Depreciation by Two Methods Sale of Foxed Asset New lithogra

Solution

Answer:

1

Depreciation under straight line method

=937500-80600 / 5 year

=171,280 depreciation each year

Accumulated

Depreciation

Depreciation,

Book Value,

year

Expense

End of Year

End of Year

1

171380

171380

766,120

2

171,380

342,760

594,740

3

171,380

514,140

423,360

4

171,380

685,520

251,980

5

171,380

856,900

80,600

_________________________________________________

2

Depreciation under DDB method

= Rate for DDB

=Straight-line rate x 2

=(100/5) x 2

=20% x2

=40%

Accumulated

Depreciation

Depreciation,

Book Value,

Expense

End of Year

End of Year

1

375000 (937500*40%)

375000

562500

2

225000 (562500*40%)

600000

337500

3

135000 (337500*40%)

735000

202500

4

81000 (202500*40%)

816000

121500

5

40900 (121500-80600)

856900

80600

_____________________________________________

3

Description

Debit $

Credit $

Cash

137300

Accumulated depreciation-equipment

816000

Equipment

937500

Gain on sale of equipment

15800

_________________________________________

Description

Debit $

Credit $

Cash

117900

Accumulated depreciation-equipment

816000

Loss on sale of equipment

3600

Equipment

937500

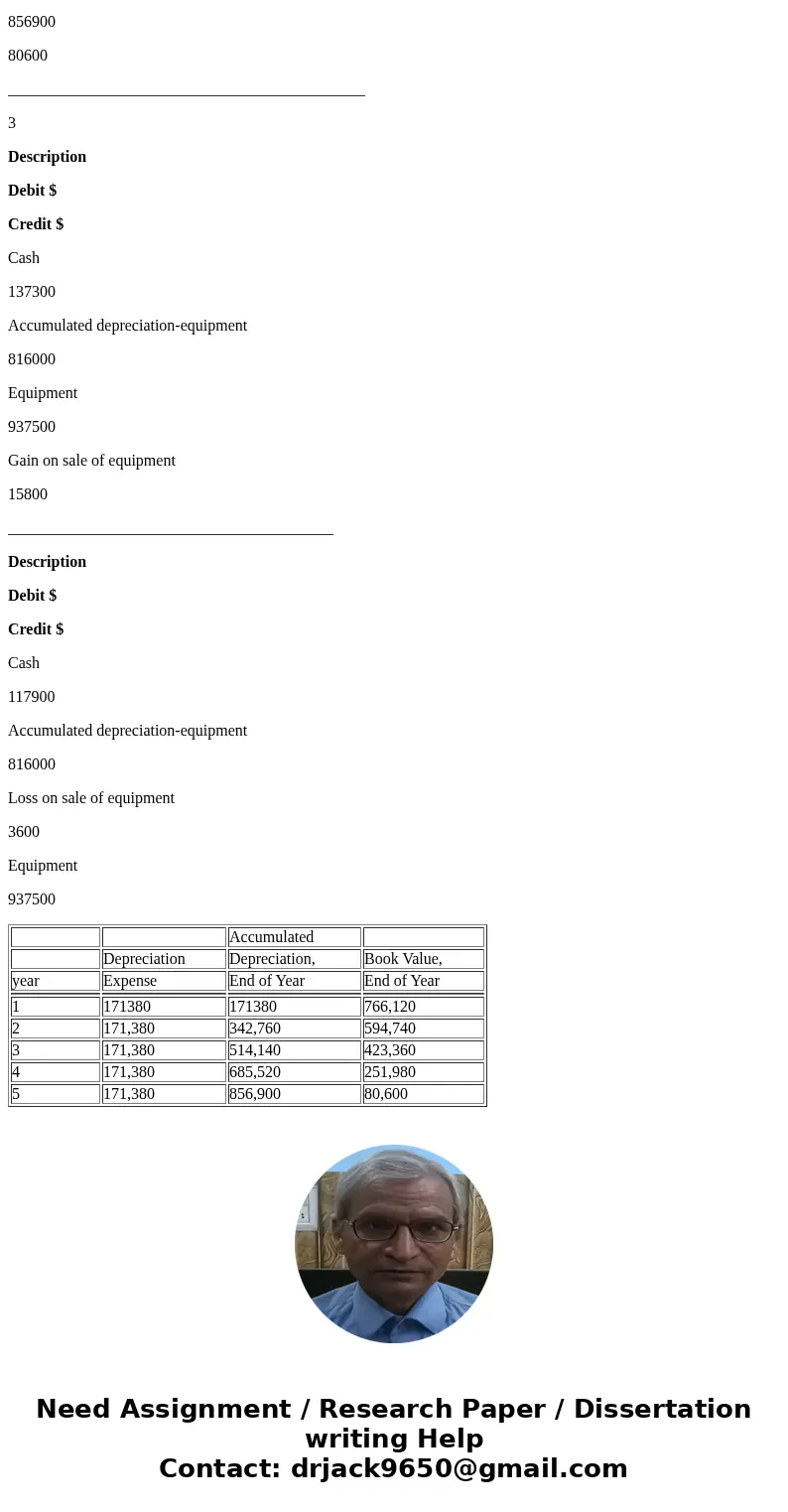

| Accumulated | |||

| Depreciation | Depreciation, | Book Value, | |

| year | Expense | End of Year | End of Year |

| 1 | 171380 | 171380 | 766,120 |

| 2 | 171,380 | 342,760 | 594,740 |

| 3 | 171,380 | 514,140 | 423,360 |

| 4 | 171,380 | 685,520 | 251,980 |

| 5 | 171,380 | 856,900 | 80,600 |

Homework Sourse

Homework Sourse