ANALYSIS AND INTERPRETATION OF FINANCIAL STATEMENTS 625 CUMU

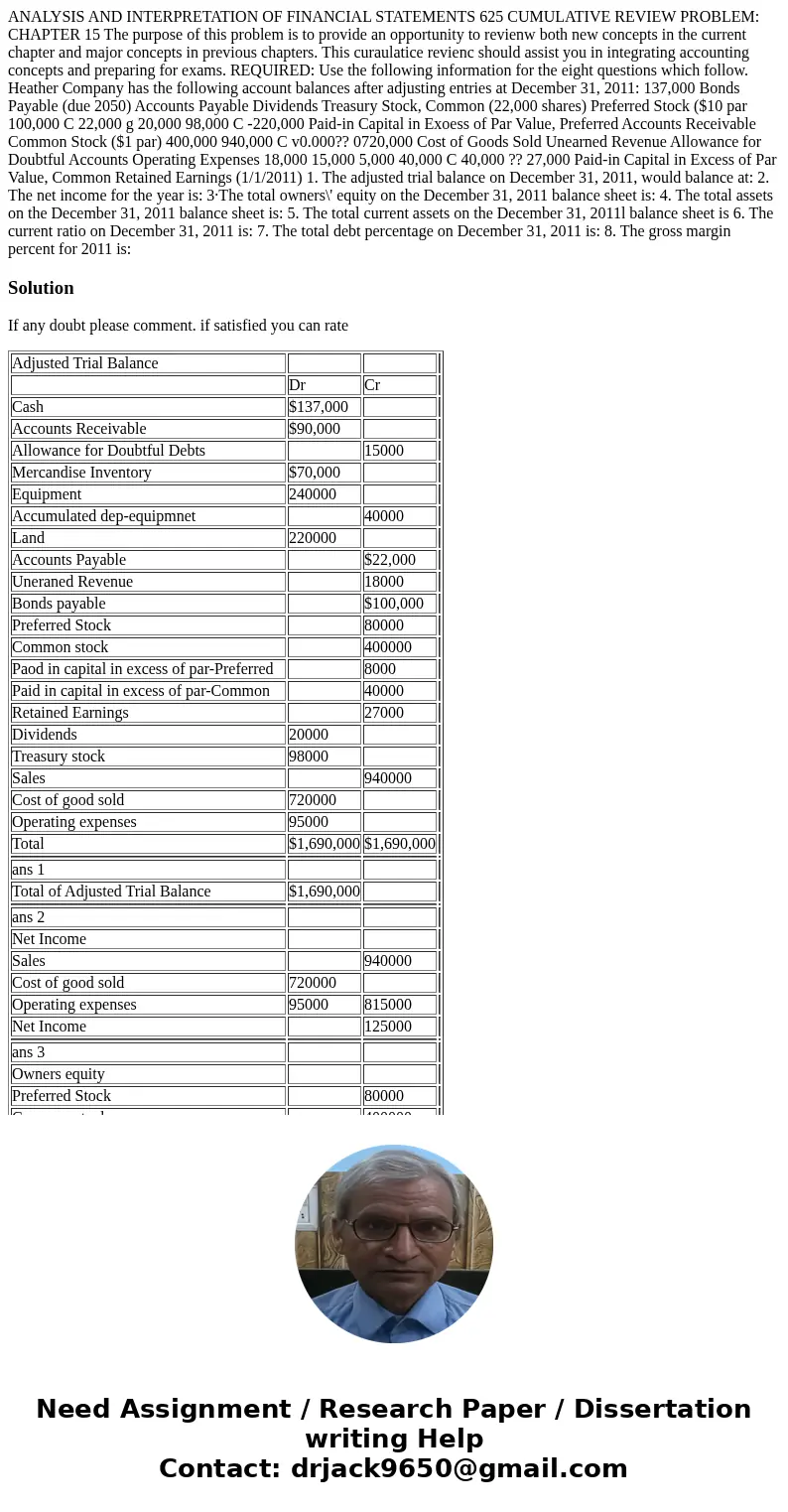

ANALYSIS AND INTERPRETATION OF FINANCIAL STATEMENTS 625 CUMULATIVE REVIEW PROBLEM: CHAPTER 15 The purpose of this problem is to provide an opportunity to revienw both new concepts in the current chapter and major concepts in previous chapters. This curaulatice revienc should assist you in integrating accounting concepts and preparing for exams. REQUIRED: Use the following information for the eight questions which follow. Heather Company has the following account balances after adjusting entries at December 31, 2011: 137,000 Bonds Payable (due 2050) Accounts Payable Dividends Treasury Stock, Common (22,000 shares) Preferred Stock ($10 par 100,000 C 22,000 g 20,000 98,000 C -220,000 Paid-in Capital in Exoess of Par Value, Preferred Accounts Receivable Common Stock ($1 par) 400,000 940,000 C v0.000?? 0720,000 Cost of Goods Sold Unearned Revenue Allowance for Doubtful Accounts Operating Expenses 18,000 15,000 5,000 40,000 C 40,000 ?? 27,000 Paid-in Capital in Excess of Par Value, Common Retained Earnings (1/1/2011) 1. The adjusted trial balance on December 31, 2011, would balance at: 2. The net income for the year is: 3·The total owners\' equity on the December 31, 2011 balance sheet is: 4. The total assets on the December 31, 2011 balance sheet is: 5. The total current assets on the December 31, 2011l balance sheet is 6. The current ratio on December 31, 2011 is: 7. The total debt percentage on December 31, 2011 is: 8. The gross margin percent for 2011 is:

Solution

If any doubt please comment. if satisfied you can rate

| Adjusted Trial Balance | |||

| Dr | Cr | ||

| Cash | $137,000 | ||

| Accounts Receivable | $90,000 | ||

| Allowance for Doubtful Debts | 15000 | ||

| Mercandise Inventory | $70,000 | ||

| Equipment | 240000 | ||

| Accumulated dep-equipmnet | 40000 | ||

| Land | 220000 | ||

| Accounts Payable | $22,000 | ||

| Uneraned Revenue | 18000 | ||

| Bonds payable | $100,000 | ||

| Preferred Stock | 80000 | ||

| Common stock | 400000 | ||

| Paod in capital in excess of par-Preferred | 8000 | ||

| Paid in capital in excess of par-Common | 40000 | ||

| Retained Earnings | 27000 | ||

| Dividends | 20000 | ||

| Treasury stock | 98000 | ||

| Sales | 940000 | ||

| Cost of good sold | 720000 | ||

| Operating expenses | 95000 | ||

| Total | $1,690,000 | $1,690,000 | |

| ans 1 | |||

| Total of Adjusted Trial Balance | $1,690,000 | ||

| ans 2 | |||

| Net Income | |||

| Sales | 940000 | ||

| Cost of good sold | 720000 | ||

| Operating expenses | 95000 | 815000 | |

| Net Income | 125000 | ||

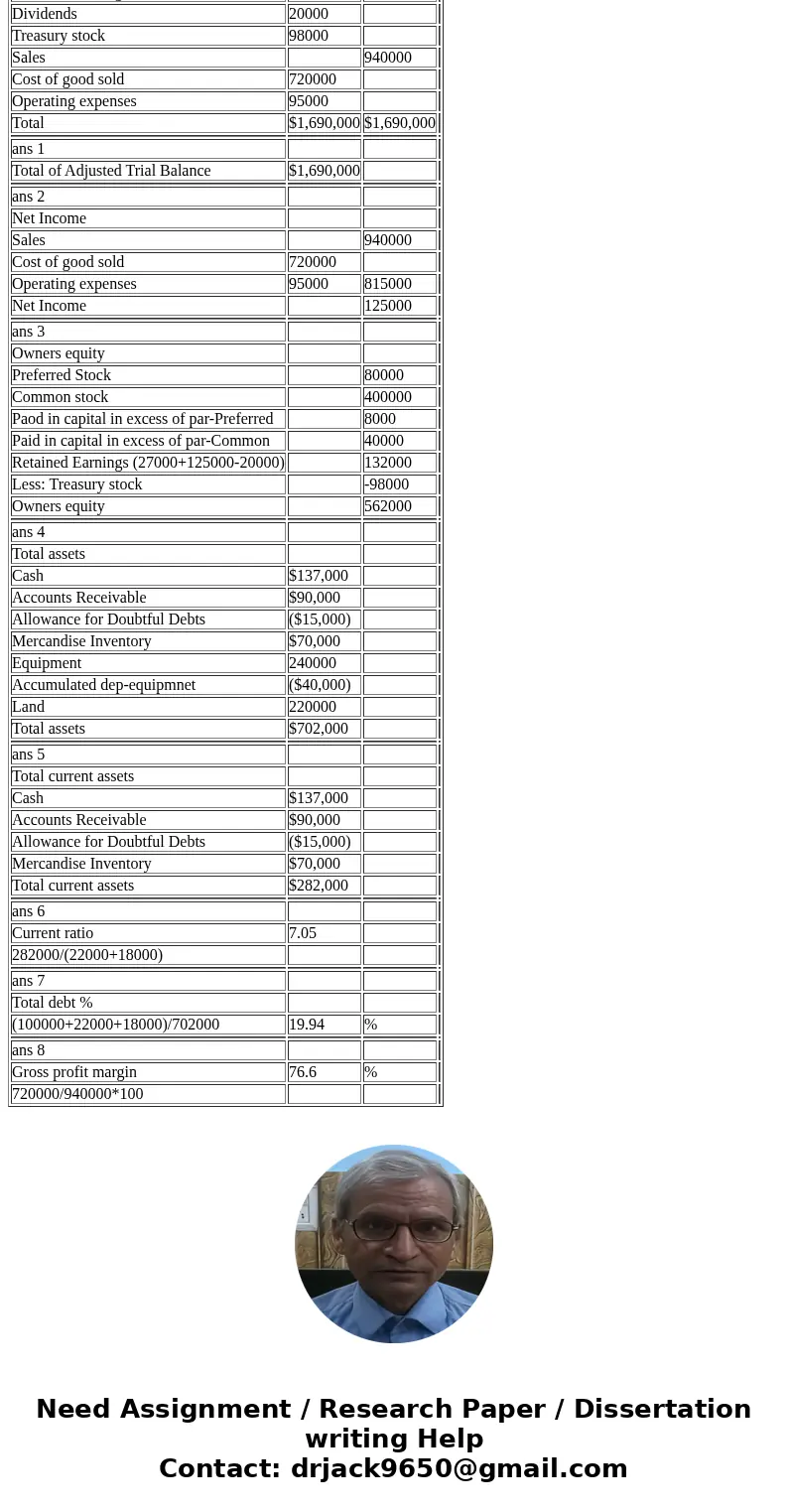

| ans 3 | |||

| Owners equity | |||

| Preferred Stock | 80000 | ||

| Common stock | 400000 | ||

| Paod in capital in excess of par-Preferred | 8000 | ||

| Paid in capital in excess of par-Common | 40000 | ||

| Retained Earnings (27000+125000-20000) | 132000 | ||

| Less: Treasury stock | -98000 | ||

| Owners equity | 562000 | ||

| ans 4 | |||

| Total assets | |||

| Cash | $137,000 | ||

| Accounts Receivable | $90,000 | ||

| Allowance for Doubtful Debts | ($15,000) | ||

| Mercandise Inventory | $70,000 | ||

| Equipment | 240000 | ||

| Accumulated dep-equipmnet | ($40,000) | ||

| Land | 220000 | ||

| Total assets | $702,000 | ||

| ans 5 | |||

| Total current assets | |||

| Cash | $137,000 | ||

| Accounts Receivable | $90,000 | ||

| Allowance for Doubtful Debts | ($15,000) | ||

| Mercandise Inventory | $70,000 | ||

| Total current assets | $282,000 | ||

| ans 6 | |||

| Current ratio | 7.05 | ||

| 282000/(22000+18000) | |||

| ans 7 | |||

| Total debt % | |||

| (100000+22000+18000)/702000 | 19.94 | % | |

| ans 8 | |||

| Gross profit margin | 76.6 | % | |

| 720000/940000*100 |

Homework Sourse

Homework Sourse