Test 2 Chapters3 and4 Problem 1 15 Points Ledger Account Bal

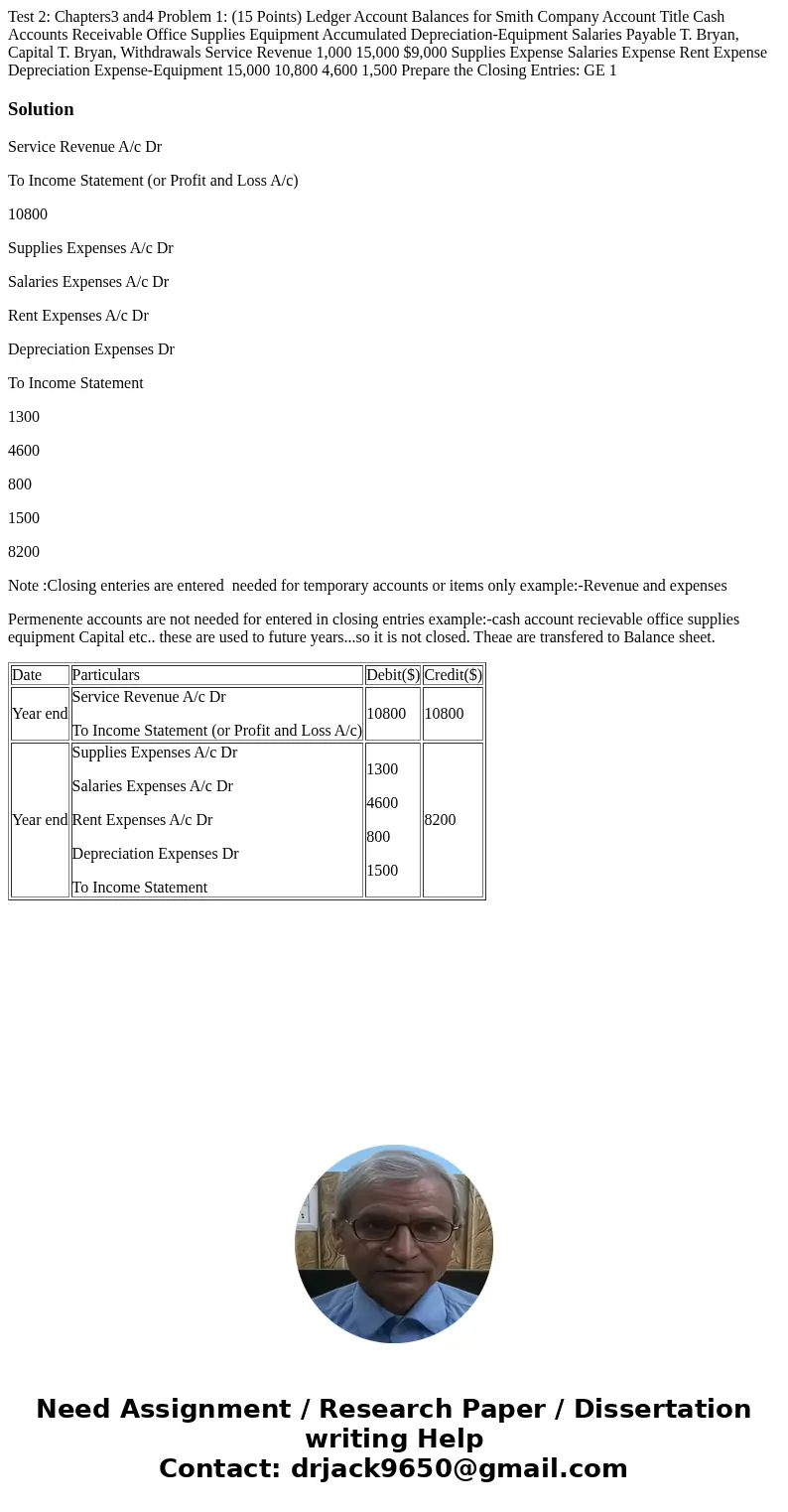

Test 2: Chapters3 and4 Problem 1: (15 Points) Ledger Account Balances for Smith Company Account Title Cash Accounts Receivable Office Supplies Equipment Accumulated Depreciation-Equipment Salaries Payable T. Bryan, Capital T. Bryan, Withdrawals Service Revenue 1,000 15,000 $9,000 Supplies Expense Salaries Expense Rent Expense Depreciation Expense-Equipment 15,000 10,800 4,600 1,500 Prepare the Closing Entries: GE 1

Solution

Service Revenue A/c Dr

To Income Statement (or Profit and Loss A/c)

10800

Supplies Expenses A/c Dr

Salaries Expenses A/c Dr

Rent Expenses A/c Dr

Depreciation Expenses Dr

To Income Statement

1300

4600

800

1500

8200

Note :Closing enteries are entered needed for temporary accounts or items only example:-Revenue and expenses

Permenente accounts are not needed for entered in closing entries example:-cash account recievable office supplies equipment Capital etc.. these are used to future years...so it is not closed. Theae are transfered to Balance sheet.

| Date | Particulars | Debit($) | Credit($) |

| Year end | Service Revenue A/c Dr To Income Statement (or Profit and Loss A/c) | 10800 | 10800 |

| Year end | Supplies Expenses A/c Dr Salaries Expenses A/c Dr Rent Expenses A/c Dr Depreciation Expenses Dr To Income Statement | 1300 4600 800 1500 | 8200 |

Homework Sourse

Homework Sourse