for XXX Corp what is the balance of retained earnings for Us

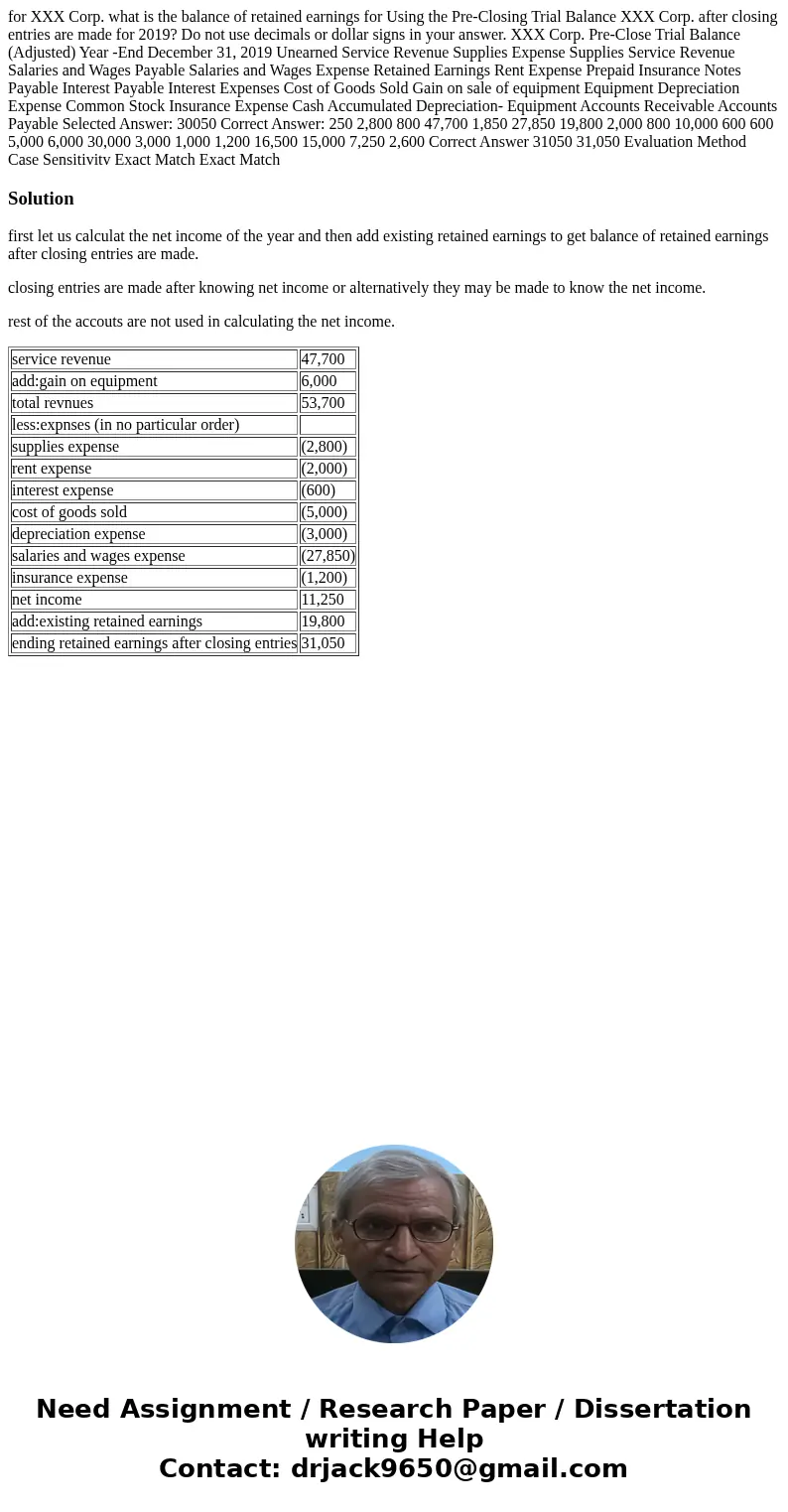

for XXX Corp. what is the balance of retained earnings for Using the Pre-Closing Trial Balance XXX Corp. after closing entries are made for 2019? Do not use decimals or dollar signs in your answer. XXX Corp. Pre-Close Trial Balance (Adjusted) Year -End December 31, 2019 Unearned Service Revenue Supplies Expense Supplies Service Revenue Salaries and Wages Payable Salaries and Wages Expense Retained Earnings Rent Expense Prepaid Insurance Notes Payable Interest Payable Interest Expenses Cost of Goods Sold Gain on sale of equipment Equipment Depreciation Expense Common Stock Insurance Expense Cash Accumulated Depreciation- Equipment Accounts Receivable Accounts Payable Selected Answer: 30050 Correct Answer: 250 2,800 800 47,700 1,850 27,850 19,800 2,000 800 10,000 600 600 5,000 6,000 30,000 3,000 1,000 1,200 16,500 15,000 7,250 2,600 Correct Answer 31050 31,050 Evaluation Method Case Sensitivitv Exact Match Exact Match

Solution

first let us calculat the net income of the year and then add existing retained earnings to get balance of retained earnings after closing entries are made.

closing entries are made after knowing net income or alternatively they may be made to know the net income.

rest of the accouts are not used in calculating the net income.

| service revenue | 47,700 |

| add:gain on equipment | 6,000 |

| total revnues | 53,700 |

| less:expnses (in no particular order) | |

| supplies expense | (2,800) |

| rent expense | (2,000) |

| interest expense | (600) |

| cost of goods sold | (5,000) |

| depreciation expense | (3,000) |

| salaries and wages expense | (27,850) |

| insurance expense | (1,200) |

| net income | 11,250 |

| add:existing retained earnings | 19,800 |

| ending retained earnings after closing entries | 31,050 |

Homework Sourse

Homework Sourse