Problem 2 Statement of cash flows The information shown belo

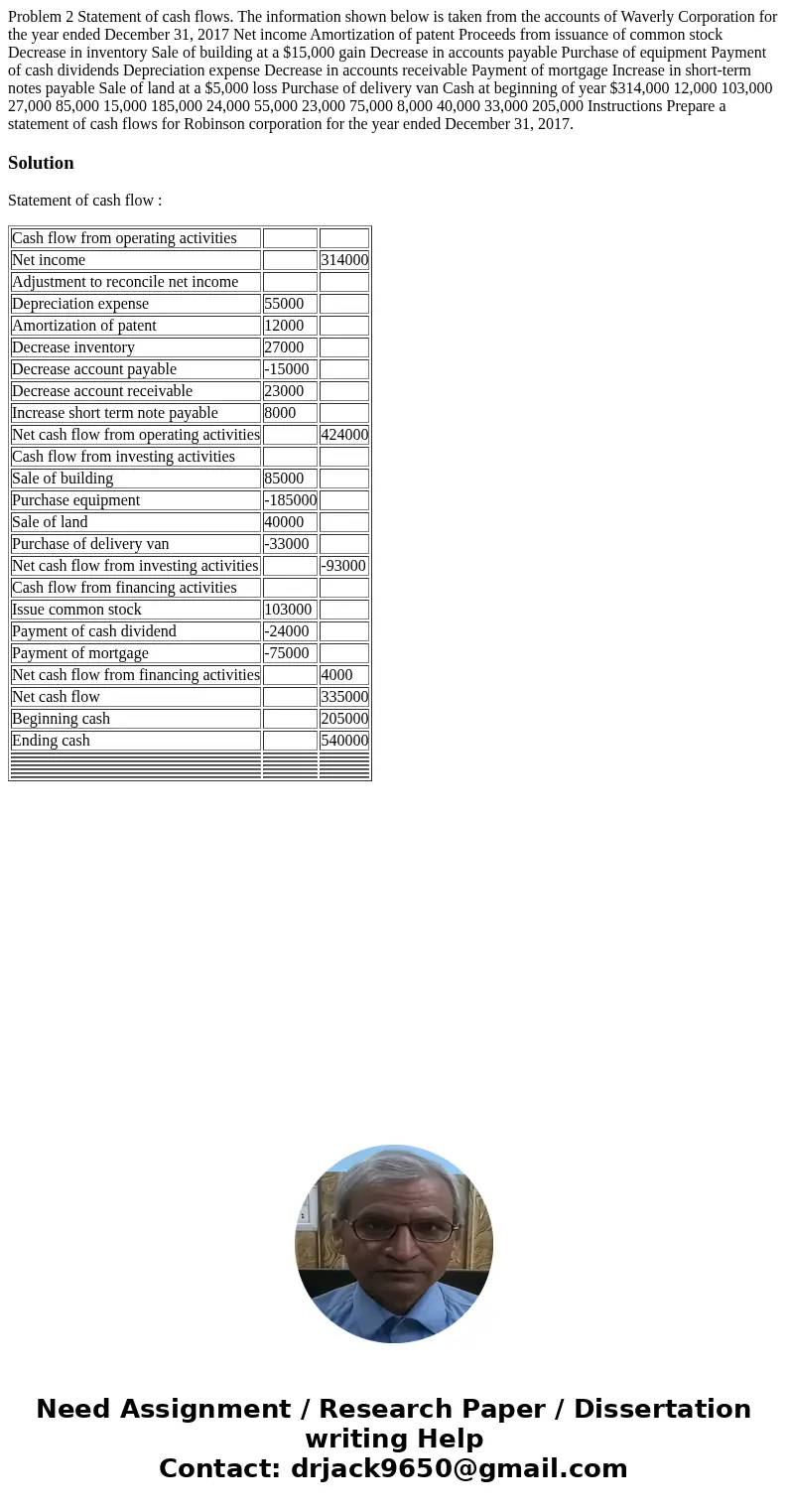

Problem 2 Statement of cash flows. The information shown below is taken from the accounts of Waverly Corporation for the year ended December 31, 2017 Net income Amortization of patent Proceeds from issuance of common stock Decrease in inventory Sale of building at a $15,000 gain Decrease in accounts payable Purchase of equipment Payment of cash dividends Depreciation expense Decrease in accounts receivable Payment of mortgage Increase in short-term notes payable Sale of land at a $5,000 loss Purchase of delivery van Cash at beginning of year $314,000 12,000 103,000 27,000 85,000 15,000 185,000 24,000 55,000 23,000 75,000 8,000 40,000 33,000 205,000 Instructions Prepare a statement of cash flows for Robinson corporation for the year ended December 31, 2017.

Solution

Statement of cash flow :

| Cash flow from operating activities | ||

| Net income | 314000 | |

| Adjustment to reconcile net income | ||

| Depreciation expense | 55000 | |

| Amortization of patent | 12000 | |

| Decrease inventory | 27000 | |

| Decrease account payable | -15000 | |

| Decrease account receivable | 23000 | |

| Increase short term note payable | 8000 | |

| Net cash flow from operating activities | 424000 | |

| Cash flow from investing activities | ||

| Sale of building | 85000 | |

| Purchase equipment | -185000 | |

| Sale of land | 40000 | |

| Purchase of delivery van | -33000 | |

| Net cash flow from investing activities | -93000 | |

| Cash flow from financing activities | ||

| Issue common stock | 103000 | |

| Payment of cash dividend | -24000 | |

| Payment of mortgage | -75000 | |

| Net cash flow from financing activities | 4000 | |

| Net cash flow | 335000 | |

| Beginning cash | 205000 | |

| Ending cash | 540000 | |

Homework Sourse

Homework Sourse