A machine that produces cellphone components is purchased on

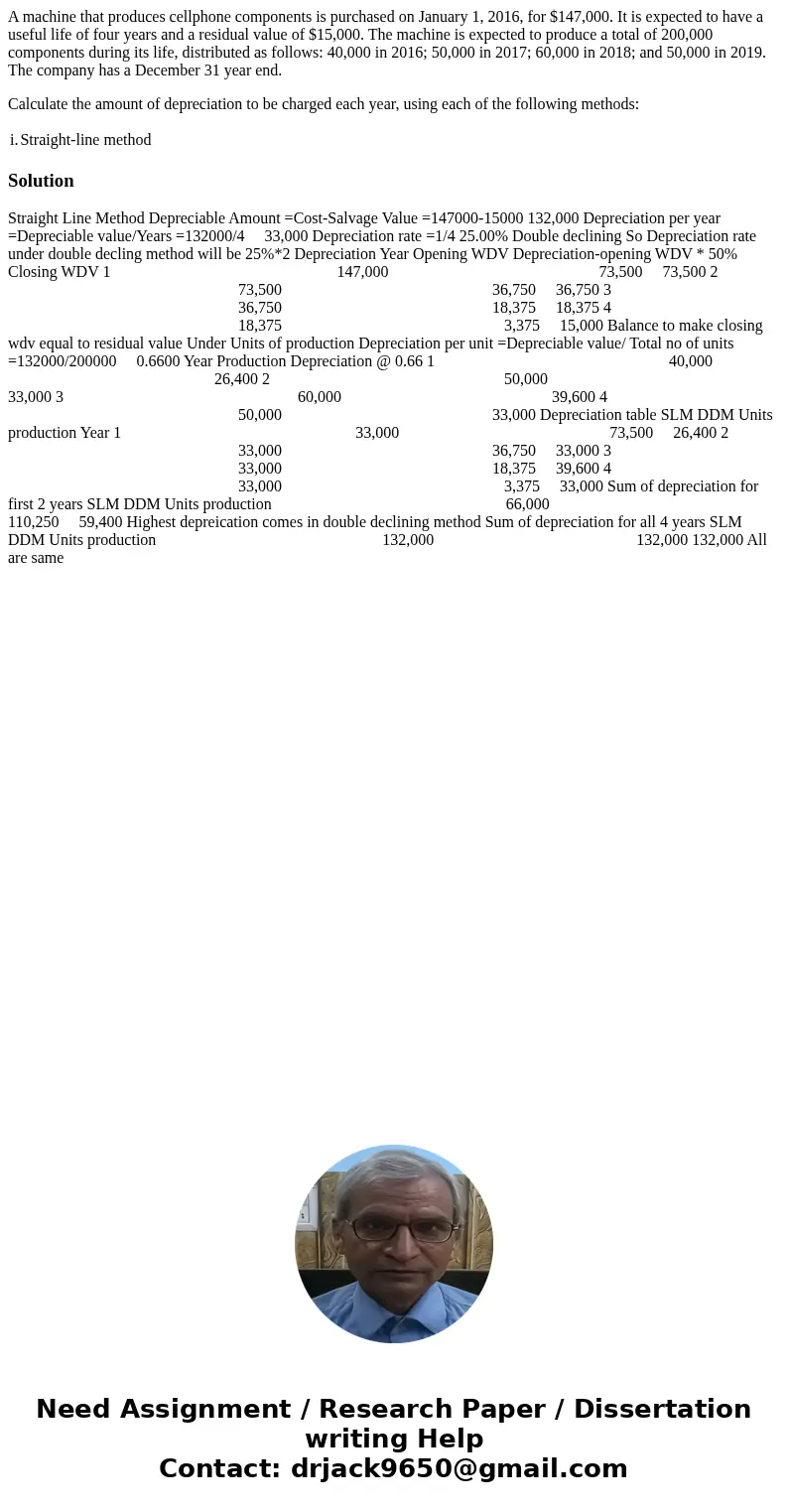

A machine that produces cellphone components is purchased on January 1, 2016, for $147,000. It is expected to have a useful life of four years and a residual value of $15,000. The machine is expected to produce a total of 200,000 components during its life, distributed as follows: 40,000 in 2016; 50,000 in 2017; 60,000 in 2018; and 50,000 in 2019. The company has a December 31 year end.

Calculate the amount of depreciation to be charged each year, using each of the following methods:

| i. | Straight-line method |

Solution

Straight Line Method Depreciable Amount =Cost-Salvage Value =147000-15000 132,000 Depreciation per year =Depreciable value/Years =132000/4 33,000 Depreciation rate =1/4 25.00% Double declining So Depreciation rate under double decling method will be 25%*2 Depreciation Year Opening WDV Depreciation-opening WDV * 50% Closing WDV 1 147,000 73,500 73,500 2 73,500 36,750 36,750 3 36,750 18,375 18,375 4 18,375 3,375 15,000 Balance to make closing wdv equal to residual value Under Units of production Depreciation per unit =Depreciable value/ Total no of units =132000/200000 0.6600 Year Production Depreciation @ 0.66 1 40,000 26,400 2 50,000 33,000 3 60,000 39,600 4 50,000 33,000 Depreciation table SLM DDM Units production Year 1 33,000 73,500 26,400 2 33,000 36,750 33,000 3 33,000 18,375 39,600 4 33,000 3,375 33,000 Sum of depreciation for first 2 years SLM DDM Units production 66,000 110,250 59,400 Highest depreication comes in double declining method Sum of depreciation for all 4 years SLM DDM Units production 132,000 132,000 132,000 All are same

Homework Sourse

Homework Sourse