8 rtizes Cheers Inc is authorized to issue 11 9 year bonds p

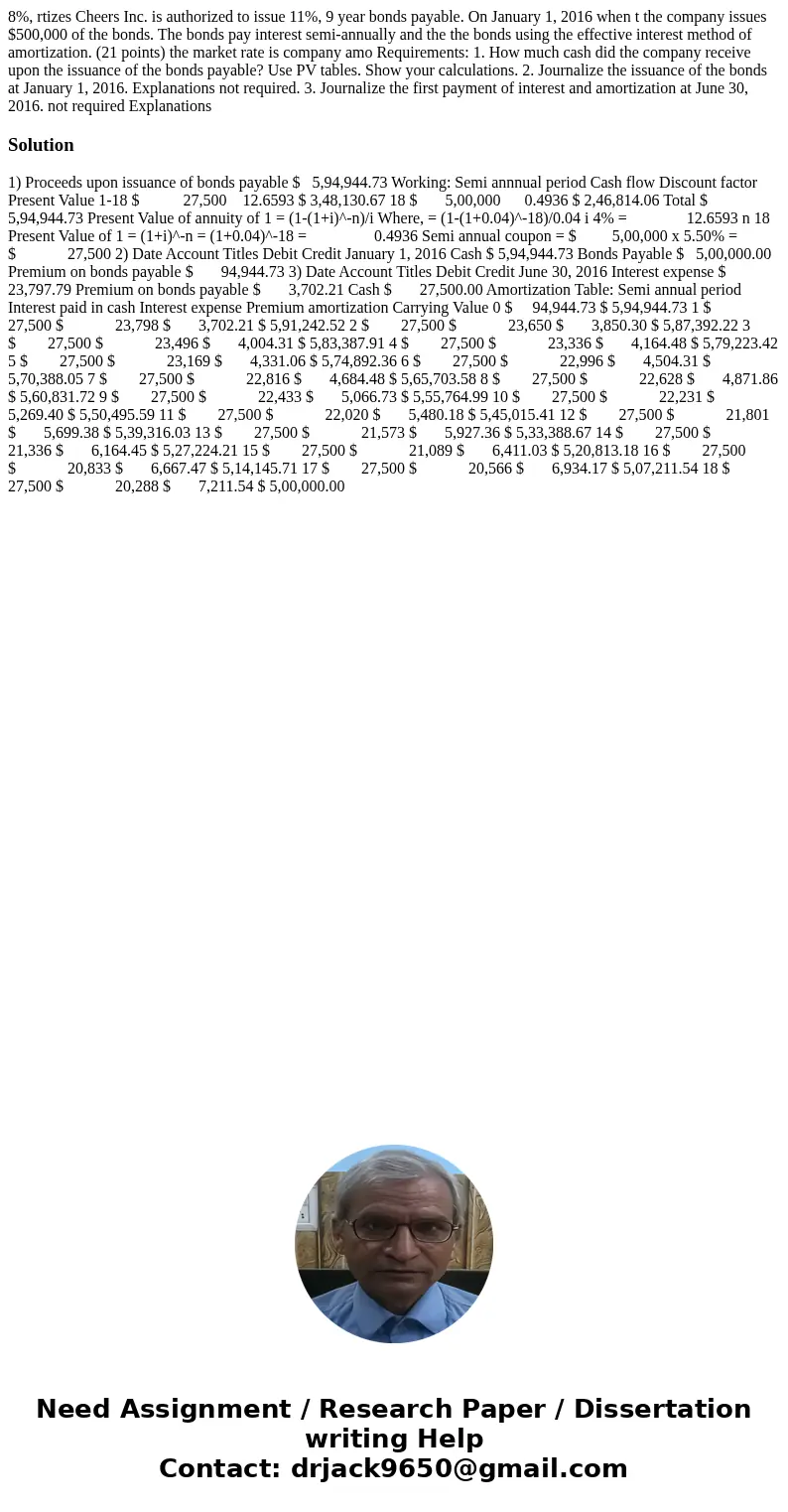

8%, rtizes Cheers Inc. is authorized to issue 11%, 9 year bonds payable. On January 1, 2016 when t the company issues $500,000 of the bonds. The bonds pay interest semi-annually and the the bonds using the effective interest method of amortization. (21 points) the market rate is company amo Requirements: 1. How much cash did the company receive upon the issuance of the bonds payable? Use PV tables. Show your calculations. 2. Journalize the issuance of the bonds at January 1, 2016. Explanations not required. 3. Journalize the first payment of interest and amortization at June 30, 2016. not required Explanations

Solution

1) Proceeds upon issuance of bonds payable $ 5,94,944.73 Working: Semi annnual period Cash flow Discount factor Present Value 1-18 $ 27,500 12.6593 $ 3,48,130.67 18 $ 5,00,000 0.4936 $ 2,46,814.06 Total $ 5,94,944.73 Present Value of annuity of 1 = (1-(1+i)^-n)/i Where, = (1-(1+0.04)^-18)/0.04 i 4% = 12.6593 n 18 Present Value of 1 = (1+i)^-n = (1+0.04)^-18 = 0.4936 Semi annual coupon = $ 5,00,000 x 5.50% = $ 27,500 2) Date Account Titles Debit Credit January 1, 2016 Cash $ 5,94,944.73 Bonds Payable $ 5,00,000.00 Premium on bonds payable $ 94,944.73 3) Date Account Titles Debit Credit June 30, 2016 Interest expense $ 23,797.79 Premium on bonds payable $ 3,702.21 Cash $ 27,500.00 Amortization Table: Semi annual period Interest paid in cash Interest expense Premium amortization Carrying Value 0 $ 94,944.73 $ 5,94,944.73 1 $ 27,500 $ 23,798 $ 3,702.21 $ 5,91,242.52 2 $ 27,500 $ 23,650 $ 3,850.30 $ 5,87,392.22 3 $ 27,500 $ 23,496 $ 4,004.31 $ 5,83,387.91 4 $ 27,500 $ 23,336 $ 4,164.48 $ 5,79,223.42 5 $ 27,500 $ 23,169 $ 4,331.06 $ 5,74,892.36 6 $ 27,500 $ 22,996 $ 4,504.31 $ 5,70,388.05 7 $ 27,500 $ 22,816 $ 4,684.48 $ 5,65,703.58 8 $ 27,500 $ 22,628 $ 4,871.86 $ 5,60,831.72 9 $ 27,500 $ 22,433 $ 5,066.73 $ 5,55,764.99 10 $ 27,500 $ 22,231 $ 5,269.40 $ 5,50,495.59 11 $ 27,500 $ 22,020 $ 5,480.18 $ 5,45,015.41 12 $ 27,500 $ 21,801 $ 5,699.38 $ 5,39,316.03 13 $ 27,500 $ 21,573 $ 5,927.36 $ 5,33,388.67 14 $ 27,500 $ 21,336 $ 6,164.45 $ 5,27,224.21 15 $ 27,500 $ 21,089 $ 6,411.03 $ 5,20,813.18 16 $ 27,500 $ 20,833 $ 6,667.47 $ 5,14,145.71 17 $ 27,500 $ 20,566 $ 6,934.17 $ 5,07,211.54 18 $ 27,500 $ 20,288 $ 7,211.54 $ 5,00,000.00

Homework Sourse

Homework Sourse