Gilkison Corporation uses a joborder costing system to assig

Solution

Transactions

Cash

Raw Materials

Work in Process

Finished Goods

Manufacturing overhead

PP&E (net)

=

Accounts payable

Retained Earnings

Beginning balances, October 1

$ 10,600.00

$ 4,600.00

$ 15,600.00

$ 19,600.00

$ 0.00

$ 229,600.00

=

$ 15,300.00

$ 264,700.00

1

$ 66,600.00

=

$ 66,600.00

2

-$ 50,600.00

$ 50,600.00

=

3

-$ 7,300.00

$ 7,300.00

=

4

-$ 95,600.00

$ 95,600.00

=

5

-$ 25,600.00

$ 25,600.00

=

6

-$ 30,600.00

=

-$ 30,600.00

7

$ 12,600.00

=

$ 12,600.00

8

$ 10,600.00

-$ 10,600.00

=

9

-$ 2,300.00

=

-$ 2,300.00

10

-$ 15,600.00

=

-$ 15,600.00

11

$ 58,800.00

-$ 58,800.00

=

12

-$ 196,600.00

$ 196,600.00

=

13

$ 281,000.00

=

$ 281,000.00

14

-$ 205,600.00

=

-$ 205,600.00

15

-$ 81,600.00

=

-$ 81,600.00

16

$ 2,700.00

=

$ 2,700.00

Ending balances at October 30

$ 42,600.00

$ 13,300.00

$ 24,000.00

$ 10,600.00

$ 0.00

$ 216,700.00

=

$ 12,900.00

$ 294,300.00

Gilkison Corporation

Schedule of Cost of Goods sold

For the month ended October 31

Beginning finished goods inventory

$ 19,600.00

Add: Cost of goods manufactured

$ 196,600.00

Cost of goods available for sale

$ 216,200.00

Less: Ending finished goods inventory

$ 10,600.00

Unadjusted Cost of goods sold

$ 205,600.00

Less: Over-applied manufacturing overhead

-$ 2,700.00

Adjusted cost of goods sold

$ 202,900.00

Gilkison Corporation

Income Statement

For the month ended October 31

Sales

$ 281,000.00

Less: Cost of goods sold

$ 202,900.00

Gross profit

$ 78,100.00

Selling and administrative expenses

Salaries

$ 30,600.00

Depreciation expenses

$ 2,300.00

Advertising expenses

$ 15,600.00

$ 48,500.00

Net income

$ 29,600.00

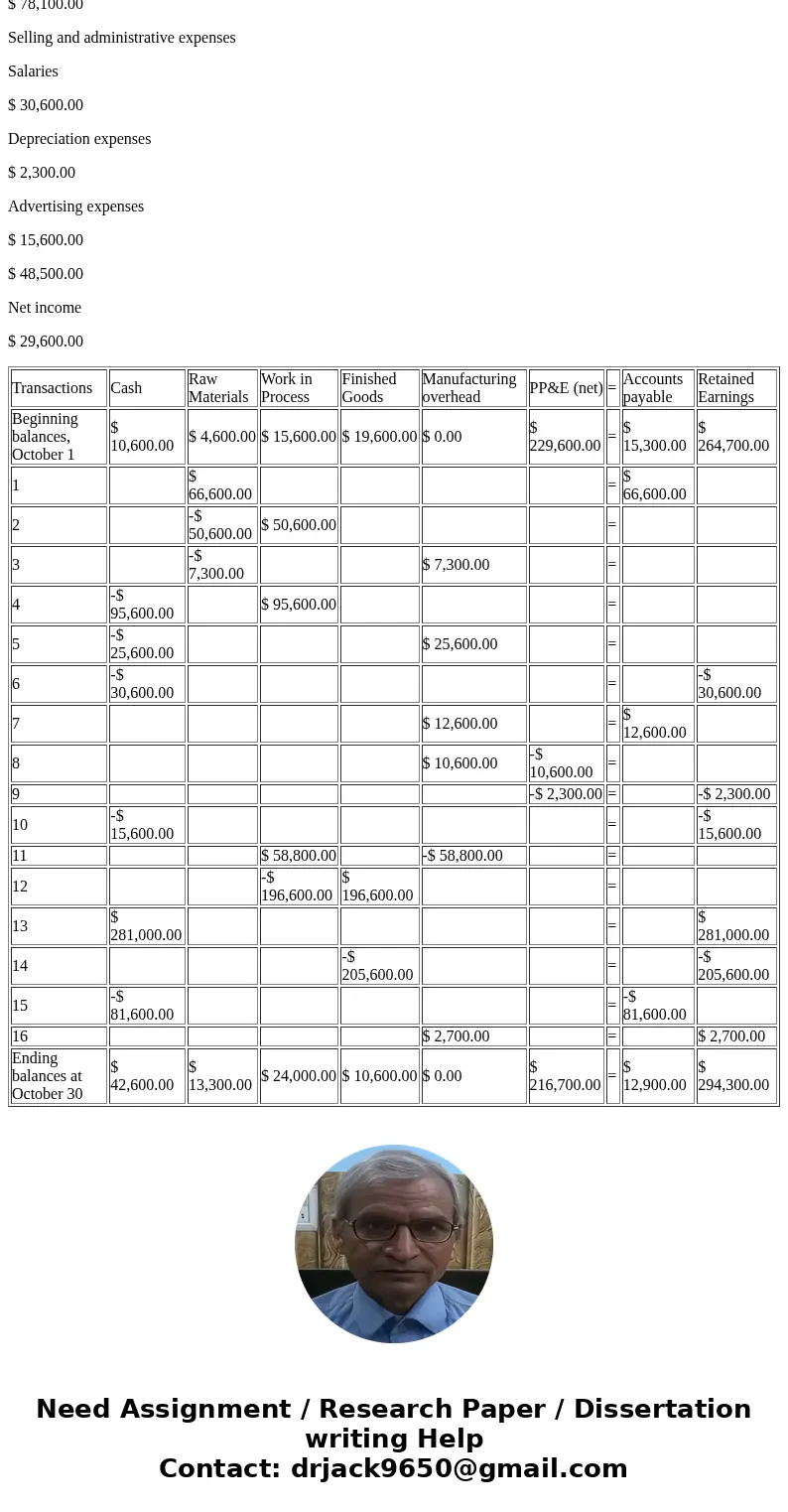

| Transactions | Cash | Raw Materials | Work in Process | Finished Goods | Manufacturing overhead | PP&E (net) | = | Accounts payable | Retained Earnings |

| Beginning balances, October 1 | $ 10,600.00 | $ 4,600.00 | $ 15,600.00 | $ 19,600.00 | $ 0.00 | $ 229,600.00 | = | $ 15,300.00 | $ 264,700.00 |

| 1 | $ 66,600.00 | = | $ 66,600.00 | ||||||

| 2 | -$ 50,600.00 | $ 50,600.00 | = | ||||||

| 3 | -$ 7,300.00 | $ 7,300.00 | = | ||||||

| 4 | -$ 95,600.00 | $ 95,600.00 | = | ||||||

| 5 | -$ 25,600.00 | $ 25,600.00 | = | ||||||

| 6 | -$ 30,600.00 | = | -$ 30,600.00 | ||||||

| 7 | $ 12,600.00 | = | $ 12,600.00 | ||||||

| 8 | $ 10,600.00 | -$ 10,600.00 | = | ||||||

| 9 | -$ 2,300.00 | = | -$ 2,300.00 | ||||||

| 10 | -$ 15,600.00 | = | -$ 15,600.00 | ||||||

| 11 | $ 58,800.00 | -$ 58,800.00 | = | ||||||

| 12 | -$ 196,600.00 | $ 196,600.00 | = | ||||||

| 13 | $ 281,000.00 | = | $ 281,000.00 | ||||||

| 14 | -$ 205,600.00 | = | -$ 205,600.00 | ||||||

| 15 | -$ 81,600.00 | = | -$ 81,600.00 | ||||||

| 16 | $ 2,700.00 | = | $ 2,700.00 | ||||||

| Ending balances at October 30 | $ 42,600.00 | $ 13,300.00 | $ 24,000.00 | $ 10,600.00 | $ 0.00 | $ 216,700.00 | = | $ 12,900.00 | $ 294,300.00 |

Homework Sourse

Homework Sourse