Exercise 1212 S Pagan and T Tabor share income on a 64 basis

Exercise 12-12 S. Pagan and T. Tabor share income on a 6:4 basis. They have capital balances of $120,000 and $70,000, respectively, when W. Wolford is admitted to the partnership Prepare the journal entry to record the admission of W. Wolford under each of the following assumptions. Your answer is partially correct. Try again. Investment of $90,000 cash for a 30% ownership interest with bonuses to the existing partners. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Account Titles and Explanation Debit Credit Cash 90000 T, Tabor, Capital 6000 W. Wolford, Capital 75000 S. Pagan, Capital 9000 Your answer is partially correct. Try again. Investment of $48,000 cash for a 30% ownership interest with a bonus to the new partner. (Credit account titles are automatically indented when amount is entered. Do not indent manually Account Titles and Explanation Debit Credit S. Pagan, Capital 7488 T. Tabor, Capital 4992 W. Wolford, Capital 60480 Cash 48000

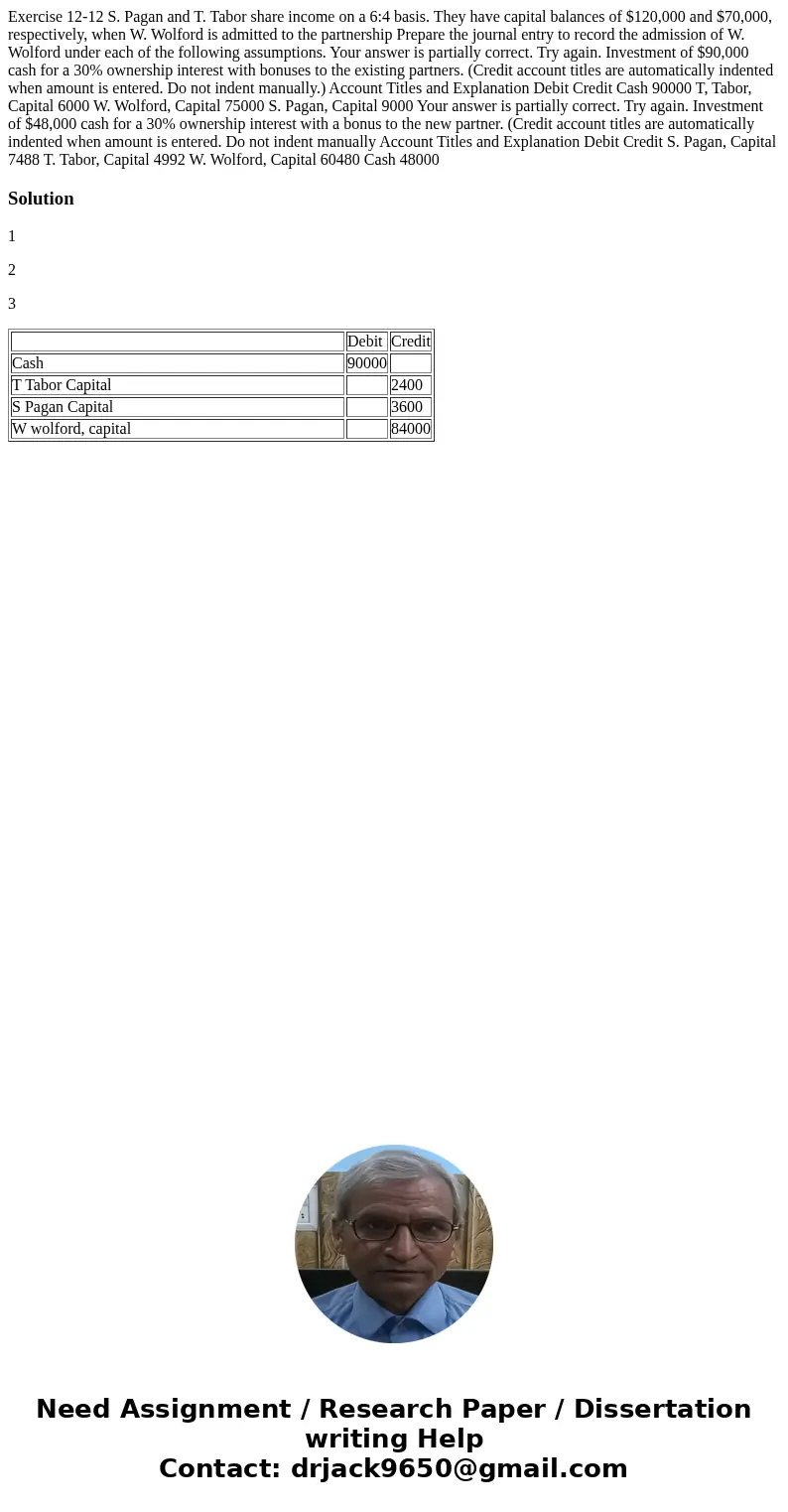

Solution

1

2

3

| Debit | Credit | |

| Cash | 90000 | |

| T Tabor Capital | 2400 | |

| S Pagan Capital | 3600 | |

| W wolford, capital | 84000 |

Homework Sourse

Homework Sourse