Mellilo Corporation issued 4500000 of 20year 95 percent bond

Mellilo Corporation issued $4,500,000 of 20-year, 9.5 percent bonds on July 1, 2018, at 98. Interest is due on June 30 and December 31 of each year, and all of the bonds in the issue mature on June 30, 2038. Mellilo\'s fiscal year ends on December 31.

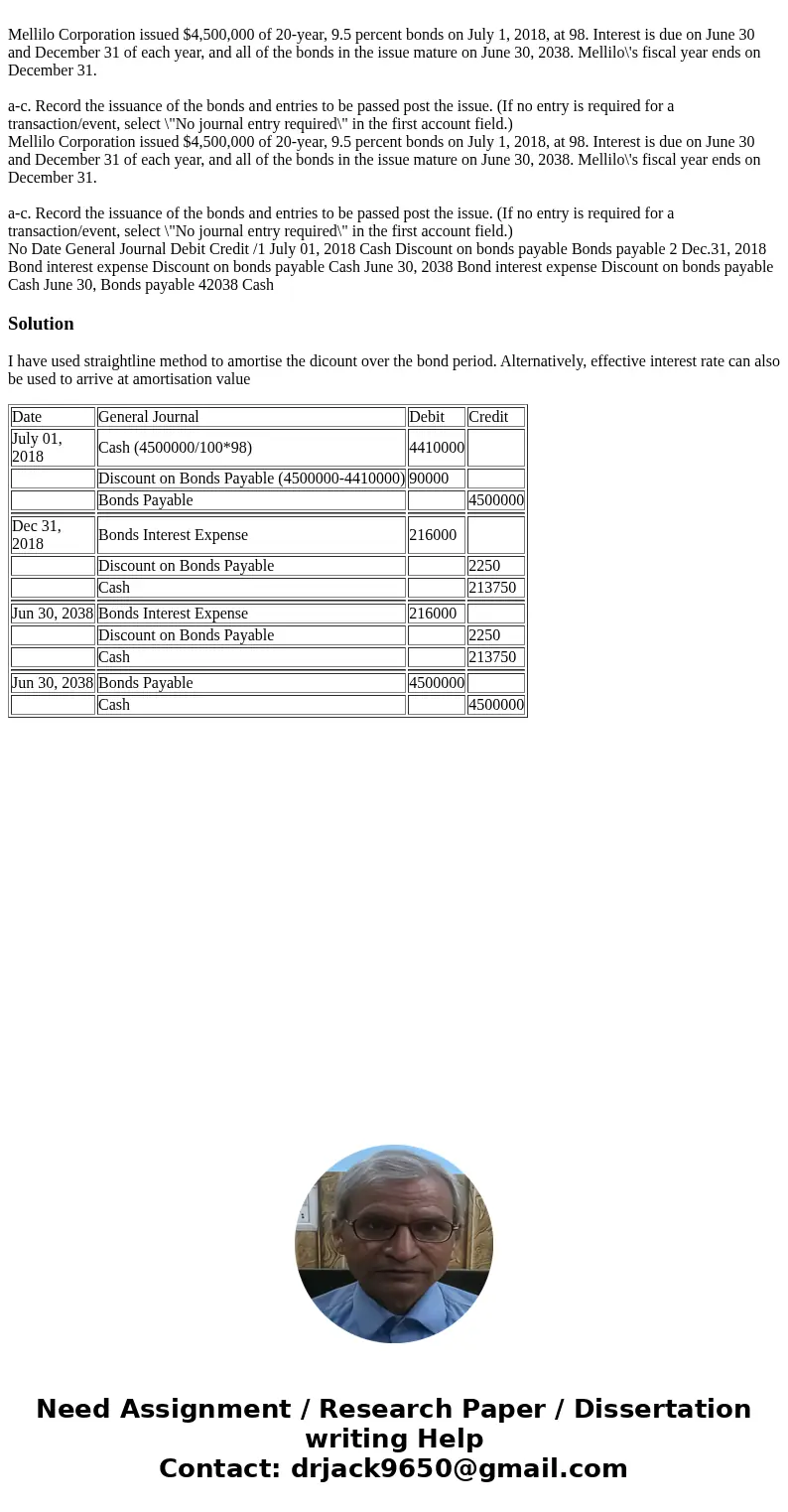

a-c. Record the issuance of the bonds and entries to be passed post the issue. (If no entry is required for a transaction/event, select \"No journal entry required\" in the first account field.)

Mellilo Corporation issued $4,500,000 of 20-year, 9.5 percent bonds on July 1, 2018, at 98. Interest is due on June 30 and December 31 of each year, and all of the bonds in the issue mature on June 30, 2038. Mellilo\'s fiscal year ends on December 31.

a-c. Record the issuance of the bonds and entries to be passed post the issue. (If no entry is required for a transaction/event, select \"No journal entry required\" in the first account field.)

No Date General Journal Debit Credit /1 July 01, 2018 Cash Discount on bonds payable Bonds payable 2 Dec.31, 2018 Bond interest expense Discount on bonds payable Cash June 30, 2038 Bond interest expense Discount on bonds payable Cash June 30, Bonds payable 42038 Cash Solution

I have used straightline method to amortise the dicount over the bond period. Alternatively, effective interest rate can also be used to arrive at amortisation value

| Date | General Journal | Debit | Credit |

| July 01, 2018 | Cash (4500000/100*98) | 4410000 | |

| Discount on Bonds Payable (4500000-4410000) | 90000 | ||

| Bonds Payable | 4500000 | ||

| Dec 31, 2018 | Bonds Interest Expense | 216000 | |

| Discount on Bonds Payable | 2250 | ||

| Cash | 213750 | ||

| Jun 30, 2038 | Bonds Interest Expense | 216000 | |

| Discount on Bonds Payable | 2250 | ||

| Cash | 213750 | ||

| Jun 30, 2038 | Bonds Payable | 4500000 | |

| Cash | 4500000 |

Homework Sourse

Homework Sourse