The Regal Cycle Company manufactures three types of bicycles

Solution

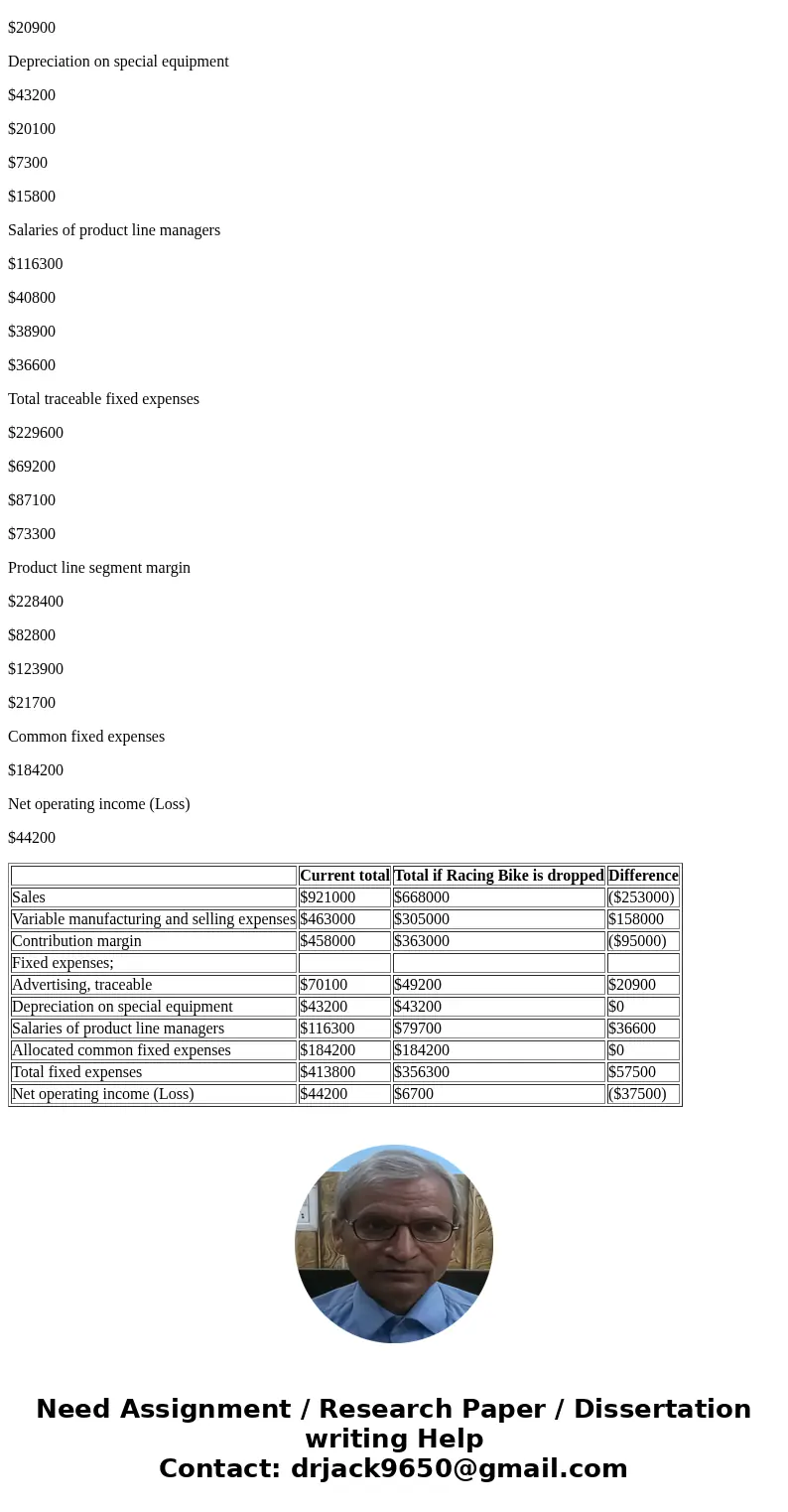

(1). Net operating income will be decreased by $37500

Thus there will be a financial disadvantage of discontinuing racing bike by $37500

Explanation;

Current total

Total if Racing Bike is dropped

Difference

Sales

$921000

$668000

($253000)

Variable manufacturing and selling expenses

$463000

$305000

$158000

Contribution margin

$458000

$363000

($95000)

Fixed expenses;

Advertising, traceable

$70100

$49200

$20900

Depreciation on special equipment

$43200

$43200

$0

Salaries of product line managers

$116300

$79700

$36600

Allocated common fixed expenses

$184200

$184200

$0

Total fixed expenses

$413800

$356300

$57500

Net operating income (Loss)

$44200

$6700

($37500)

(2).

Answer is (No)

Production and sale of racing bike should not be discontinued because it will result into a decrease of net operating income by $37500.

(3).

Totals

Dirt Bikes

Mountain Bikes

Racing Bikes

Sales

$921000

$264000

$404000

$253000

Variable manufacturing and selling expenses

$463000

$112000

$193000

$158000

Contribution margin

$458000

$152000

$211000

$95000

Traceable fixed expenses;

Advertising, traceable

$70100

$8300

$40900

$20900

Depreciation on special equipment

$43200

$20100

$7300

$15800

Salaries of product line managers

$116300

$40800

$38900

$36600

Total traceable fixed expenses

$229600

$69200

$87100

$73300

Product line segment margin

$228400

$82800

$123900

$21700

Common fixed expenses

$184200

Net operating income (Loss)

$44200

| Current total | Total if Racing Bike is dropped | Difference | |

| Sales | $921000 | $668000 | ($253000) |

| Variable manufacturing and selling expenses | $463000 | $305000 | $158000 |

| Contribution margin | $458000 | $363000 | ($95000) |

| Fixed expenses; | |||

| Advertising, traceable | $70100 | $49200 | $20900 |

| Depreciation on special equipment | $43200 | $43200 | $0 |

| Salaries of product line managers | $116300 | $79700 | $36600 |

| Allocated common fixed expenses | $184200 | $184200 | $0 |

| Total fixed expenses | $413800 | $356300 | $57500 |

| Net operating income (Loss) | $44200 | $6700 | ($37500) |

Homework Sourse

Homework Sourse