1Record the beginning of the lease for NathLangstrom Service

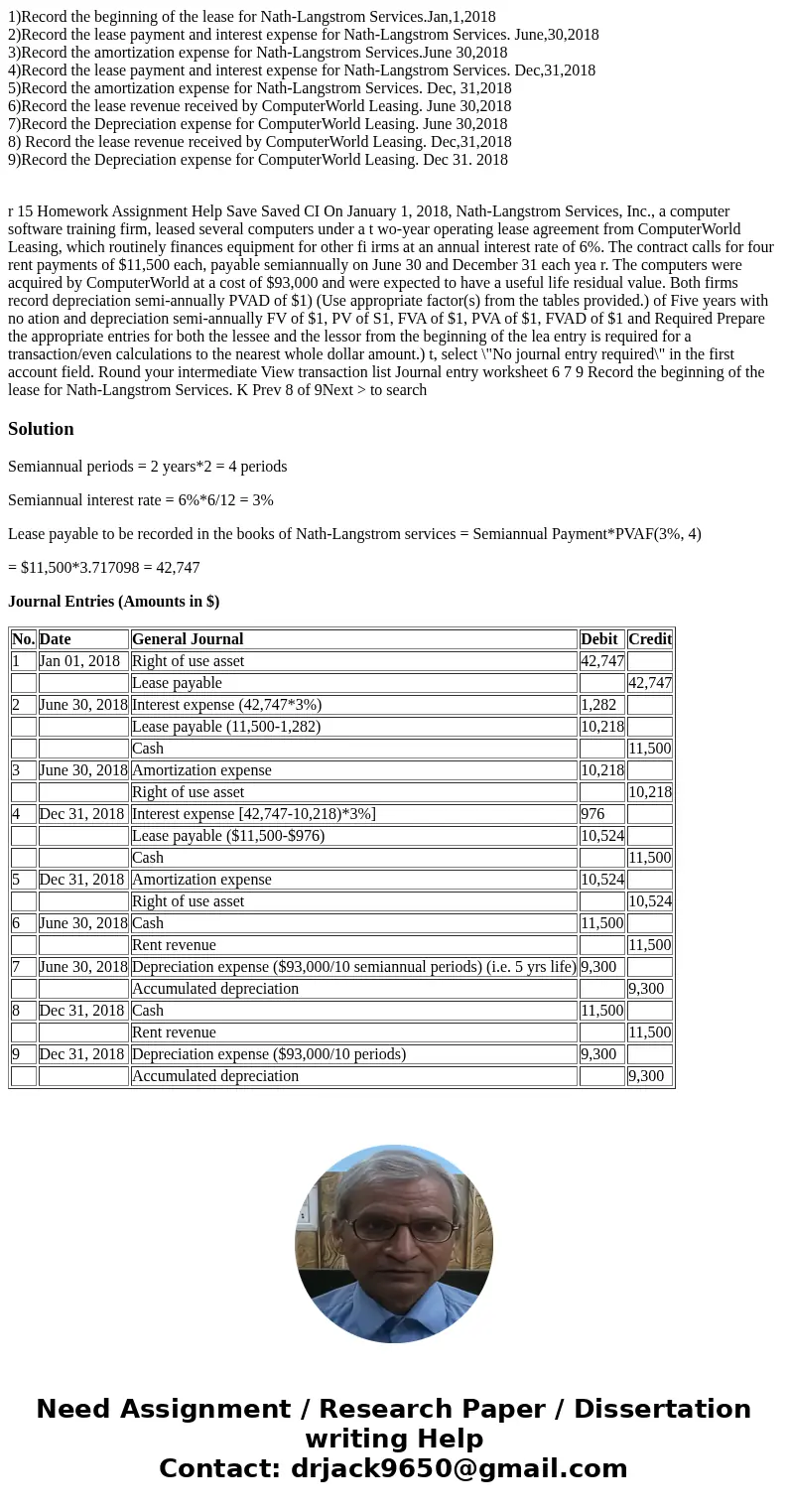

1)Record the beginning of the lease for Nath-Langstrom Services.Jan,1,2018

2)Record the lease payment and interest expense for Nath-Langstrom Services. June,30,2018

3)Record the amortization expense for Nath-Langstrom Services.June 30,2018

4)Record the lease payment and interest expense for Nath-Langstrom Services. Dec,31,2018

5)Record the amortization expense for Nath-Langstrom Services. Dec, 31,2018

6)Record the lease revenue received by ComputerWorld Leasing. June 30,2018

7)Record the Depreciation expense for ComputerWorld Leasing. June 30,2018

8) Record the lease revenue received by ComputerWorld Leasing. Dec,31,2018

9)Record the Depreciation expense for ComputerWorld Leasing. Dec 31. 2018

Solution

Semiannual periods = 2 years*2 = 4 periods

Semiannual interest rate = 6%*6/12 = 3%

Lease payable to be recorded in the books of Nath-Langstrom services = Semiannual Payment*PVAF(3%, 4)

= $11,500*3.717098 = 42,747

Journal Entries (Amounts in $)

| No. | Date | General Journal | Debit | Credit |

| 1 | Jan 01, 2018 | Right of use asset | 42,747 | |

| Lease payable | 42,747 | |||

| 2 | June 30, 2018 | Interest expense (42,747*3%) | 1,282 | |

| Lease payable (11,500-1,282) | 10,218 | |||

| Cash | 11,500 | |||

| 3 | June 30, 2018 | Amortization expense | 10,218 | |

| Right of use asset | 10,218 | |||

| 4 | Dec 31, 2018 | Interest expense [42,747-10,218)*3%] | 976 | |

| Lease payable ($11,500-$976) | 10,524 | |||

| Cash | 11,500 | |||

| 5 | Dec 31, 2018 | Amortization expense | 10,524 | |

| Right of use asset | 10,524 | |||

| 6 | June 30, 2018 | Cash | 11,500 | |

| Rent revenue | 11,500 | |||

| 7 | June 30, 2018 | Depreciation expense ($93,000/10 semiannual periods) (i.e. 5 yrs life) | 9,300 | |

| Accumulated depreciation | 9,300 | |||

| 8 | Dec 31, 2018 | Cash | 11,500 | |

| Rent revenue | 11,500 | |||

| 9 | Dec 31, 2018 | Depreciation expense ($93,000/10 periods) | 9,300 | |

| Accumulated depreciation | 9,300 |

Homework Sourse

Homework Sourse