a Fill in the Quantity Supplied after tax column assuming th

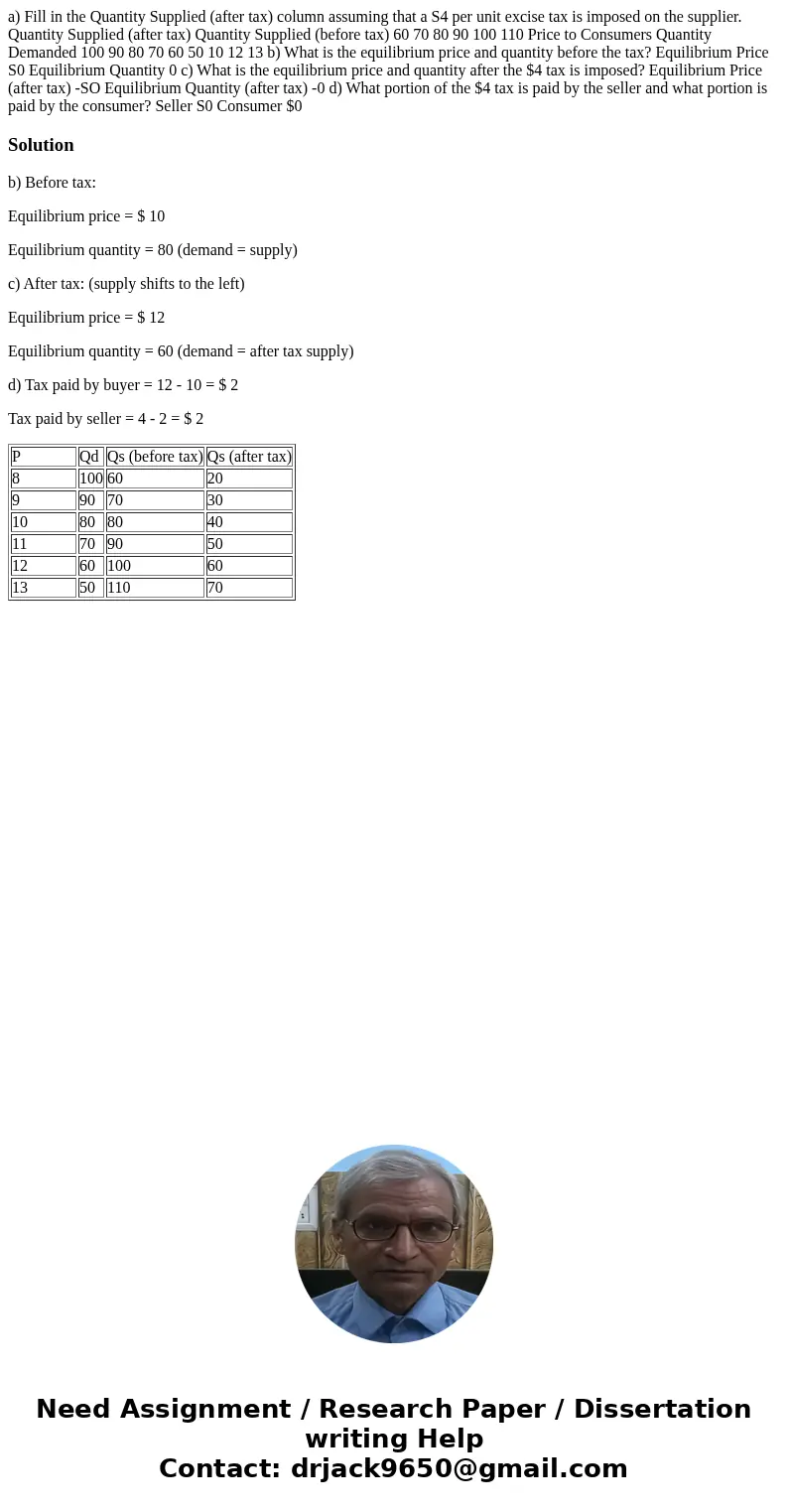

a) Fill in the Quantity Supplied (after tax) column assuming that a S4 per unit excise tax is imposed on the supplier. Quantity Supplied (after tax) Quantity Supplied (before tax) 60 70 80 90 100 110 Price to Consumers Quantity Demanded 100 90 80 70 60 50 10 12 13 b) What is the equilibrium price and quantity before the tax? Equilibrium Price S0 Equilibrium Quantity 0 c) What is the equilibrium price and quantity after the $4 tax is imposed? Equilibrium Price (after tax) -SO Equilibrium Quantity (after tax) -0 d) What portion of the $4 tax is paid by the seller and what portion is paid by the consumer? Seller S0 Consumer $0

Solution

b) Before tax:

Equilibrium price = $ 10

Equilibrium quantity = 80 (demand = supply)

c) After tax: (supply shifts to the left)

Equilibrium price = $ 12

Equilibrium quantity = 60 (demand = after tax supply)

d) Tax paid by buyer = 12 - 10 = $ 2

Tax paid by seller = 4 - 2 = $ 2

| P | Qd | Qs (before tax) | Qs (after tax) |

| 8 | 100 | 60 | 20 |

| 9 | 90 | 70 | 30 |

| 10 | 80 | 80 | 40 |

| 11 | 70 | 90 | 50 |

| 12 | 60 | 100 | 60 |

| 13 | 50 | 110 | 70 |

Homework Sourse

Homework Sourse