sorry but the question is in the third picture thank you Che

sorry but the question is in the third picture. thank you

Check my work value 1.00 points 6. What direct labor cost would be included in the company\'s flexible budget for March? Direct labor References eBook &Resources; Learning Objective: 08-02 Prepare a report showing revenue and spending variances Worksheet Learning Objective: 08-04 Compute the direct materials price and quantity variances and explain their significance. Difficulty: 2 Medium Learning Objective: 08-01 Prepare a flexible budget Learning Objective: 08-05 Compute the direct labor rate and efficiency variances and explain their significance Check my workSolution

Solution:

Part 6 --- Labor Cost as per flexible budget for March

Flexible Budget means the budget prepared based on the standard price for actual activity level achieved.

Labor Cost that would be included in the company’s flexible budget for March = Actual Units Produced 26,600 Units x Required Labor Hour per unit 3 hours at standard labor rate $15

= $1,197,000

Part 7 – Direct Labor Efficiency Variance for March = $147,000 Favorable

Labor Quantity / Efficiency Variance

Standard Hours Allowed for actual production:

Actual Production

26600

Units

x Allowed Standard Hours Per Unit

3

Hours

Total Standard Hours Allowed for actual production (SHAP)

79,800

Hours

Actual Labor Hours Worked (AH)

70,000

Hours

Variance or Difference in Hours

9,800

Hours

x Standard Hourly Rate (SHR)

$15.00

per hour

Labor Efficiency Variance

$147,000

Favorable

Part 8 --- Direct Labor Rate Variance for March = $70,000 Unfavorable

Labor Rate Variance

Actual Hourly Rate

$16.00

Per Hour

Standard Hourly Rate

$15.00

Per Hour

Variance or Difference in Rate

$1.00

Per Hour

x Actual Labor Hours worked

70000

Hours

Labor Rate Variance

$70,000

Unfavorable

Part 9 is missing in the question

Part 10 --- Variable Overhead Efficiency Variance for March = $68,600 Favorable

Variable Overhead Efficiency/Quantity Variance

Standard Hours Allowed for actual production:

Actual Production

26,600

Units

x Allowed Standard Hours Per Unit

3

MHs

Total Standard Hours Allowed for actual production (SHAP)

79800

hours

Actual Hours Worked (AH)

70000

Hours

Variance or Difference in Hours

9800

hours

x Standard Hourly Variable Overhead Rate

$7.00

per hour

Variable Overhead Efficiency Variance

$68,600

Favorable

Hope the above calculations, working and explanations are clear to you and help you in understanding the concept of question.... please rate my answer...in case any doubt, post a comment and I will try to resolve the doubt ASAP…thank you

Pls ask separate question for remaining parts

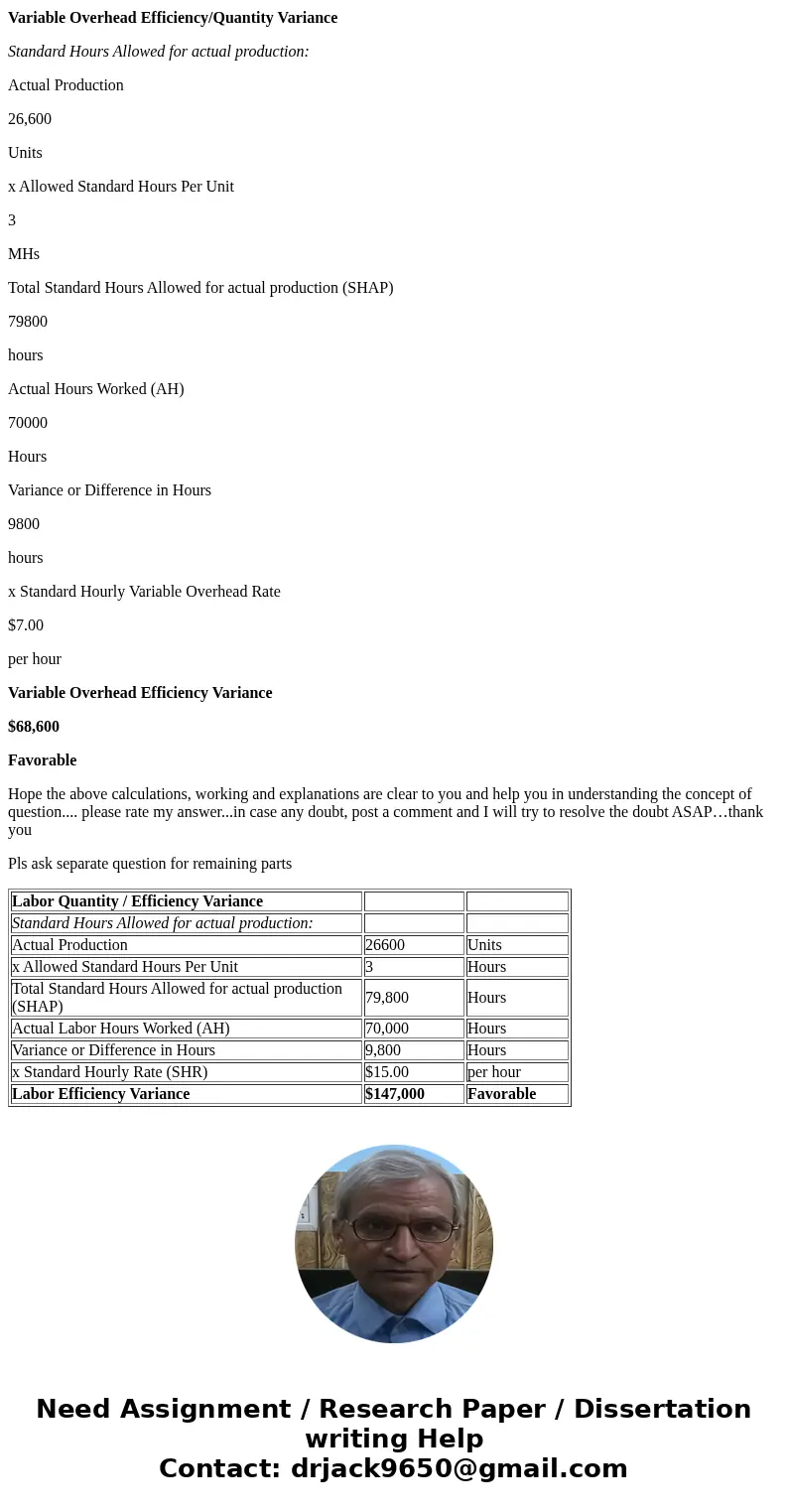

| Labor Quantity / Efficiency Variance | ||

| Standard Hours Allowed for actual production: | ||

| Actual Production | 26600 | Units |

| x Allowed Standard Hours Per Unit | 3 | Hours |

| Total Standard Hours Allowed for actual production (SHAP) | 79,800 | Hours |

| Actual Labor Hours Worked (AH) | 70,000 | Hours |

| Variance or Difference in Hours | 9,800 | Hours |

| x Standard Hourly Rate (SHR) | $15.00 | per hour |

| Labor Efficiency Variance | $147,000 | Favorable |

Homework Sourse

Homework Sourse