Maxwell Company manufactures and sells a single product Pric

Maxwell Company manufactures and sells a single product. Price and cost data regarding Maxwell’s product and operations for fiscal year 2016 are as follows (presented under absorption or full costing):

_____________________________________________________________________________

Revenue (120,000 units) $3,000,000

Less: Cost of sales

Direct materials $1,320,000

Directed Labor 600,000

Variable manufacturing overhead 300,000

Fixed manufacturing overhead 192,000 2,412,000

Gross margin $588,000

Less: Variable selling expenses $156,000

Fixed selling and administrative expenses 276,000 432,000

Net income $156,000

_________________________________________________________________________

a. Compute the number of units required to be produced and sold in order to earn direct costing profits of $260,000 in 2017; you may assume that in 2017, fixed costs, as well as per unit variable cost and (per unit) selling prices are the same as for fiscal year 2016.

b. Answer this question independently of part (a) above. Now suppose that Maxwell’s management believes that direct labor costs will increase by 8 percent in fiscal year 2017, but all other variable costs per unit, fixed costs, and selling prices will remain as in 2016. Compute the breakeven point in units for 2017 based on these assumptions.

Solution

Answers

Amount

Units

per unit

Revenues

$ 30,00,000.00

120000

$ 25.00

Less: Variable Cost

Direct material

$ 13,20,000.00

120000

$ 11.00

Direct labor

$ 6,00,000.00

120000

$ 5.00

Variable manufacturing Overhead

$ 3,00,000.00

120000

$ 2.50

Variable selling expenses

$ 1,56,000.00

120000

$ 1.30

Total variable cost

$ 23,76,000.00

120000

$ 19.80

Contribution margin

$ 6,24,000.00

120000

$ 5.20

Less: Fixed Costs

Fixed manufacturing overhead

$ 1,92,000.00

Fixed selling & administrative overhead

$ 2,76,000.00

Total Fixed cost

$ 4,68,000.00

Net Income

$ 1,56,000.00

A

Desired Net Income

$ 2,60,000.00

B

Total Fixed Cost

$ 4,68,000.00

C=A+B

Total contribution margin desired

$ 7,28,000.00

D

Unit Contribution margin

$ 5.20

E = C/D

No. of unit s to be produced and sold to earn desired profits

140,000 units

Answer = 140,000 unit

New Labor cost will be $5 + 8% = $ 5.4 (increased by $ 0.4)

Hence, new unit contribution margin will be old unit contribution – 0.4 = $ 5.2 - $0.4 = $ 4.8

A

Desired Net Income

$ 2,60,000.00

B

Total Fixed Cost

$ 4,68,000.00

C=A+B

Total contribution margin desired

$ 7,28,000.00

D

Unit Contribution margin

$ 4.80

E = C/D

No. of unit s to be produced and sold to earn desired profits

151,667 units

Answer = 151,667 units.

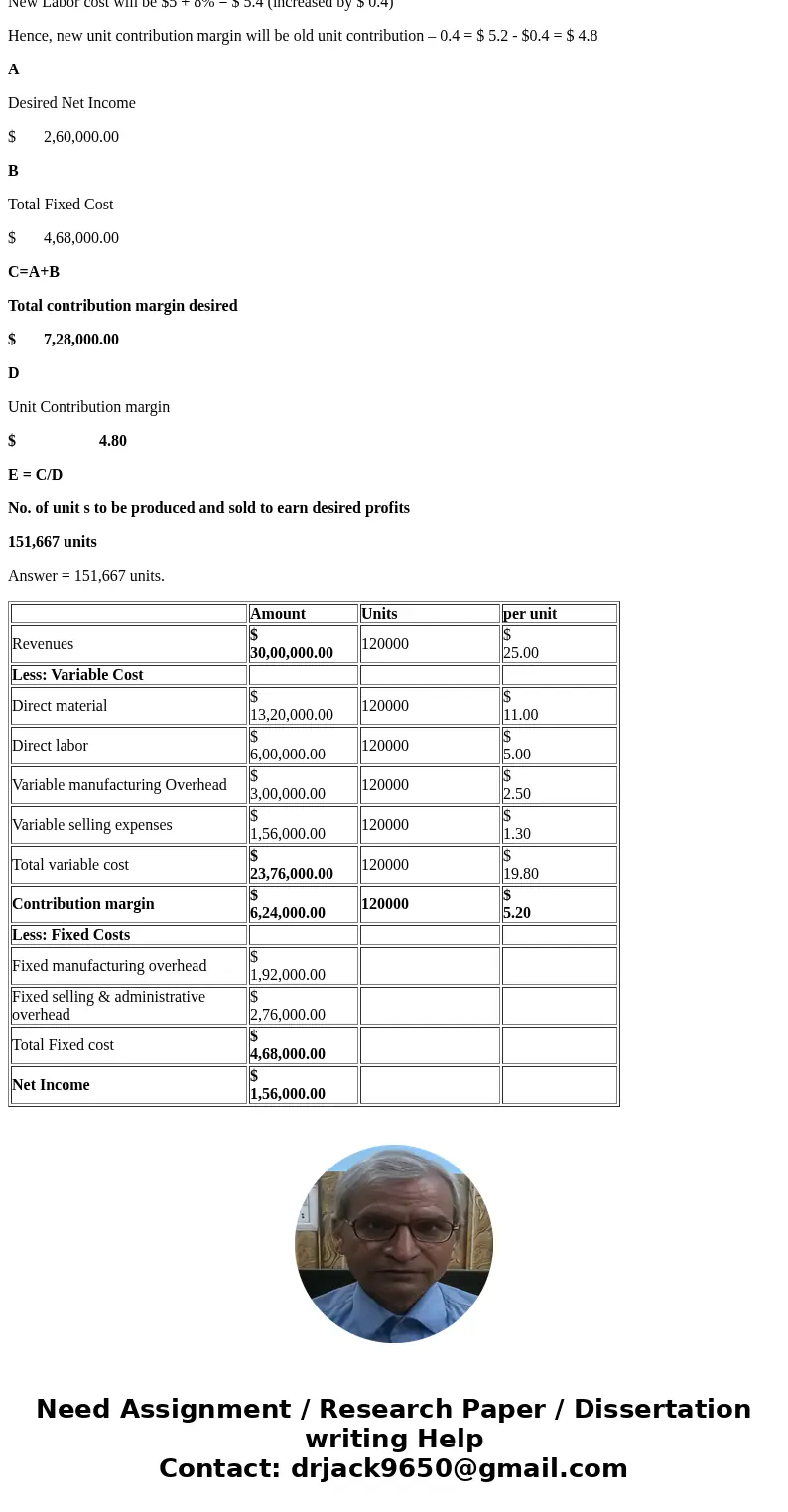

| Amount | Units | per unit | |

| Revenues | $ 30,00,000.00 | 120000 | $ 25.00 |

| Less: Variable Cost | |||

| Direct material | $ 13,20,000.00 | 120000 | $ 11.00 |

| Direct labor | $ 6,00,000.00 | 120000 | $ 5.00 |

| Variable manufacturing Overhead | $ 3,00,000.00 | 120000 | $ 2.50 |

| Variable selling expenses | $ 1,56,000.00 | 120000 | $ 1.30 |

| Total variable cost | $ 23,76,000.00 | 120000 | $ 19.80 |

| Contribution margin | $ 6,24,000.00 | 120000 | $ 5.20 |

| Less: Fixed Costs | |||

| Fixed manufacturing overhead | $ 1,92,000.00 | ||

| Fixed selling & administrative overhead | $ 2,76,000.00 | ||

| Total Fixed cost | $ 4,68,000.00 | ||

| Net Income | $ 1,56,000.00 |

Homework Sourse

Homework Sourse