Dinkel Concrete acquired the outstanding common stock of Pin

Dinkel Concrete acquired the outstanding common stock of Pink paying $1,350,000 for 50,000 shares ston, Inc. on January 1, 2017, by e Pinkston declared and paid a S0 50 per share cash dividend on December 31, 2017 ePinkston reported net income of $600,000 for the year At December 31, 2017, the market price of Pinkston\'s common stock was $30 per share. \" Dinkel has the intent to sell the Pinkston investment sometime in the future and therefore classifies its investment in Pinkston as available-for-sale. Instructions (a) Assuming Dinkel purchased a 10% interest in Pinkston .>So, ooo s oooo What method should Dinkel use to account for this investment? Cast meth od i. Prepare all the 2017 required journal entries for Dinkel\'s Concrete investment in Pinkston. ii. ii. At what value is Dinkels investment in Pinkston reported on the December 31, 2017 Balance Sheet? $ (b) Assuming Dinkel purchased a 25% interest in Pinkston i. What method should Dinkel use to account for this investment? ii. Prepare all the 2017 required journal entries for Dinkel\'s Concrete investment in Pinkston. ii At what value is Dinkels investment in Pinkston reported on the December 31, 2017 Balance Sheet? S

Solution

Answer- A:

Date

Account Title and Investment

Debit

Credit

Jan-01

Investment in Pinkston Inc.

1350000

Cash

1350000

(To record the investment made in Pinkston Inc.)

Dec-31

Cash

25000

Dividend Revenue

25000

(To record the dividend received $0.50 per share)

Dec-31

Investment in Pinkston Inc.

150000

Unrealized Gain on Available-for-sale Securities

150000

(To record the increase in market price Pinkston\'s share from $27 to $30 per share)

Answer- B:

Date

Account Title and Investment

Debit

Credit

Jan-01

Investment in Pinkston Inc.

1350000

Cash

1350000

(To record the investment made in Pinkston Inc.)

Dec-31

Investment in Pinkston Inc.

150000

Equity in Subsidiary\'s earnings (600,000 * 25%)

150000

(To record the share of income in Pinkston\'s earnings)

Dec-31

Cash

25000

Investment in Pinkston Inc.

25000

(To record the dividend received $0.50 per share)

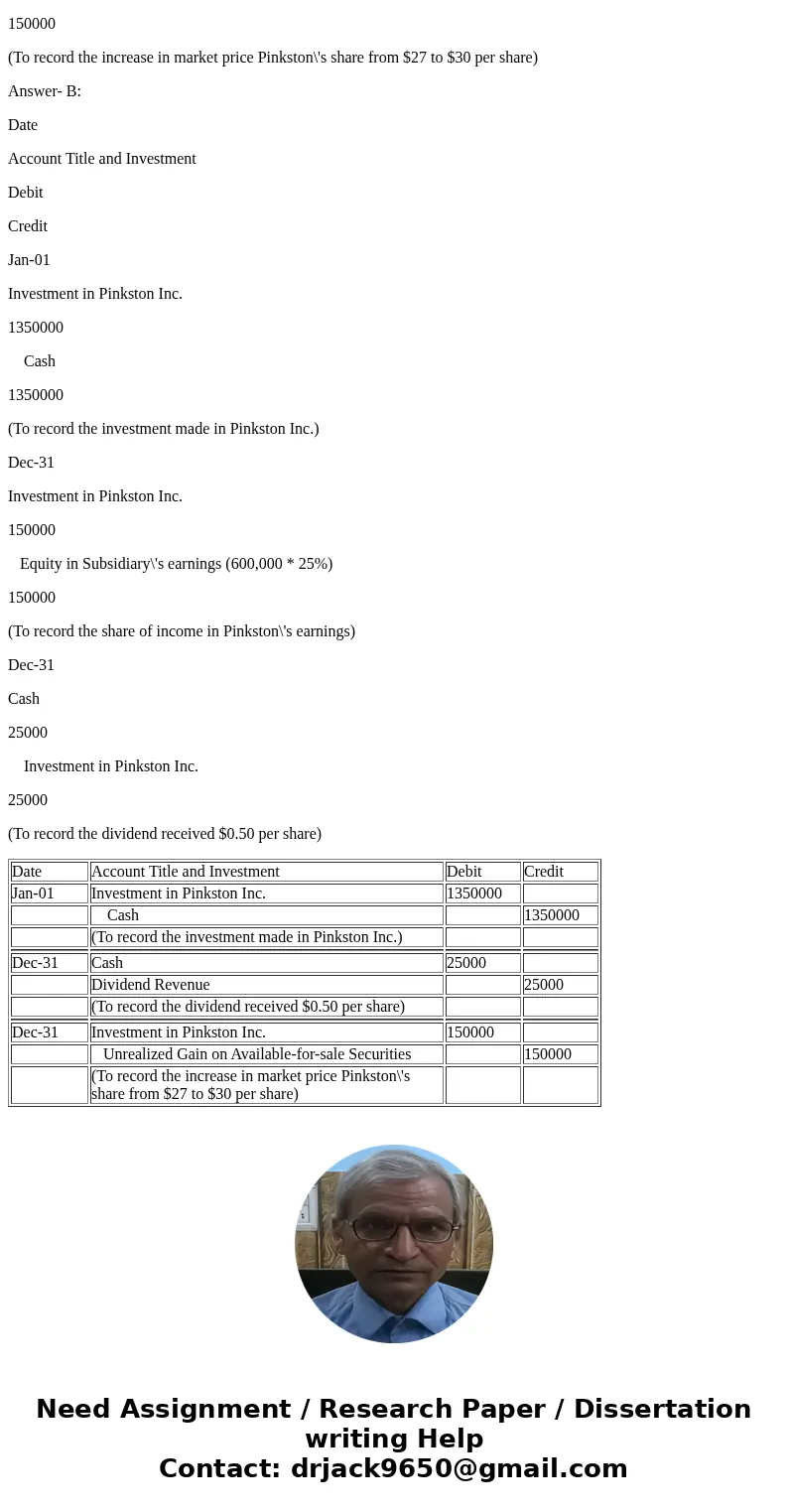

| Date | Account Title and Investment | Debit | Credit |

| Jan-01 | Investment in Pinkston Inc. | 1350000 | |

| Cash | 1350000 | ||

| (To record the investment made in Pinkston Inc.) | |||

| Dec-31 | Cash | 25000 | |

| Dividend Revenue | 25000 | ||

| (To record the dividend received $0.50 per share) | |||

| Dec-31 | Investment in Pinkston Inc. | 150000 | |

| Unrealized Gain on Available-for-sale Securities | 150000 | ||

| (To record the increase in market price Pinkston\'s share from $27 to $30 per share) |

Homework Sourse

Homework Sourse