1 Journalize the April transactions using a periodic invento

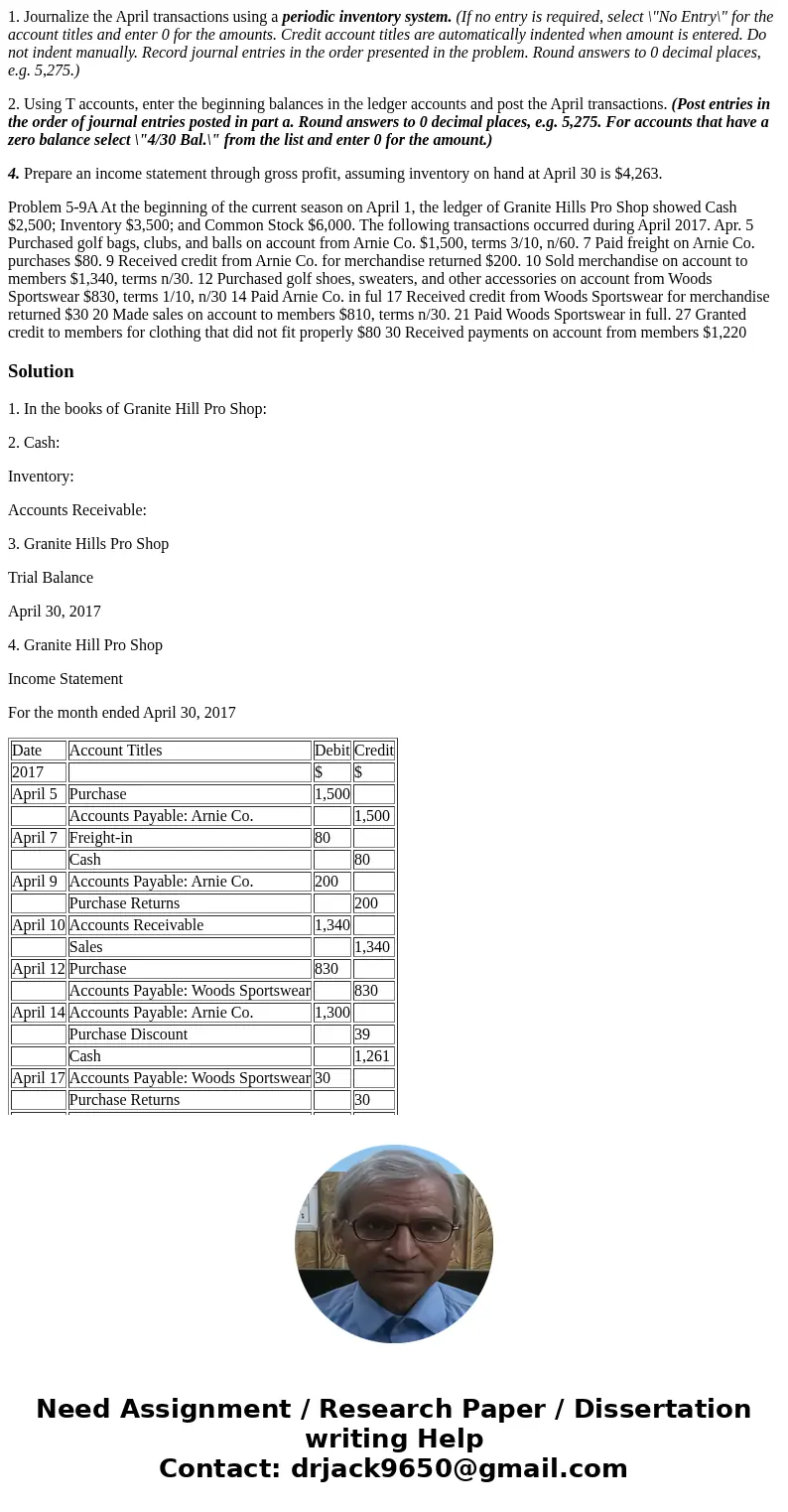

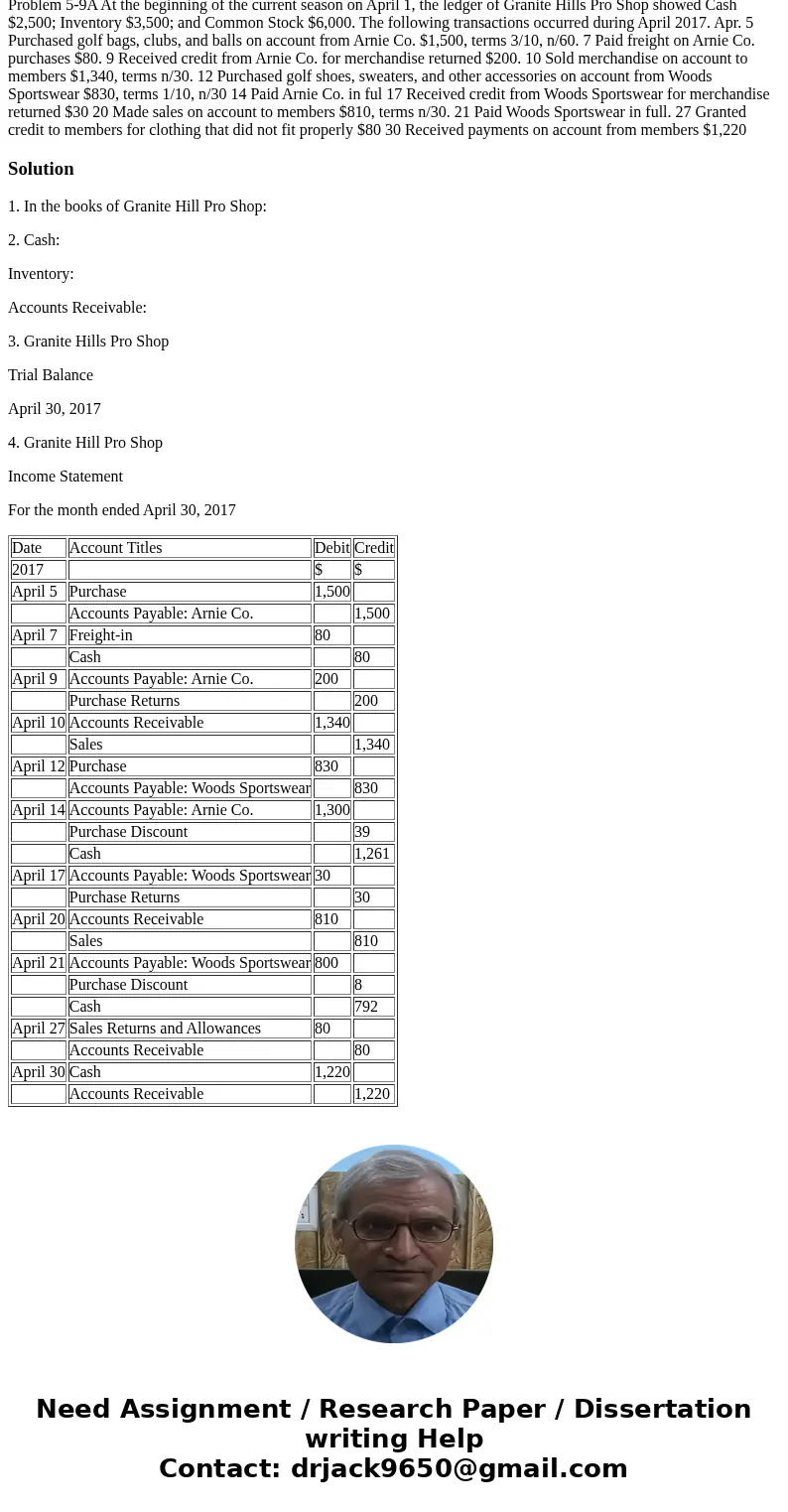

1. Journalize the April transactions using a periodic inventory system. (If no entry is required, select \"No Entry\" for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually. Record journal entries in the order presented in the problem. Round answers to 0 decimal places, e.g. 5,275.)

2. Using T accounts, enter the beginning balances in the ledger accounts and post the April transactions. (Post entries in the order of journal entries posted in part a. Round answers to 0 decimal places, e.g. 5,275. For accounts that have a zero balance select \"4/30 Bal.\" from the list and enter 0 for the amount.)

4. Prepare an income statement through gross profit, assuming inventory on hand at April 30 is $4,263.

Problem 5-9A At the beginning of the current season on April 1, the ledger of Granite Hills Pro Shop showed Cash $2,500; Inventory $3,500; and Common Stock $6,000. The following transactions occurred during April 2017. Apr. 5 Purchased golf bags, clubs, and balls on account from Arnie Co. $1,500, terms 3/10, n/60. 7 Paid freight on Arnie Co. purchases $80. 9 Received credit from Arnie Co. for merchandise returned $200. 10 Sold merchandise on account to members $1,340, terms n/30. 12 Purchased golf shoes, sweaters, and other accessories on account from Woods Sportswear $830, terms 1/10, n/30 14 Paid Arnie Co. in ful 17 Received credit from Woods Sportswear for merchandise returned $30 20 Made sales on account to members $810, terms n/30. 21 Paid Woods Sportswear in full. 27 Granted credit to members for clothing that did not fit properly $80 30 Received payments on account from members $1,220Solution

1. In the books of Granite Hill Pro Shop:

2. Cash:

Inventory:

Accounts Receivable:

3. Granite Hills Pro Shop

Trial Balance

April 30, 2017

4. Granite Hill Pro Shop

Income Statement

For the month ended April 30, 2017

| Date | Account Titles | Debit | Credit |

| 2017 | $ | $ | |

| April 5 | Purchase | 1,500 | |

| Accounts Payable: Arnie Co. | 1,500 | ||

| April 7 | Freight-in | 80 | |

| Cash | 80 | ||

| April 9 | Accounts Payable: Arnie Co. | 200 | |

| Purchase Returns | 200 | ||

| April 10 | Accounts Receivable | 1,340 | |

| Sales | 1,340 | ||

| April 12 | Purchase | 830 | |

| Accounts Payable: Woods Sportswear | 830 | ||

| April 14 | Accounts Payable: Arnie Co. | 1,300 | |

| Purchase Discount | 39 | ||

| Cash | 1,261 | ||

| April 17 | Accounts Payable: Woods Sportswear | 30 | |

| Purchase Returns | 30 | ||

| April 20 | Accounts Receivable | 810 | |

| Sales | 810 | ||

| April 21 | Accounts Payable: Woods Sportswear | 800 | |

| Purchase Discount | 8 | ||

| Cash | 792 | ||

| April 27 | Sales Returns and Allowances | 80 | |

| Accounts Receivable | 80 | ||

| April 30 | Cash | 1,220 | |

| Accounts Receivable | 1,220 |

Homework Sourse

Homework Sourse