a Quick Ratio Calculate the companys quick ratio for 2016 an

a) Quick Ratio Calculate the company\'s quick ratio for 2016 and compare the result to the industry average.

b) Current Ratio Calculate the company’s current ratio for 2016 and compare the result to the industry average.

c) Accounts Receivable Turnover Calculate the company’s accounts receivable turnover for 2016 and compare the result to the industry average.

Solution

Hi tech Instrument Inc

Industry Ratio

Diffrence

Quick Ratio

1.4

1.3

0.1

Current ratio

2.3

2.4

-0.1

Accounts Receivable Turnover

4.8

5.9

-1.1

Comparison

Quick Ratio- Hi-tech Instruments Inc has a better Liquid Position as compared to Industry.

Current Ratio-As compared to Industry Hi-tech Instruments Inc has a lower Current ratio which indicates its ability to pay its long term and short term obligations. Although the difference is not too much but satisfactory.

Accounts Turnover Ratio- As Compared to Industry Hi-tech Instruments Inc’s Accounts Receivable Turnover ratio is lower. Hi tech Inc is collecting its Receivables in 76 days (Approx) as compared to industry which collects its receivables in 62 days (approx).

Working Notes

Calculation of Quick Ratio

Formula =(Current Assets-Inventories )/Current Liabilities

(103800-39500)/45000

1.4

Calculation of Current ratio

Formula =Current Assets/Current Liabilities

103800/45000

2.3

Calculation of Accounts Receivables Turnover

Formula = Net credit sales /Average Accounts Receiveble

(210000/43500)

4.8

Average Receivables

Receivables in 2015

$ 41,000.00

Receivables in 2016

$ 46,000.00

$ 87,000.00

Average Receivables( 87000/2)

$ 43,500.00

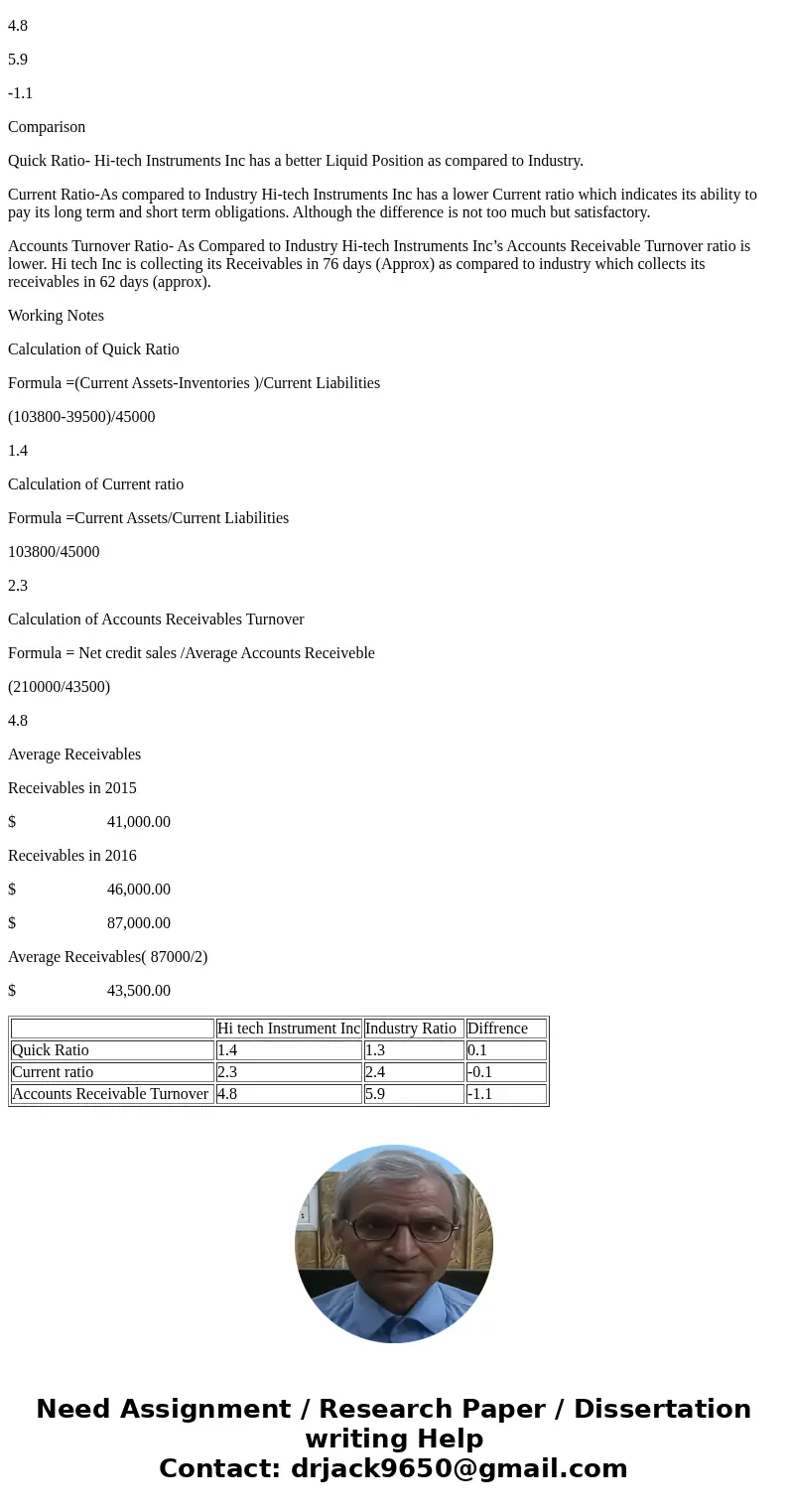

| Hi tech Instrument Inc | Industry Ratio | Diffrence | |

| Quick Ratio | 1.4 | 1.3 | 0.1 |

| Current ratio | 2.3 | 2.4 | -0.1 |

| Accounts Receivable Turnover | 4.8 | 5.9 | -1.1 |

Homework Sourse

Homework Sourse