Lightspeed Industries Balance Sheet As of December 31 2017 a

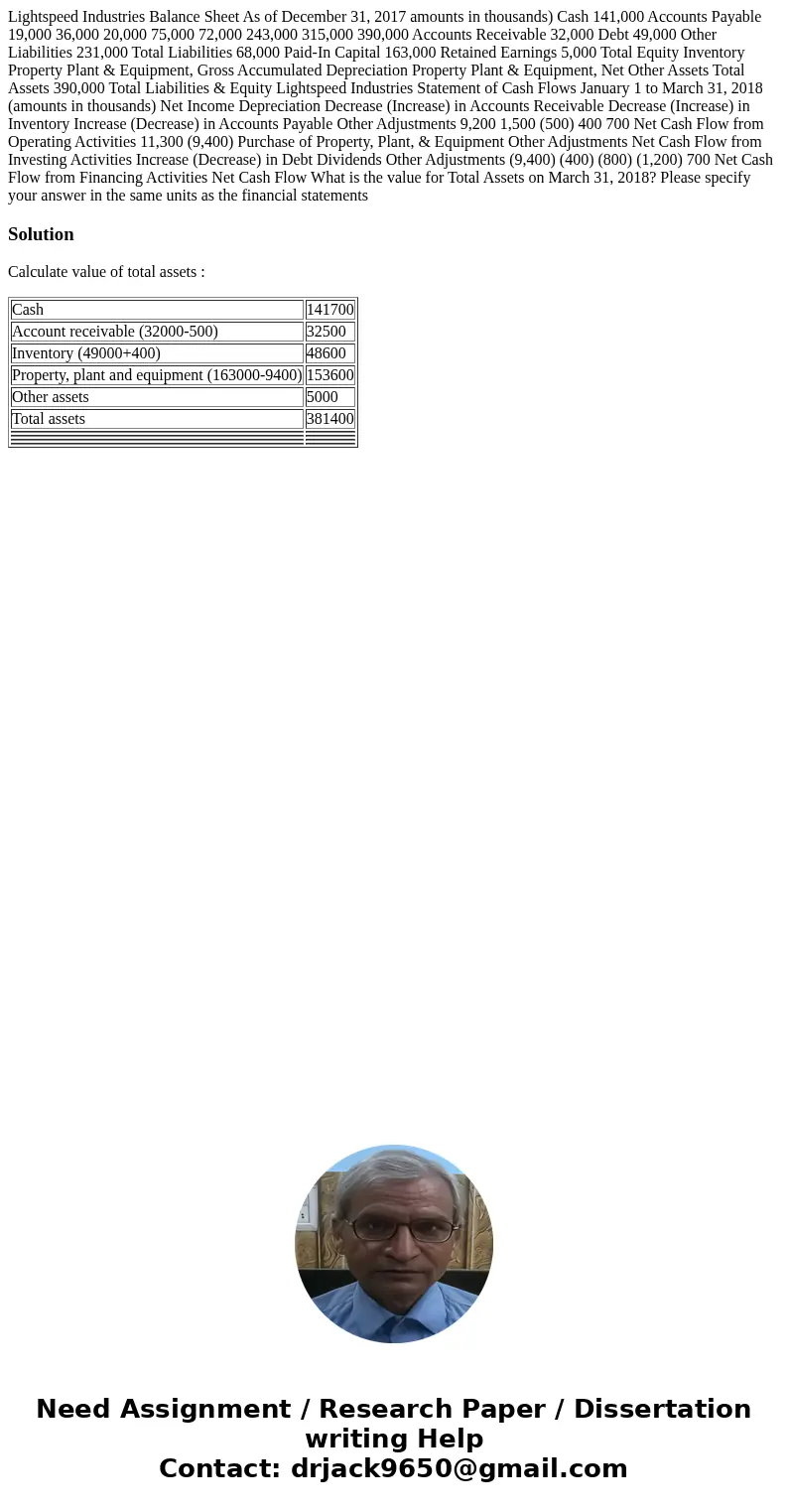

Lightspeed Industries Balance Sheet As of December 31, 2017 amounts in thousands) Cash 141,000 Accounts Payable 19,000 36,000 20,000 75,000 72,000 243,000 315,000 390,000 Accounts Receivable 32,000 Debt 49,000 Other Liabilities 231,000 Total Liabilities 68,000 Paid-In Capital 163,000 Retained Earnings 5,000 Total Equity Inventory Property Plant & Equipment, Gross Accumulated Depreciation Property Plant & Equipment, Net Other Assets Total Assets 390,000 Total Liabilities & Equity Lightspeed Industries Statement of Cash Flows January 1 to March 31, 2018 (amounts in thousands) Net Income Depreciation Decrease (Increase) in Accounts Receivable Decrease (Increase) in Inventory Increase (Decrease) in Accounts Payable Other Adjustments 9,200 1,500 (500) 400 700 Net Cash Flow from Operating Activities 11,300 (9,400) Purchase of Property, Plant, & Equipment Other Adjustments Net Cash Flow from Investing Activities Increase (Decrease) in Debt Dividends Other Adjustments (9,400) (400) (800) (1,200) 700 Net Cash Flow from Financing Activities Net Cash Flow What is the value for Total Assets on March 31, 2018? Please specify your answer in the same units as the financial statements

Solution

Calculate value of total assets :

| Cash | 141700 |

| Account receivable (32000-500) | 32500 |

| Inventory (49000+400) | 48600 |

| Property, plant and equipment (163000-9400) | 153600 |

| Other assets | 5000 |

| Total assets | 381400 |

Homework Sourse

Homework Sourse