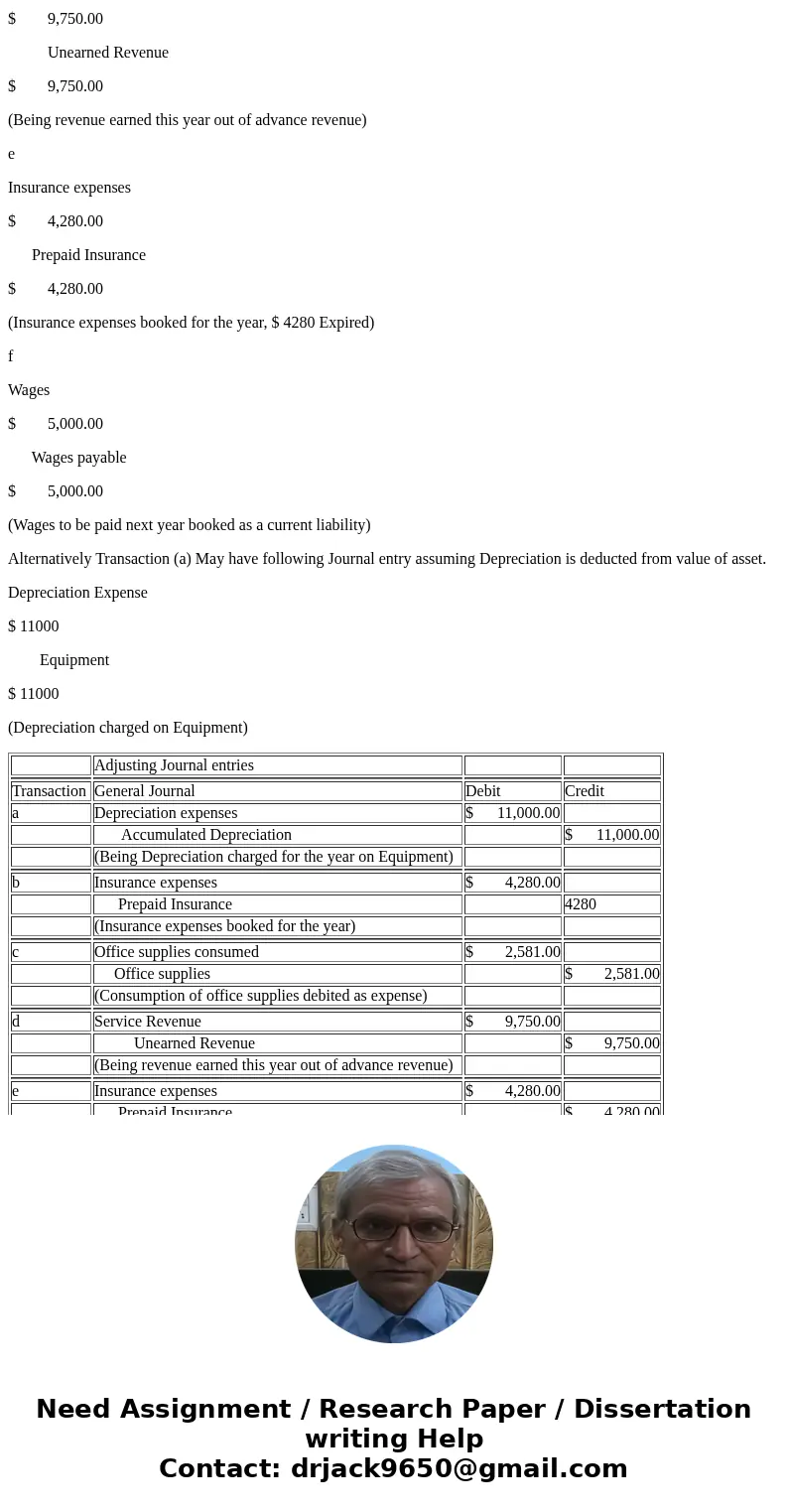

| Adjusting Journal entries | |||

| Transaction | General Journal | Debit | Credit |

| a | Depreciation expenses | $ 11,000.00 | |

| Accumulated Depreciation | $ 11,000.00 | ||

| (Being Depreciation charged for the year on Equipment) | |||

| b | Insurance expenses | $ 4,280.00 | |

| Prepaid Insurance | 4280 | ||

| (Insurance expenses booked for the year) | |||

| c | Office supplies consumed | $ 2,581.00 | |

| Office supplies | $ 2,581.00 | ||

| (Consumption of office supplies debited as expense) | |||

| d | Service Revenue | $ 9,750.00 | |

| Unearned Revenue | $ 9,750.00 | ||

| (Being revenue earned this year out of advance revenue) | |||

| e | Insurance expenses | $ 4,280.00 | |

| Prepaid Insurance | $ 4,280.00 | ||

| (Insurance expenses booked for the year, $ 4280 Expired) | |||

| f | Wages | $ 5,000.00 | |

| Wages payable | $ 5,000.00 | ||

| (Wages to be paid next year booked as a current liability) |

Homework Sourse

Homework Sourse