5 Houghton s 31 par value common stock for 20 per share On J

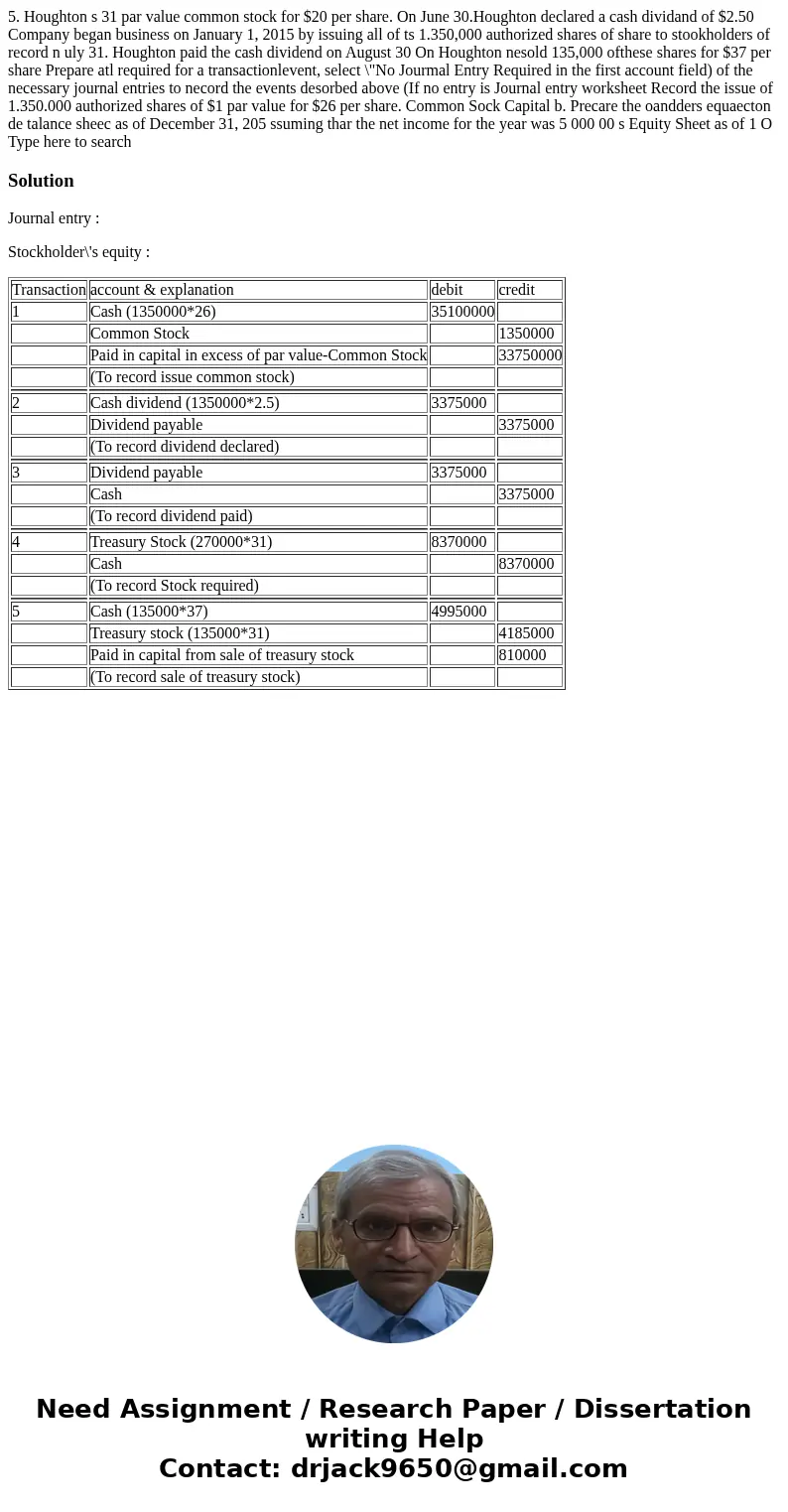

5. Houghton s 31 par value common stock for $20 per share. On June 30.Houghton declared a cash dividand of $2.50 Company began business on January 1, 2015 by issuing all of ts 1.350,000 authorized shares of share to stookholders of record n uly 31. Houghton paid the cash dividend on August 30 On Houghton nesold 135,000 ofthese shares for $37 per share Prepare atl required for a transactionlevent, select \"No Jourmal Entry Required in the first account field) of the necessary journal entries to necord the events desorbed above (If no entry is Journal entry worksheet Record the issue of 1.350.000 authorized shares of $1 par value for $26 per share. Common Sock Capital b. Precare the oandders equaecton de talance sheec as of December 31, 205 ssuming thar the net income for the year was 5 000 00 s Equity Sheet as of 1 O Type here to search

Solution

Journal entry :

Stockholder\'s equity :

| Transaction | account & explanation | debit | credit |

| 1 | Cash (1350000*26) | 35100000 | |

| Common Stock | 1350000 | ||

| Paid in capital in excess of par value-Common Stock | 33750000 | ||

| (To record issue common stock) | |||

| 2 | Cash dividend (1350000*2.5) | 3375000 | |

| Dividend payable | 3375000 | ||

| (To record dividend declared) | |||

| 3 | Dividend payable | 3375000 | |

| Cash | 3375000 | ||

| (To record dividend paid) | |||

| 4 | Treasury Stock (270000*31) | 8370000 | |

| Cash | 8370000 | ||

| (To record Stock required) | |||

| 5 | Cash (135000*37) | 4995000 | |

| Treasury stock (135000*31) | 4185000 | ||

| Paid in capital from sale of treasury stock | 810000 | ||

| (To record sale of treasury stock) |

Homework Sourse

Homework Sourse