Protrade Corporation acquired 80 percent of the outstanding

Solution

a.

Cost of Goods Sold

562250

Inventory

472750

Net Income attributable to Non controlling Interest

27600

b.

Cost of Goods Sold

592250

Inventory

475375

Net Income attributable to Non controlling Interest

26550

c.

Building (net)

525000

Operating Exp

285000

Net Income attributable to Non controlling Interest

27600

(a) COGS:-

Portrade COGS

390000

Seacraft COGS

297000

Elimination of 2018 Intra equity Transfer

(130000)

Recognition gross profit deferred in 2017 (2018 beginning inventory)

48000 transfer price / 1.6 = 30000 cost

48000 – 30000 = 18000 intra equity gross profit

(18000)

Deferral of 2018 intra equity gross profit in ending inventory

62000 transfer price / 1.6 = 38750 cost

62000 – 38750 = 23250 intra equity gross profit

23250

562250

Inventory :-

Portrade Inventory

366000

Seacraft Inventory

130000

Deferral of 2018 intra equity gross profit in ending inventory

62000 transfer price / 1.6 = 38750 cost

62000 – 38750 = 23250 intra equity gross profit

(23250)

472750

Net Income Attributable to Non controlling Int :-

Seacraft sale

560000

Seacraft COGS

(297000)

Seacraft Operating Exp

(125000)

138000

Net Income Attributable to Non controlling Int (138000 * 20%)

27600

(b) COGS:-

Portrade COGS

390000

Seacraft COGS

297000

Elimination of 2018 Intra equity Transfer

(100000)

Recognition gross profit deferred in 2017 (2018 beginning inventory)

41000 transfer price / 1.6 = 25625 cost

41000 – 25625 = 15375 intra equity gross profit

(15375)

Deferral of 2018 intra equity gross profit in ending inventory

55000 transfer price / 1.6 = 34375 cost

55000 – 34375 = 20625 intra equity gross profit

20625

592250

Inventory :-

Portrade Inventory

366000

Seacraft Inventory

130000

Deferral of 2018 intra equity gross profit in ending inventory

55000 transfer price / 1.6 = 34375 cost

55000 – 34375 = 20625 intra equity gross profit

(20625)

475375

Net Income Attributable to Non controlling Int :-

Seacraft sale

560000

Seacraft COGS

(297000)

Seacraft Operating Exp

(125000)

[(55000 – 41000)/1.6] * 0.6

(5250)

132750

Net Income Attributable to Non controlling Int (132750 * 20%)

26550

(c) Building :-

Portrade Building

378000

Seacraft Building

177000

(+) Depreciation on gain (120000 – 70000)/5

10000

(-) [120000 – 70000] - 10000

40000

525000

Operating Exp :-

Portrade Operating Exp

170000

Seacraft Operating Exp

125000

(-) Depreciation on gain

10000

285000

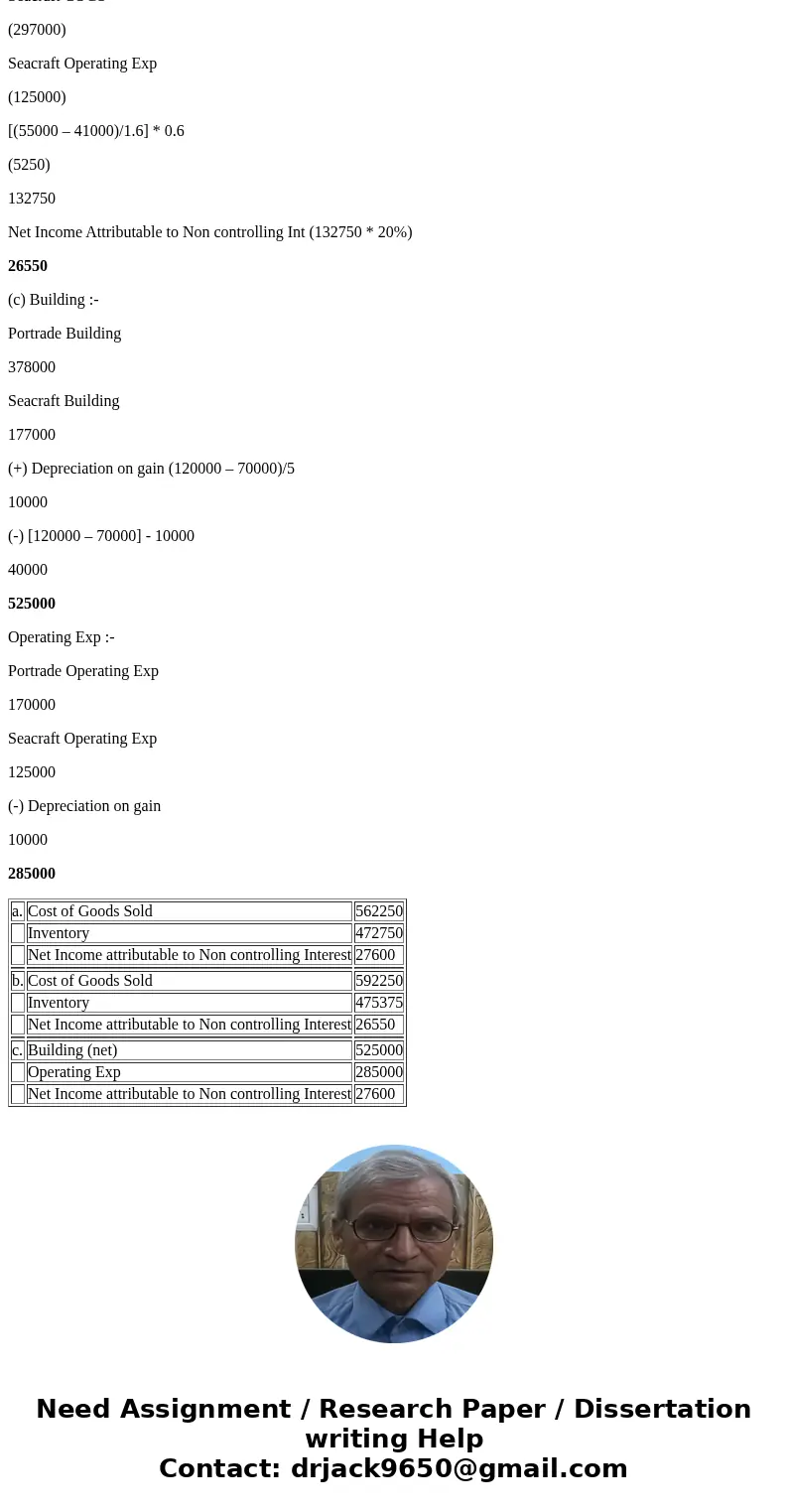

| a. | Cost of Goods Sold | 562250 |

| Inventory | 472750 | |

| Net Income attributable to Non controlling Interest | 27600 | |

| b. | Cost of Goods Sold | 592250 |

| Inventory | 475375 | |

| Net Income attributable to Non controlling Interest | 26550 | |

| c. | Building (net) | 525000 |

| Operating Exp | 285000 | |

| Net Income attributable to Non controlling Interest | 27600 |

Homework Sourse

Homework Sourse