Selected data on inventory purchases and sales for Celebrity

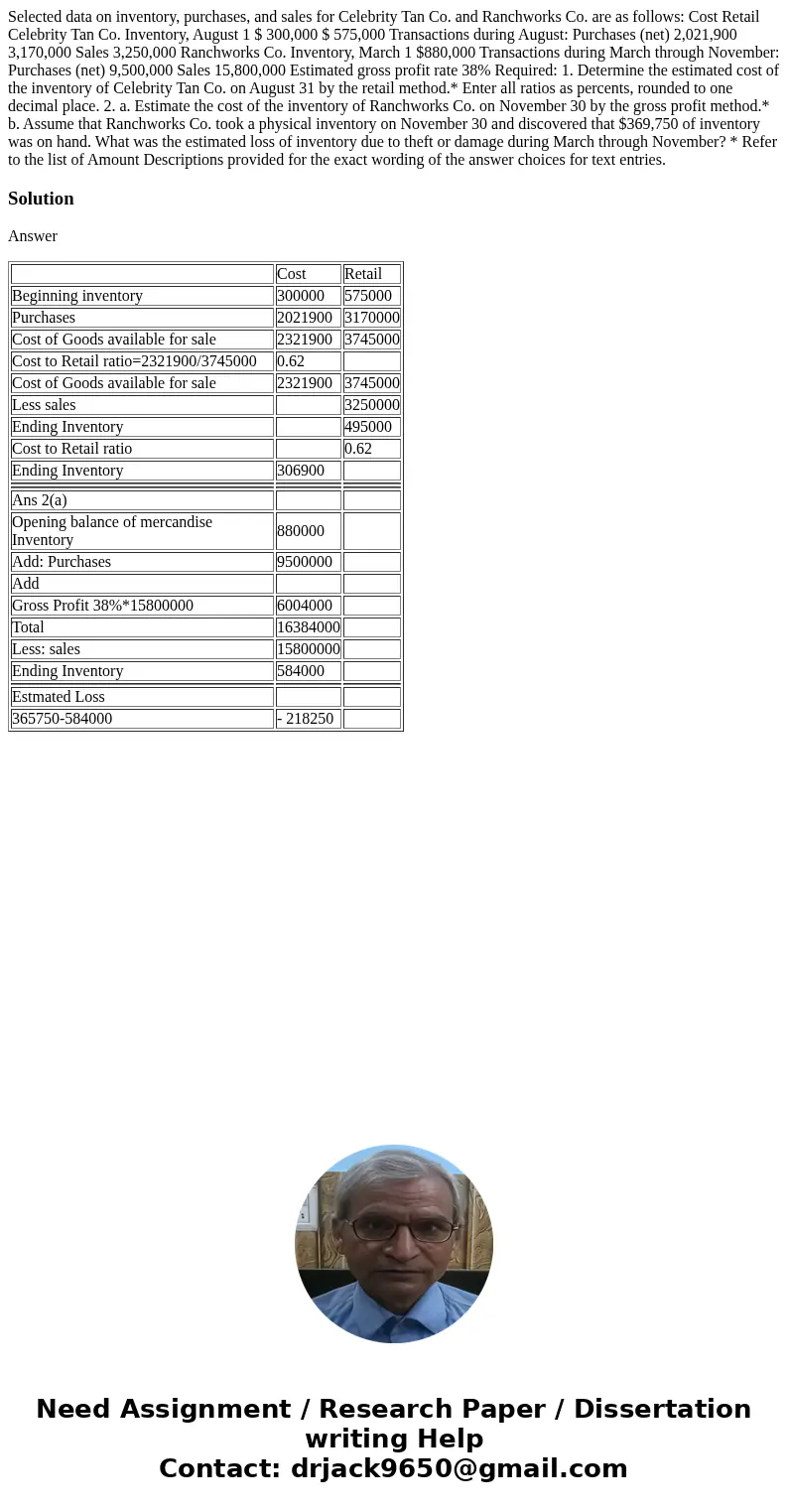

Selected data on inventory, purchases, and sales for Celebrity Tan Co. and Ranchworks Co. are as follows: Cost Retail Celebrity Tan Co. Inventory, August 1 $ 300,000 $ 575,000 Transactions during August: Purchases (net) 2,021,900 3,170,000 Sales 3,250,000 Ranchworks Co. Inventory, March 1 $880,000 Transactions during March through November: Purchases (net) 9,500,000 Sales 15,800,000 Estimated gross profit rate 38% Required: 1. Determine the estimated cost of the inventory of Celebrity Tan Co. on August 31 by the retail method.* Enter all ratios as percents, rounded to one decimal place. 2. a. Estimate the cost of the inventory of Ranchworks Co. on November 30 by the gross profit method.* b. Assume that Ranchworks Co. took a physical inventory on November 30 and discovered that $369,750 of inventory was on hand. What was the estimated loss of inventory due to theft or damage during March through November? * Refer to the list of Amount Descriptions provided for the exact wording of the answer choices for text entries.

Solution

Answer

| Cost | Retail | |

| Beginning inventory | 300000 | 575000 |

| Purchases | 2021900 | 3170000 |

| Cost of Goods available for sale | 2321900 | 3745000 |

| Cost to Retail ratio=2321900/3745000 | 0.62 | |

| Cost of Goods available for sale | 2321900 | 3745000 |

| Less sales | 3250000 | |

| Ending Inventory | 495000 | |

| Cost to Retail ratio | 0.62 | |

| Ending Inventory | 306900 | |

| Ans 2(a) | ||

| Opening balance of mercandise Inventory | 880000 | |

| Add: Purchases | 9500000 | |

| Add | ||

| Gross Profit 38%*15800000 | 6004000 | |

| Total | 16384000 | |

| Less: sales | 15800000 | |

| Ending Inventory | 584000 | |

| Estmated Loss | ||

| 365750-584000 | - 218250 |

Homework Sourse

Homework Sourse