0 5 Required The foowing information applies to the question

Solution

Ratio

Formula & figures

Barco

Formula & figures

Kyan

Profit margin ratio = net income/sales

177815/790000

22.51%

213986/895200

23.90%

It is better for KYAN

total asset turnover = total sales/total assets

790000/495940

1.59

895200/550150

1.63

It is better for KYAN

return on total assets = net income/total assets

177815/495950

35.85%

213986/550150

38.90%

It is better for KYAN

return on common stock holder equity = net income/total equity

177815/354800

50.12%

213986/350850

60.99%

It is better for KYAN

price earning ratio = market price/eps

90/4.68

19.23

90/5.46

16.48

it is better for Barco

Dividend Yield = dividend paid/market price

3.74/75

4.99%

3.93/75

5.24%

it is better for kyan

On the basis of the above ratios we can say that KYAN is a better option for investment

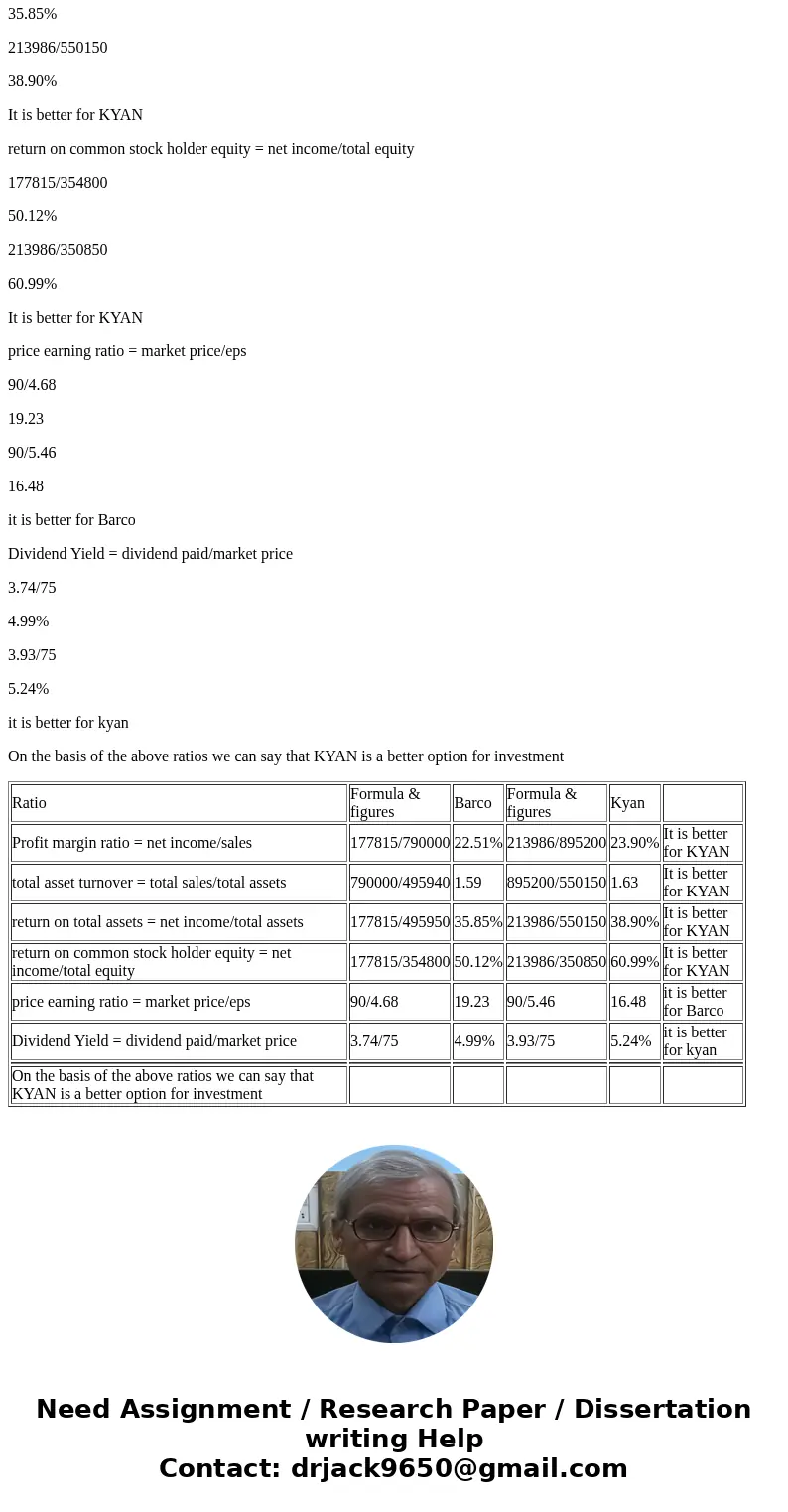

| Ratio | Formula & figures | Barco | Formula & figures | Kyan | |

| Profit margin ratio = net income/sales | 177815/790000 | 22.51% | 213986/895200 | 23.90% | It is better for KYAN |

| total asset turnover = total sales/total assets | 790000/495940 | 1.59 | 895200/550150 | 1.63 | It is better for KYAN |

| return on total assets = net income/total assets | 177815/495950 | 35.85% | 213986/550150 | 38.90% | It is better for KYAN |

| return on common stock holder equity = net income/total equity | 177815/354800 | 50.12% | 213986/350850 | 60.99% | It is better for KYAN |

| price earning ratio = market price/eps | 90/4.68 | 19.23 | 90/5.46 | 16.48 | it is better for Barco |

| Dividend Yield = dividend paid/market price | 3.74/75 | 4.99% | 3.93/75 | 5.24% | it is better for kyan |

| On the basis of the above ratios we can say that KYAN is a better option for investment |

Homework Sourse

Homework Sourse