4 A piece of equipment is bought for 100000 has a salvage va

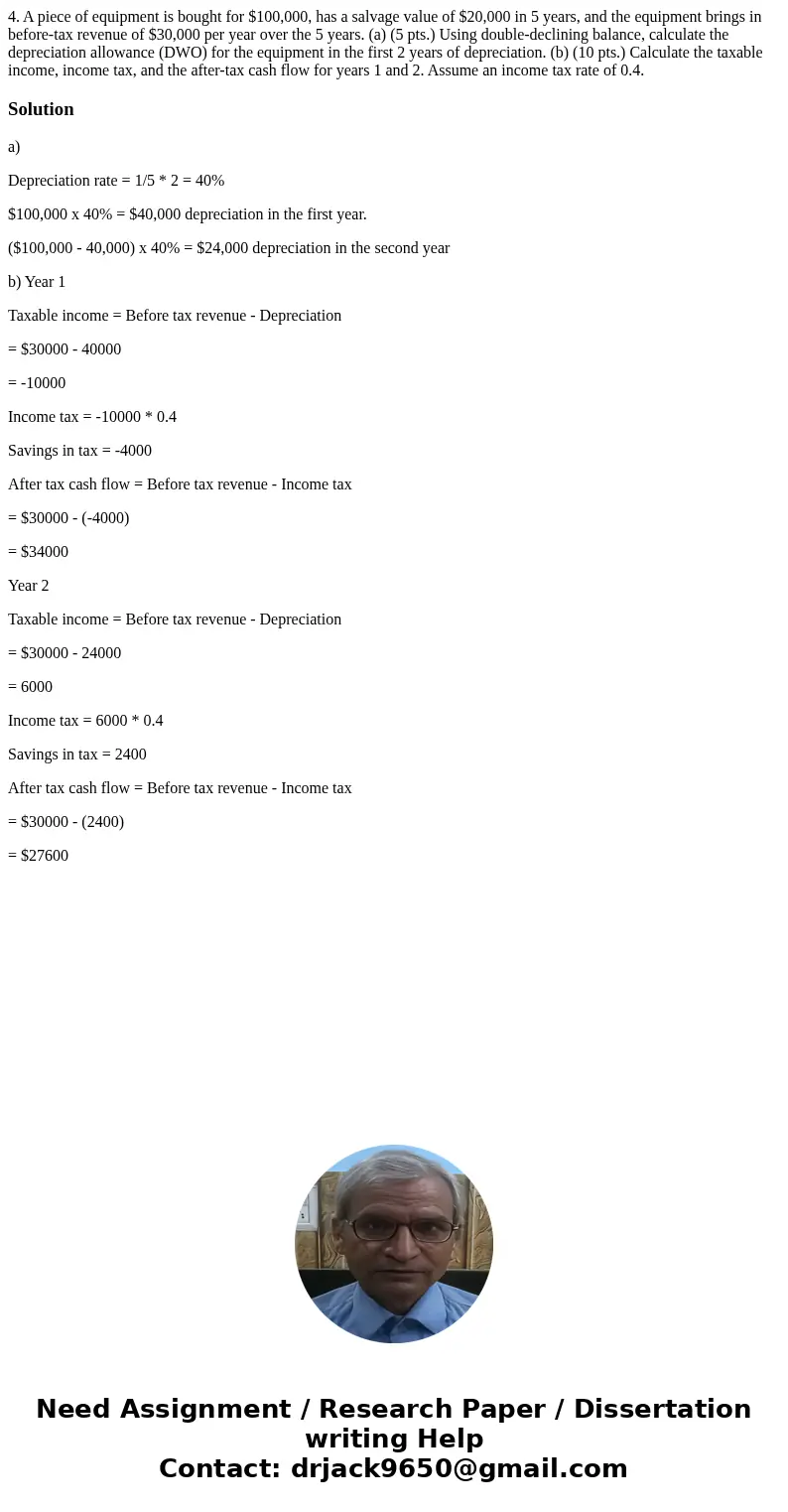

4. A piece of equipment is bought for $100,000, has a salvage value of $20,000 in 5 years, and the equipment brings in before-tax revenue of $30,000 per year over the 5 years. (a) (5 pts.) Using double-declining balance, calculate the depreciation allowance (DWO) for the equipment in the first 2 years of depreciation. (b) (10 pts.) Calculate the taxable income, income tax, and the after-tax cash flow for years 1 and 2. Assume an income tax rate of 0.4.

Solution

a)

Depreciation rate = 1/5 * 2 = 40%

$100,000 x 40% = $40,000 depreciation in the first year.

($100,000 - 40,000) x 40% = $24,000 depreciation in the second year

b) Year 1

Taxable income = Before tax revenue - Depreciation

= $30000 - 40000

= -10000

Income tax = -10000 * 0.4

Savings in tax = -4000

After tax cash flow = Before tax revenue - Income tax

= $30000 - (-4000)

= $34000

Year 2

Taxable income = Before tax revenue - Depreciation

= $30000 - 24000

= 6000

Income tax = 6000 * 0.4

Savings in tax = 2400

After tax cash flow = Before tax revenue - Income tax

= $30000 - (2400)

= $27600

Homework Sourse

Homework Sourse