03 IRR 10 pts Your company is planning to buy a new machine

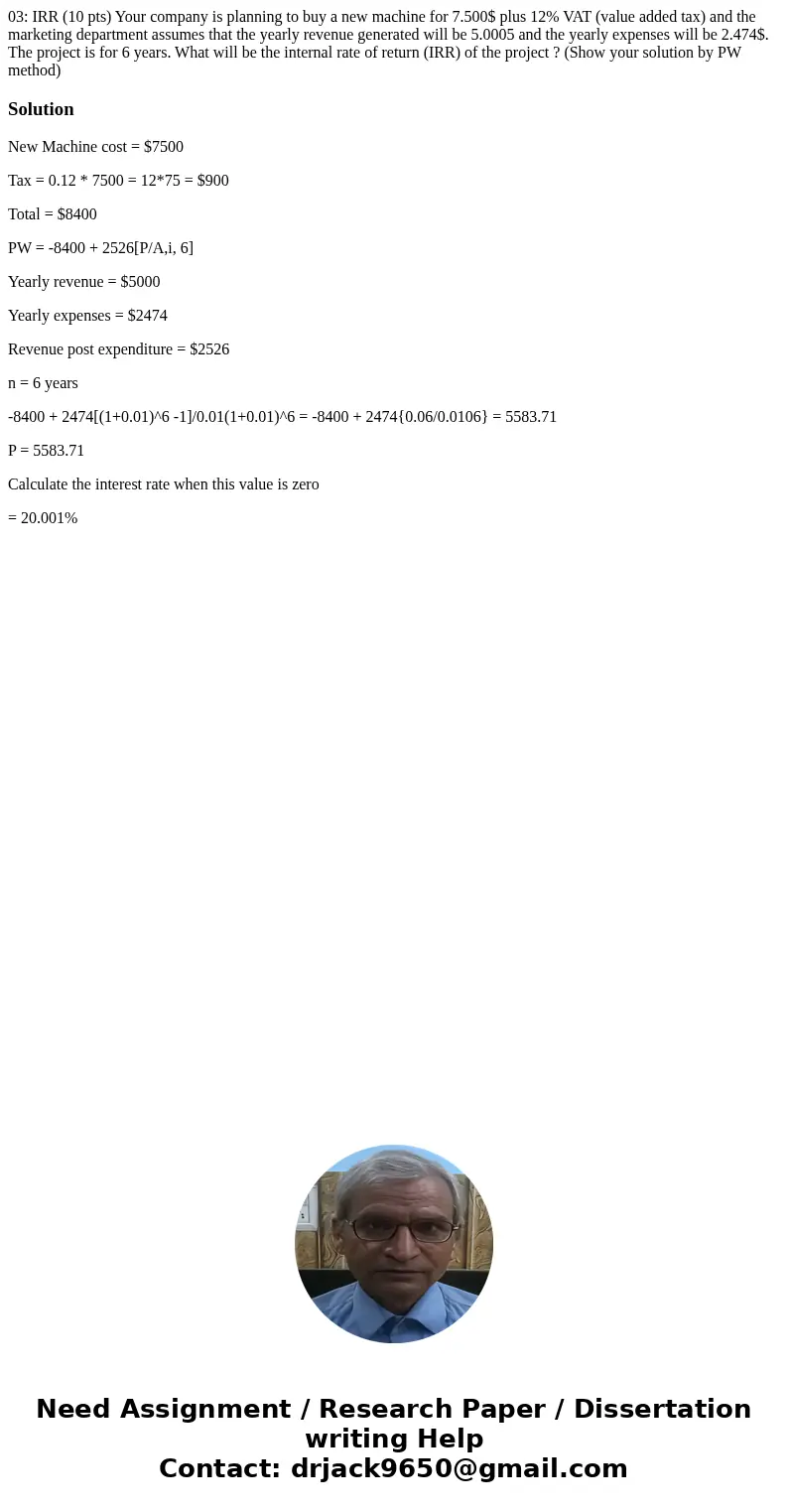

03: IRR (10 pts) Your company is planning to buy a new machine for 7.500$ plus 12% VAT (value added tax) and the marketing department assumes that the yearly revenue generated will be 5.0005 and the yearly expenses will be 2.474$. The project is for 6 years. What will be the internal rate of return (IRR) of the project ? (Show your solution by PW method)

Solution

New Machine cost = $7500

Tax = 0.12 * 7500 = 12*75 = $900

Total = $8400

PW = -8400 + 2526[P/A,i, 6]

Yearly revenue = $5000

Yearly expenses = $2474

Revenue post expenditure = $2526

n = 6 years

-8400 + 2474[(1+0.01)^6 -1]/0.01(1+0.01)^6 = -8400 + 2474{0.06/0.0106} = 5583.71

P = 5583.71

Calculate the interest rate when this value is zero

= 20.001%

Homework Sourse

Homework Sourse