Diamond Computer Company has been purchasing carrying cases

Diamond Computer Company has been purchasing carrying cases for its portable computers at a purchase price of $89 per unit. The company, which is currently operating below full capacity, charges factory overhead to production at the rate of 60% of direct labor cost. The fully absorbed unit costs to produce comparable carrying cases are expected to be as follows: Direct materials $59 Direct labor 20 Factory overhead (60% of direct labor) 12 Total cost per unit $91 If Diamond Computer Company manufactures the carrying cases, fixed factory overhead costs will not increase and variable factory overhead costs associated with the cases are expected to be 10% of the direct labor costs. Required: A. Prepare a differential analysis, dated February 24 to determine whether the company should make (Alternative 1) or buy (Alternative 2) the carrying case. Refer to the lists of Labels and Amount Descriptions for the exact wording of the answer choices for text entries. For those boxes in which you must enter subtracted or negative numbers use a minus sign. If there is no amount or an amount is zero, enter \"0\". A colon (:) will automatically appear if required. B. On the basis of the data presented, would it be advisable to make the carrying cases or to continue buying them? Explain.

Solution

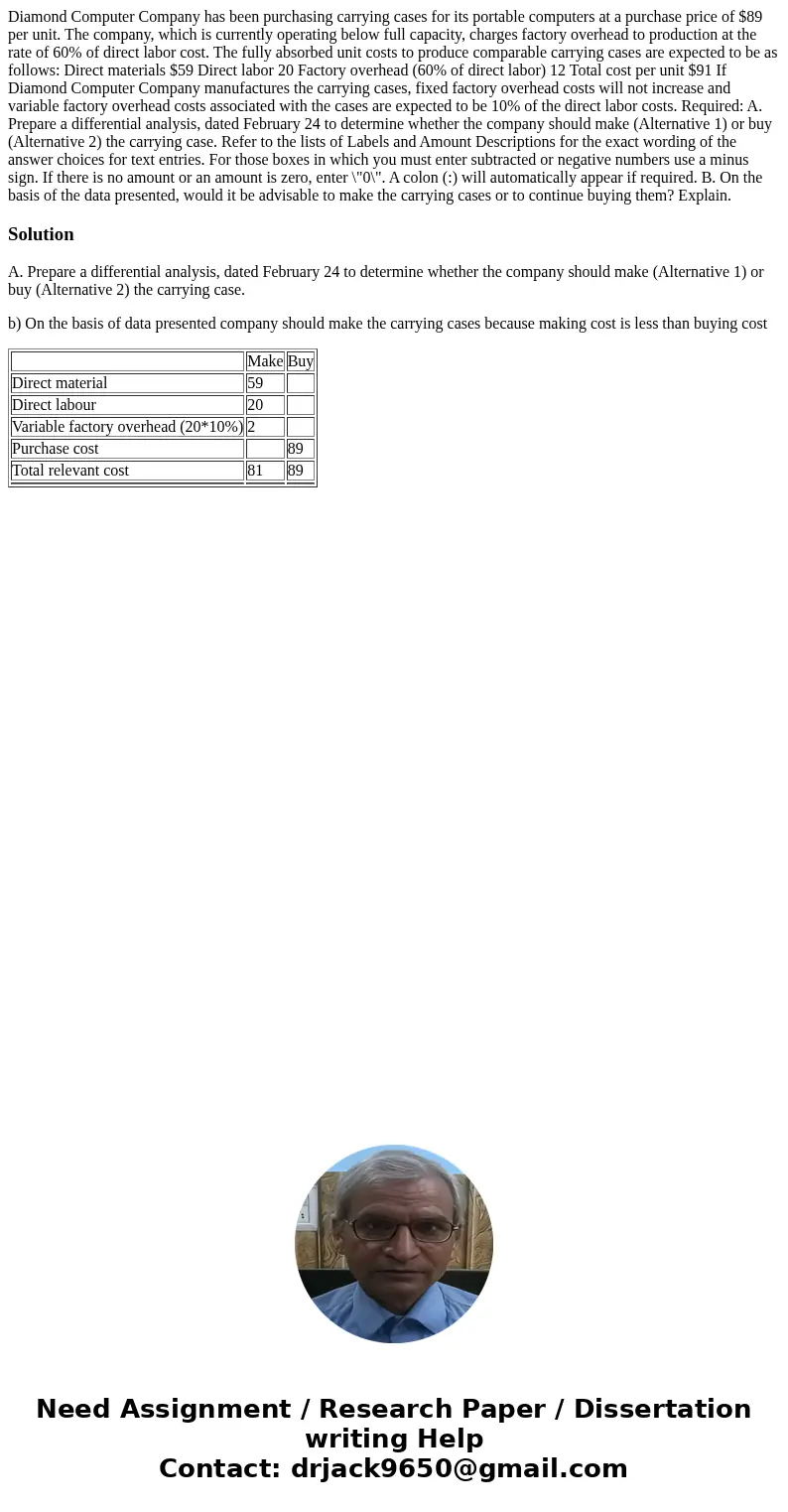

A. Prepare a differential analysis, dated February 24 to determine whether the company should make (Alternative 1) or buy (Alternative 2) the carrying case.

b) On the basis of data presented company should make the carrying cases because making cost is less than buying cost

| Make | Buy | |

| Direct material | 59 | |

| Direct labour | 20 | |

| Variable factory overhead (20*10%) | 2 | |

| Purchase cost | 89 | |

| Total relevant cost | 81 | 89 |

Homework Sourse

Homework Sourse