The following iforaion applies to the quessoms dispiayed be

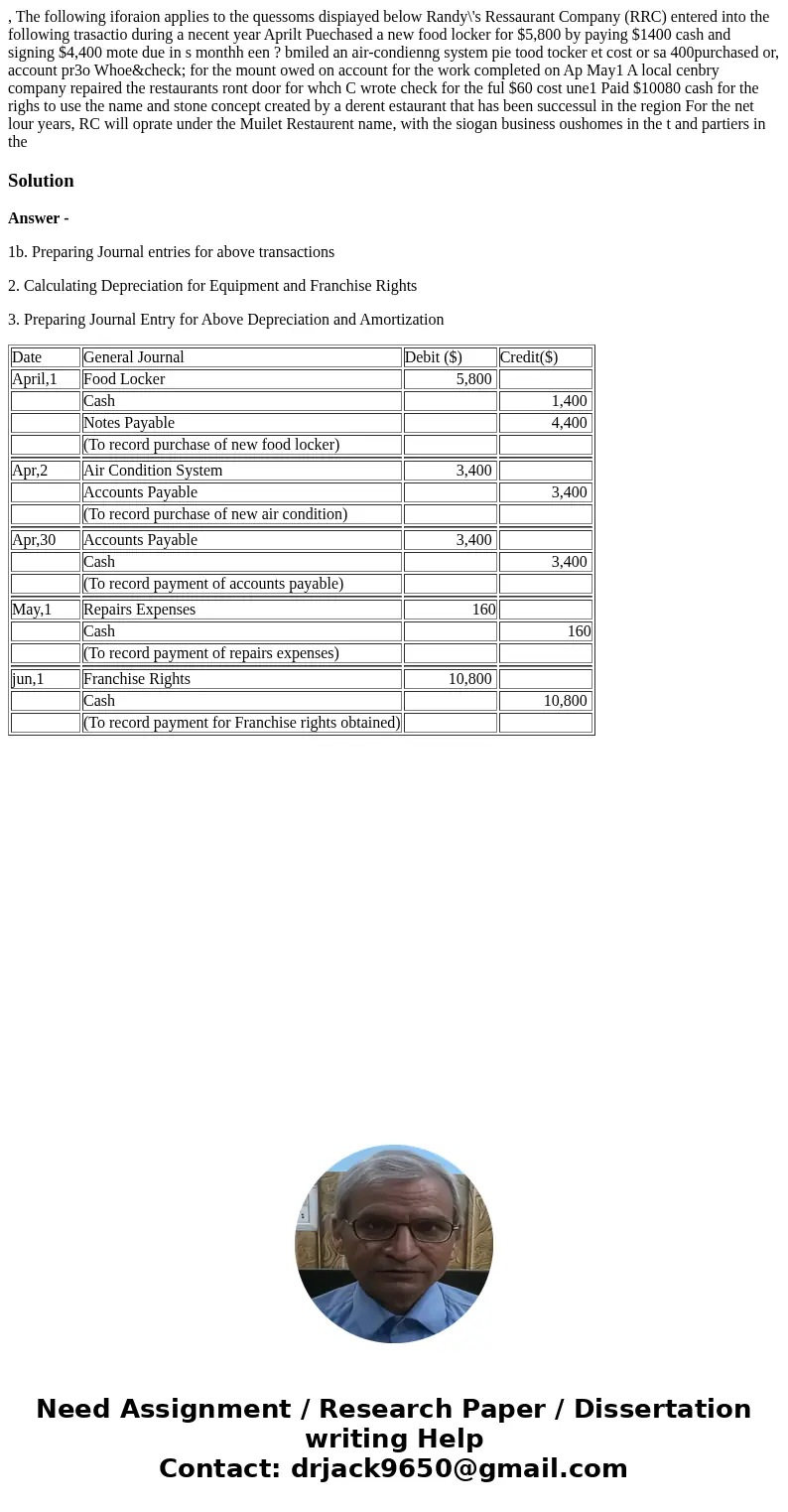

, The following iforaion applies to the quessoms dispiayed below Randy\'s Ressaurant Company (RRC) entered into the following trasactio during a necent year Aprilt Puechased a new food locker for $5,800 by paying $1400 cash and signing $4,400 mote due in s monthh een ? bmiled an air-condienng system pie tood tocker et cost or sa 400purchased or, account pr3o Whoe✓ for the mount owed on account for the work completed on Ap May1 A local cenbry company repaired the restaurants ront door for whch C wrote check for the ful $60 cost une1 Paid $10080 cash for the righs to use the name and stone concept created by a derent estaurant that has been successul in the region For the net lour years, RC will oprate under the Muilet Restaurent name, with the siogan business oushomes in the t and partiers in the

Solution

Answer -

1b. Preparing Journal entries for above transactions

2. Calculating Depreciation for Equipment and Franchise Rights

3. Preparing Journal Entry for Above Depreciation and Amortization

| Date | General Journal | Debit ($) | Credit($) |

| April,1 | Food Locker | 5,800 | |

| Cash | 1,400 | ||

| Notes Payable | 4,400 | ||

| (To record purchase of new food locker) | |||

| Apr,2 | Air Condition System | 3,400 | |

| Accounts Payable | 3,400 | ||

| (To record purchase of new air condition) | |||

| Apr,30 | Accounts Payable | 3,400 | |

| Cash | 3,400 | ||

| (To record payment of accounts payable) | |||

| May,1 | Repairs Expenses | 160 | |

| Cash | 160 | ||

| (To record payment of repairs expenses) | |||

| jun,1 | Franchise Rights | 10,800 | |

| Cash | 10,800 | ||

| (To record payment for Franchise rights obtained) |

Homework Sourse

Homework Sourse