1Record the borrowing of 53000 2 Record the accrued interest

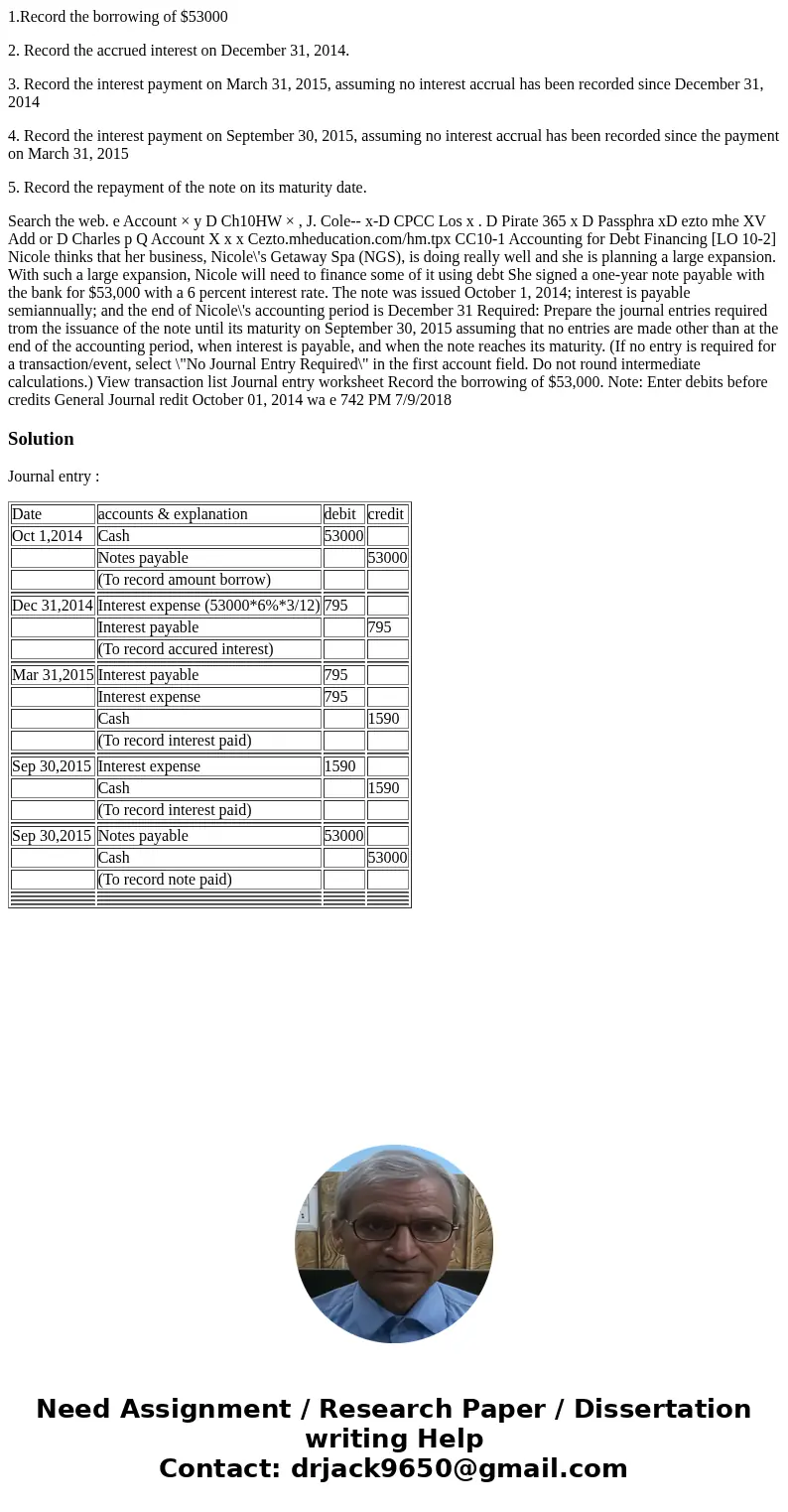

1.Record the borrowing of $53000

2. Record the accrued interest on December 31, 2014.

3. Record the interest payment on March 31, 2015, assuming no interest accrual has been recorded since December 31, 2014

4. Record the interest payment on September 30, 2015, assuming no interest accrual has been recorded since the payment on March 31, 2015

5. Record the repayment of the note on its maturity date.

Search the web. e Account × y D Ch10HW × , J. Cole-- x-D CPCC Los x . D Pirate 365 x D Passphra xD ezto mhe XV Add or D Charles p Q Account X x x Cezto.mheducation.com/hm.tpx CC10-1 Accounting for Debt Financing [LO 10-2] Nicole thinks that her business, Nicole\'s Getaway Spa (NGS), is doing really well and she is planning a large expansion. With such a large expansion, Nicole will need to finance some of it using debt She signed a one-year note payable with the bank for $53,000 with a 6 percent interest rate. The note was issued October 1, 2014; interest is payable semiannually; and the end of Nicole\'s accounting period is December 31 Required: Prepare the journal entries required trom the issuance of the note until its maturity on September 30, 2015 assuming that no entries are made other than at the end of the accounting period, when interest is payable, and when the note reaches its maturity. (If no entry is required for a transaction/event, select \"No Journal Entry Required\" in the first account field. Do not round intermediate calculations.) View transaction list Journal entry worksheet Record the borrowing of $53,000. Note: Enter debits before credits General Journal redit October 01, 2014 wa e 742 PM 7/9/2018Solution

Journal entry :

| Date | accounts & explanation | debit | credit |

| Oct 1,2014 | Cash | 53000 | |

| Notes payable | 53000 | ||

| (To record amount borrow) | |||

| Dec 31,2014 | Interest expense (53000*6%*3/12) | 795 | |

| Interest payable | 795 | ||

| (To record accured interest) | |||

| Mar 31,2015 | Interest payable | 795 | |

| Interest expense | 795 | ||

| Cash | 1590 | ||

| (To record interest paid) | |||

| Sep 30,2015 | Interest expense | 1590 | |

| Cash | 1590 | ||

| (To record interest paid) | |||

| Sep 30,2015 | Notes payable | 53000 | |

| Cash | 53000 | ||

| (To record note paid) | |||

Homework Sourse

Homework Sourse