Corporation had the following transactions during its first

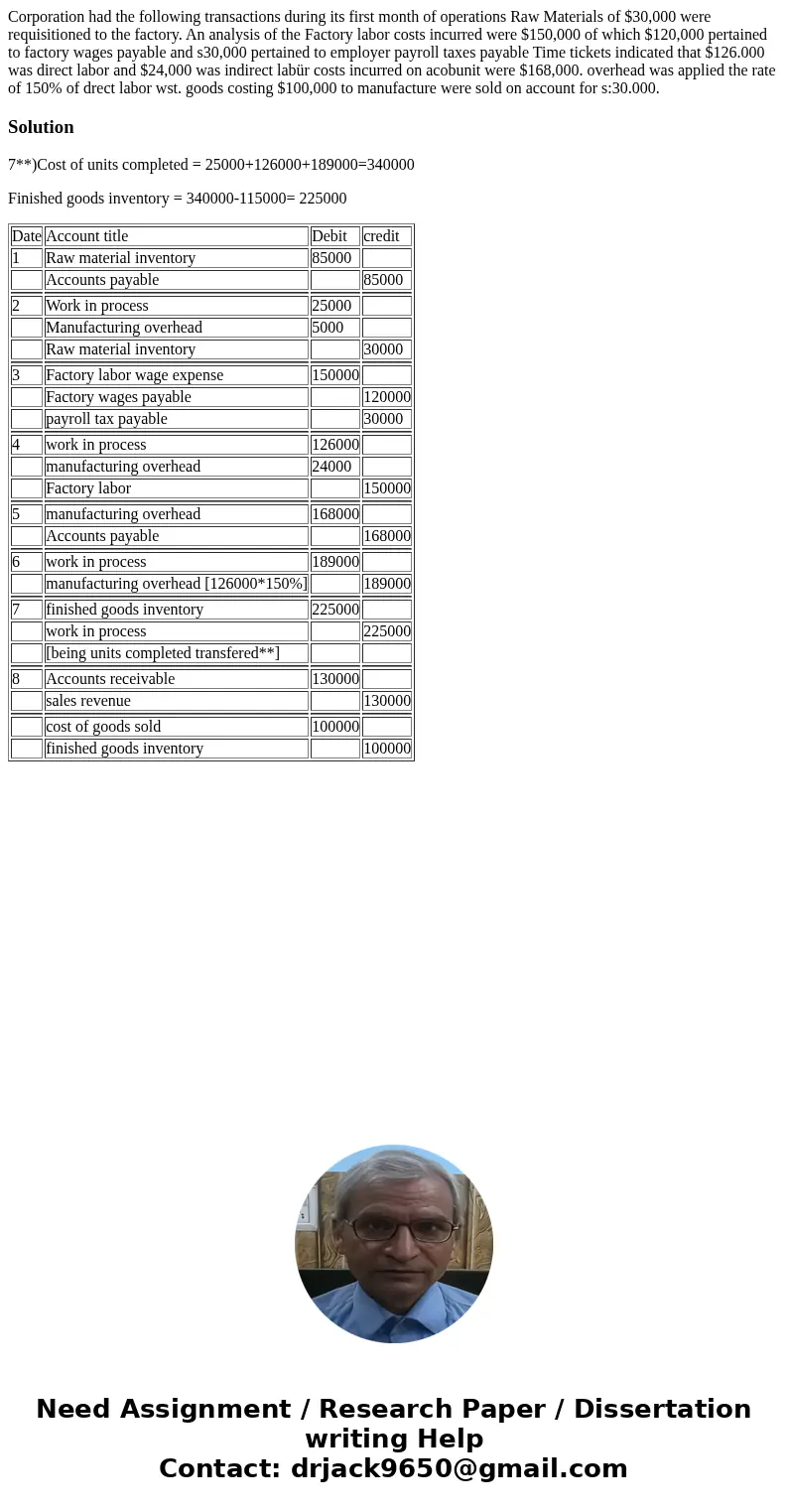

Corporation had the following transactions during its first month of operations Raw Materials of $30,000 were requisitioned to the factory. An analysis of the Factory labor costs incurred were $150,000 of which $120,000 pertained to factory wages payable and s30,000 pertained to employer payroll taxes payable Time tickets indicated that $126.000 was direct labor and $24,000 was indirect labür costs incurred on acobunit were $168,000. overhead was applied the rate of 150% of drect labor wst. goods costing $100,000 to manufacture were sold on account for s:30.000.

Solution

7**)Cost of units completed = 25000+126000+189000=340000

Finished goods inventory = 340000-115000= 225000

| Date | Account title | Debit | credit |

| 1 | Raw material inventory | 85000 | |

| Accounts payable | 85000 | ||

| 2 | Work in process | 25000 | |

| Manufacturing overhead | 5000 | ||

| Raw material inventory | 30000 | ||

| 3 | Factory labor wage expense | 150000 | |

| Factory wages payable | 120000 | ||

| payroll tax payable | 30000 | ||

| 4 | work in process | 126000 | |

| manufacturing overhead | 24000 | ||

| Factory labor | 150000 | ||

| 5 | manufacturing overhead | 168000 | |

| Accounts payable | 168000 | ||

| 6 | work in process | 189000 | |

| manufacturing overhead [126000*150%] | 189000 | ||

| 7 | finished goods inventory | 225000 | |

| work in process | 225000 | ||

| [being units completed transfered**] | |||

| 8 | Accounts receivable | 130000 | |

| sales revenue | 130000 | ||

| cost of goods sold | 100000 | ||

| finished goods inventory | 100000 |

Homework Sourse

Homework Sourse